-

The nonfarm payrolls report shows the economy is "hanging in there," though it is slowing, said Jeff MacDonald of Fiduciary Trust International.

June 6 -

This week the market has performed "exceedingly well" with the tailwind of June 1 reinvestment capital, said J.P. Morgan strategists led by Peter DeGroot.

June 5 -

The utility expects the bonds to have an all-in true interest cost of 4.91%.

June 5 -

There is still a lot of chaos and uncertainty out there, said Jennifer Johnston, director of municipal bond research at Franklin Templeton.

June 4 -

"We're going to get a lot of price discovery with the big deals, a large number of deals, and then a lot of cash to put to work," said Whitney Fitts of Appleton Partners.

June 3 -

The Delta Center hockey and basketball venue will be renovated with proceeds from the $900 million Downtown Revitalization Public Infrastructure District deal.

June 3 -

Issuance this week soars to nearly $17 billion, and investors are "bracing for another hefty serving the following week," said Birch Creek strategists.

June 2 -

The Indiana Financing Authority is the biggest entry on 2025's largest negotiated calendar with $1.5 billion of Indiana University Health system revenue bonds.

May 30 -

With higher yields and ratios, many participants say investors should be taking advantage of current levels.

May 29 -

Chicago goes to market next week with $517.95 million of taxable and tax-exempt general obligation bonds following a downward outlook revision from Fitch.

May 29 -

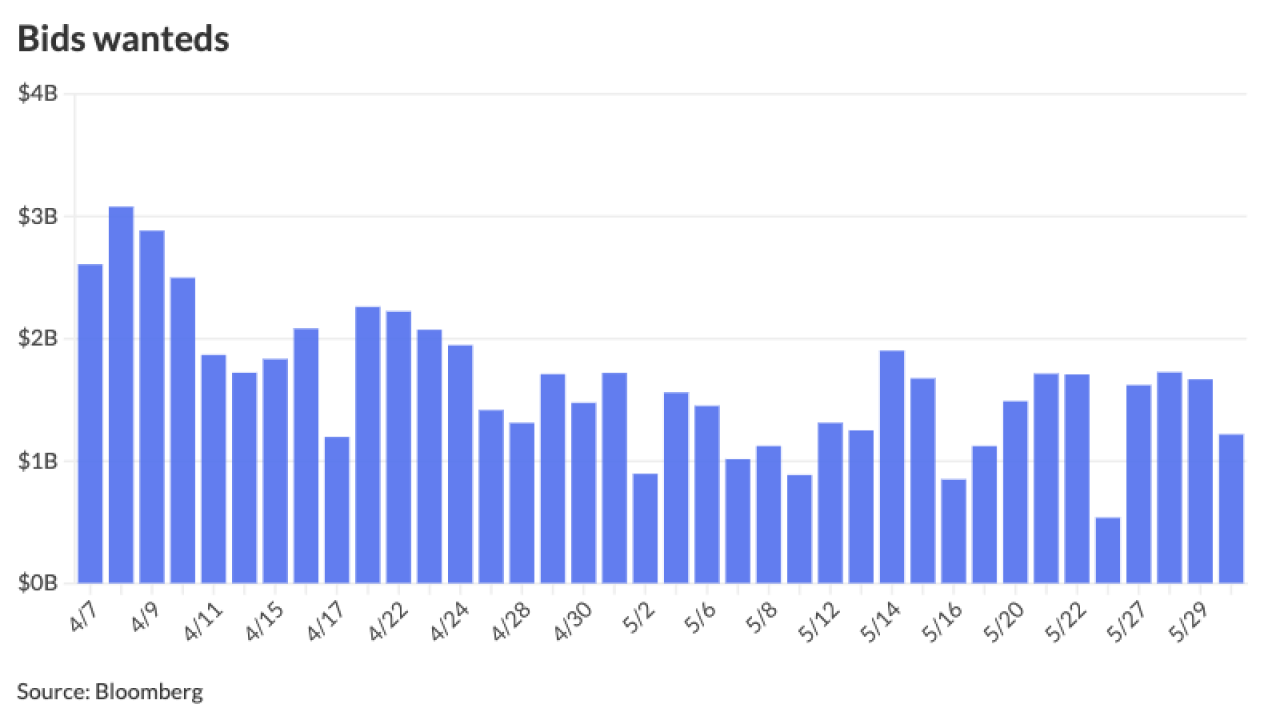

Supply has weighed on munis to some extent over the past few weeks, as week after week issuance tops $10 billion, said Jeremy Holtz, a portfolio manager at Income Research + Management.

