-

The finance team burned the midnight oil to assemble and market one of the most complex deals in the municipal market this year.

November 14 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

Trump's proposed corporate tax cut, if enacted, would further concentrate the buyer base and increase the chance of volatility, said Wells Fargo head of municipal strategy Vikram Rai.

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

The borrower is planning to use a convertible taxable "Cinderella" structure in the wake of a delay in securing tax exemption for a chunk of the deal.

November 12 -

The focus: municipal advisors — part of your regulatory responsibilities and duties (if you don't agree to evaluate pricing and/or structure, you must expressly disclose it to the client) and broker-dealers (fair dealing).

November 11 SOLVE

SOLVE -

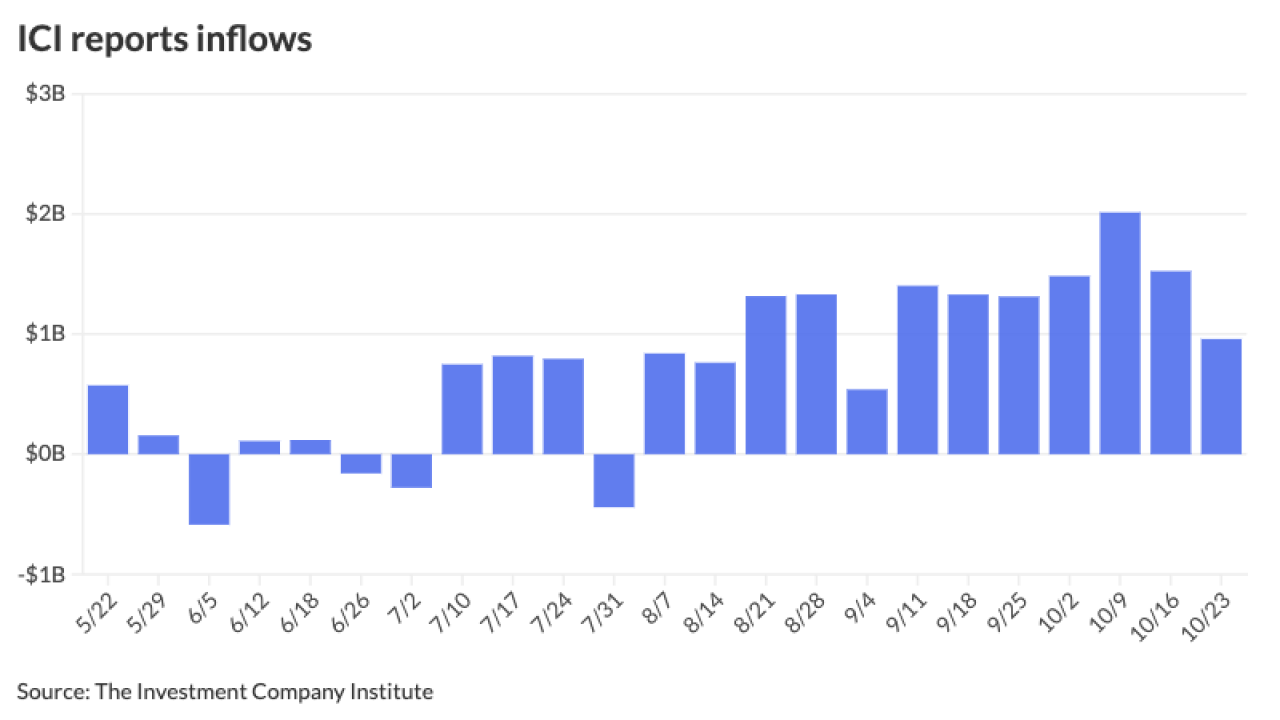

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

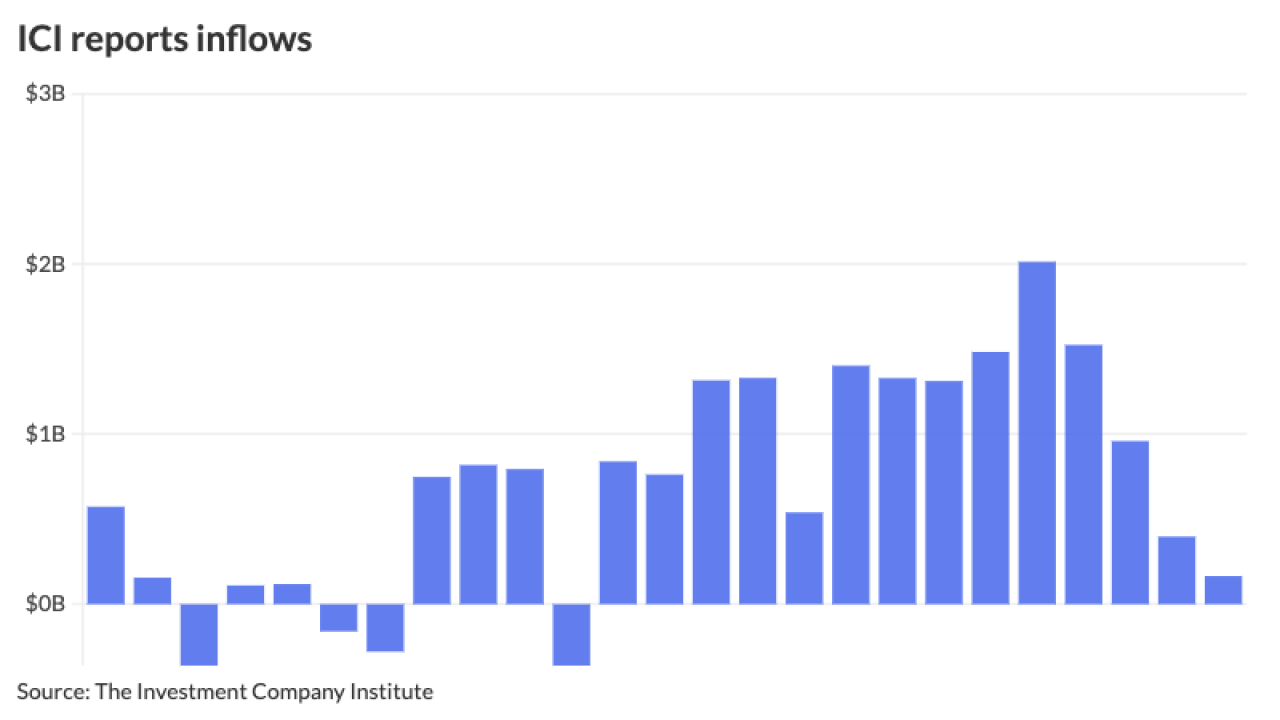

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

"A victory for former President Trump is likely to be viewed as ushering in a more inflationary environment, whereas a win for Vice President Harris will probably be seen as closer to the status quo," said Erik Weisman, chief economist and portfolio manager at MFS Investment Management."

November 5 -

Investors should "brace themselves" for further volatility, as uncertainty is likely to remain, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

November 4 -

Issuance will "not completely disappear, but will adjust to its seasonal norm from the record-breaking pace of the past several months," said Barclays' Mikhail Foux.

November 1 -

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

Nearly $1 billion of outstanding BABs may still be called back before yearend.

October 30 -

California sold tax-exempt and taxable GOs, the University of Miami priced a refunding deal while the Harris County-Houston Sports Authority came with a refunding and tender offer.

October 29 -

The Harris County-Houston Sports Authority's CEO was ousted and its chair faces ouster as it prices a $330 million deal to restructure its bond debt.

October 29 -

While the asset class is still in the red for October, it has pared back earlier losses. The Bloomberg Municipal Index is at negative 1.42% in October and positive 0.84% year to date.

October 28 -

The correction to the municipal market has improved muni to UST ratios while uncertainty hangs over ahead of the election. J.P. Morgan's Peter DeGroot said the firm expects the end of next week "will mark the end of the difficult technical period in 2024 and believe that net supply in November will lead to better valuations broadly in the municipal market."

October 25