-

Inflation is front and center this week, with the consumer price index report released on Wednesday and the producer price index on Thursday.

February 12 -

Municipals were cut up to four basis points, depending on the scale, while UST yields rose up to four basis points out long.

February 11 -

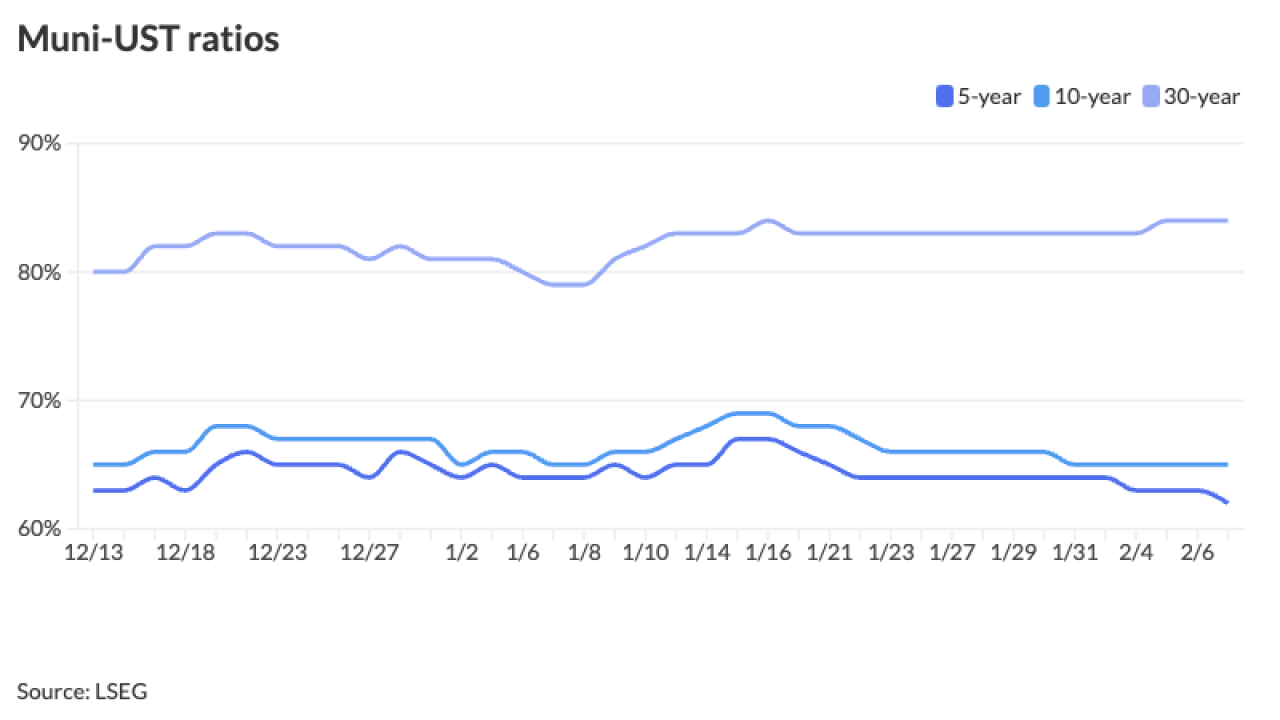

Munis continue to outpace USTs as ratios on the front end continue to richen relative to USTs, Jason Wong said.

February 10 -

Yields have fallen over the past few weeks, so "any decent excuse that rates move up a little bit after that big rally" may have occurred as the market digested the report — which was a "little bit of a mixed bag" — after the initial headline figure, said Jeff MacDonald, EVP and head of fixed income at Fiduciary Trust International.

February 7 -

The NYC TFA will test how the national news cycle has affected the market's appetites.

February 6 -

The Metropolitan Atlanta Rapid Transit Authority will issue $475 million in green sales tax revenue bonds for capital projects and refunding.

February 6 -

Muni yields were bumped one to eight basis points, depending on the scale, while UST yields fell three to 10 basis points, with the greatest gains out long.

February 5 -

Tax exemption concerns — though an elimination is unlikely — and the loss of federal stimulus will "most assuredly pull forward delayed issuance, with the first half of 2025 volume to exceed second half volume," said James Welch, a municipal portfolio manager at Principal Asset Management.

February 4 -

To close out the day, USTs remained mixed, with yields rising on the short end and falling out long, while munis were changed up to a basis point, depending on the curve.

February 3 -

January's municipal bond supply "will end up being heavier compared with the normally slow start of the year, but the pipeline should remain quite robust," Barclays said.

January 31