May 28 -

Two Midwest schools in the municipal bond market this month illustrate the range of funding challenges facing higher education under the Trump administration.

May 28 -

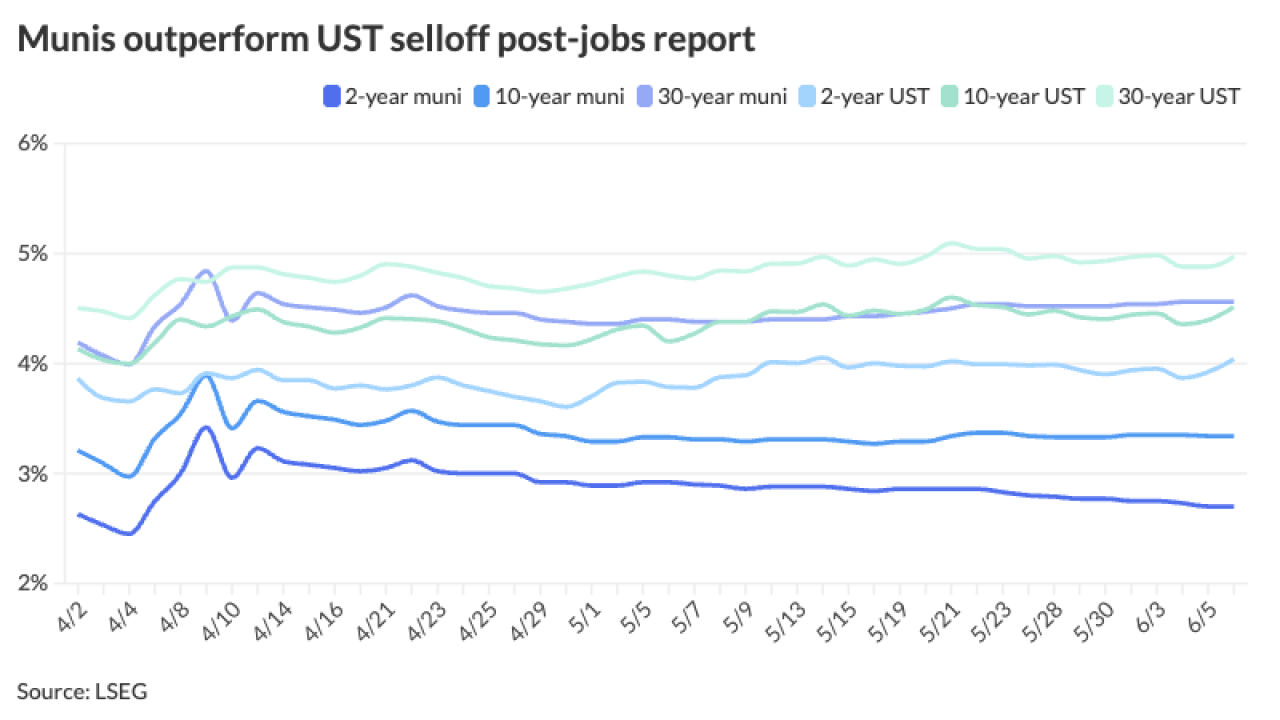

Muni yields were bumped up to eight basis points, depending on the curve, on Tuesday, but for most of last week, U.S. rates sold off on the heels of passed legislation, said Barclays strategists Mikhail Foux and Grace Cen.

May 27 -

Issuers routinely refund 5% bonds in year 10, and the resulting savings can be significant. It is notable that although refunding is typically associated with declining interest rates, 5% bonds are refunded even if rates rise.

May 27 Kalotay Advisors LLC

Kalotay Advisors LLC -

"We're seeing some of the additional instability and other things come into play," said Dan Genter, CEO of Genter Capital Management.

May 22 -

"Light demand" for Wednesday's 20-year Treasury bond auction "propelled yields to the nosebleeds and equities to the basement," said José Torres, senior economist at Interactive Brokers.

May 21 -

The "risk to the tax exemption appears to have dropped sharply as of last week ... taking with it the hypothetical risk of a supply surge ahead of any end-date for borrowers' exemption access," said Matt Fabian, a partner at Municipal Market Analytics.

May 20 -

"Munis are no longer moving on headlines; they're reacting to rates and supply," which is playing out again Monday after a choppy March and April, said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 19 -

Municipals were cut up four basis points, depending on the curve, through noon.

May 19 -

Issuance for the week of May 19 is estimated at $11.667 billion.

May 16