-

The Texas Water Development Board expects to sell up to $1.8 billion of tax-exempt and taxable bonds in September.

July 23 -

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

July 22 -

Encompassing roughly 270,000 acres, or about 420 square miles, the mixed-use property owned by the publicly traded Tejon Ranch Co. has long been at the center of a debate over wildfires and urban sprawl.

July 22 -

The new-issue calendar is at $9.7 billion the week, led by the Texas Transportation Commission with $1.7 billion of first-tier and second-tier revenue refunding bonds.

July 19 -

The sale reflects the strength and demand of New York state paper.

July 19 -

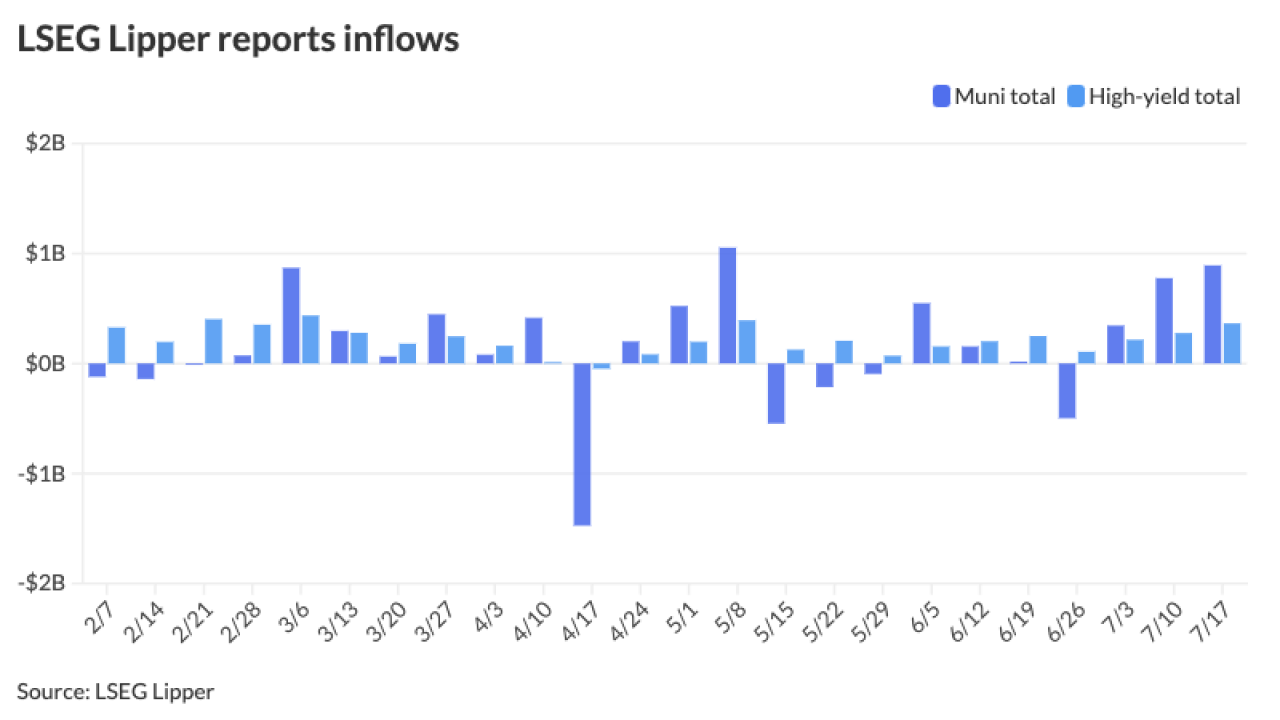

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after $775.3 million of inflows the week prior, according to LSEG Lipper.

July 18 -

Single party control of a state eases perception of bond default risk associated with laws like Chapter 9, a study found.

July 18 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Volume is predicted to continue at "robust levels," possibly through the fourth quarter, said Matt Fabian, a partner at Municipal Market Analytics.

July 16 -

The $238.8 million of voter-approved debt will end a 12-year drought in new money general obligation issuance by the nation's fifth largest city.

July 16