-

Yields may move lower after the Federal Reserve "communicates its goals to ease policy in coming meetings," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

July 30 -

Bettina Bronisz' colleagues say she'll leave a legacy of joy and laughter in the Connecticut Treasurer's office.

July 30 -

With joint proposed rulemaking details unavailable and bond issuance growing, these are top issues experts need to know.

July 30 -

"The overall muni market appears to be in a good balance despite the hefty slate of primary issuance that has occurred over the past few months," Birch Creek Capital strategists said.

July 29 -

U.S. Soccer will issue $200 million of tax-exempt revenue bonds through the Fayette County Development Authority.

July 29 -

The city will return to the market two weeks after closing its Transitional Finance Authority's biggest-ever deal.

July 29 -

The muni market tends to have "remarkable patience" in relation to USTs, said BofA strategists.

July 26 -

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

July 25 -

V2 Municipal Capital will source deals exclusively for Fundamental Advisors.

July 25 -

"While supply has been outsized over the last several weeks, the market has also seen outsized reinvestment demand over the last several months," said Nuveen strategists.

July 24 -

This week again sees elevated supply, as issuance sits at $9.673 billion, with Tuesday being a very busy day.

July 23 -

The Texas Water Development Board expects to sell up to $1.8 billion of tax-exempt and taxable bonds in September.

July 23 -

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

July 22 -

Encompassing roughly 270,000 acres, or about 420 square miles, the mixed-use property owned by the publicly traded Tejon Ranch Co. has long been at the center of a debate over wildfires and urban sprawl.

July 22 -

The new-issue calendar is at $9.7 billion the week, led by the Texas Transportation Commission with $1.7 billion of first-tier and second-tier revenue refunding bonds.

July 19 -

The sale reflects the strength and demand of New York state paper.

July 19 -

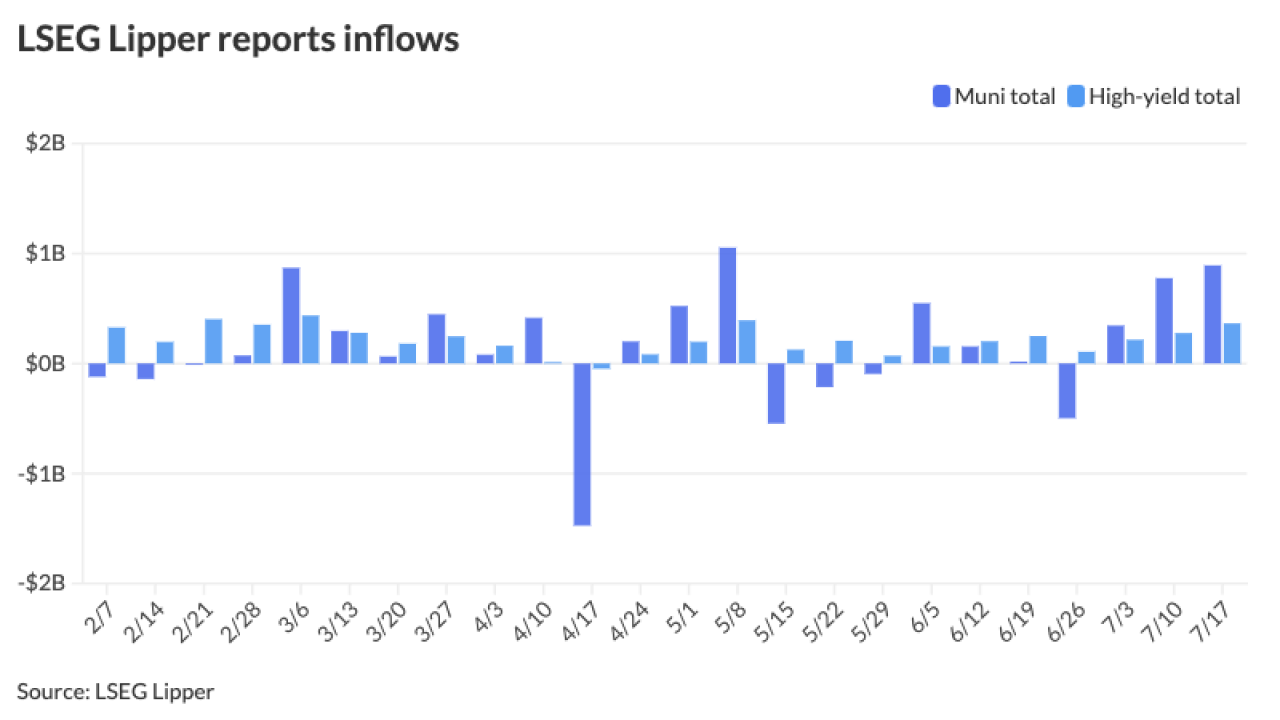

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after $775.3 million of inflows the week prior, according to LSEG Lipper.

July 18 -

Single party control of a state eases perception of bond default risk associated with laws like Chapter 9, a study found.

July 18 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Volume is predicted to continue at "robust levels," possibly through the fourth quarter, said Matt Fabian, a partner at Municipal Market Analytics.

July 16