-

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

July 25 -

"While supply has been outsized over the last several weeks, the market has also seen outsized reinvestment demand over the last several months," said Nuveen strategists.

July 24 -

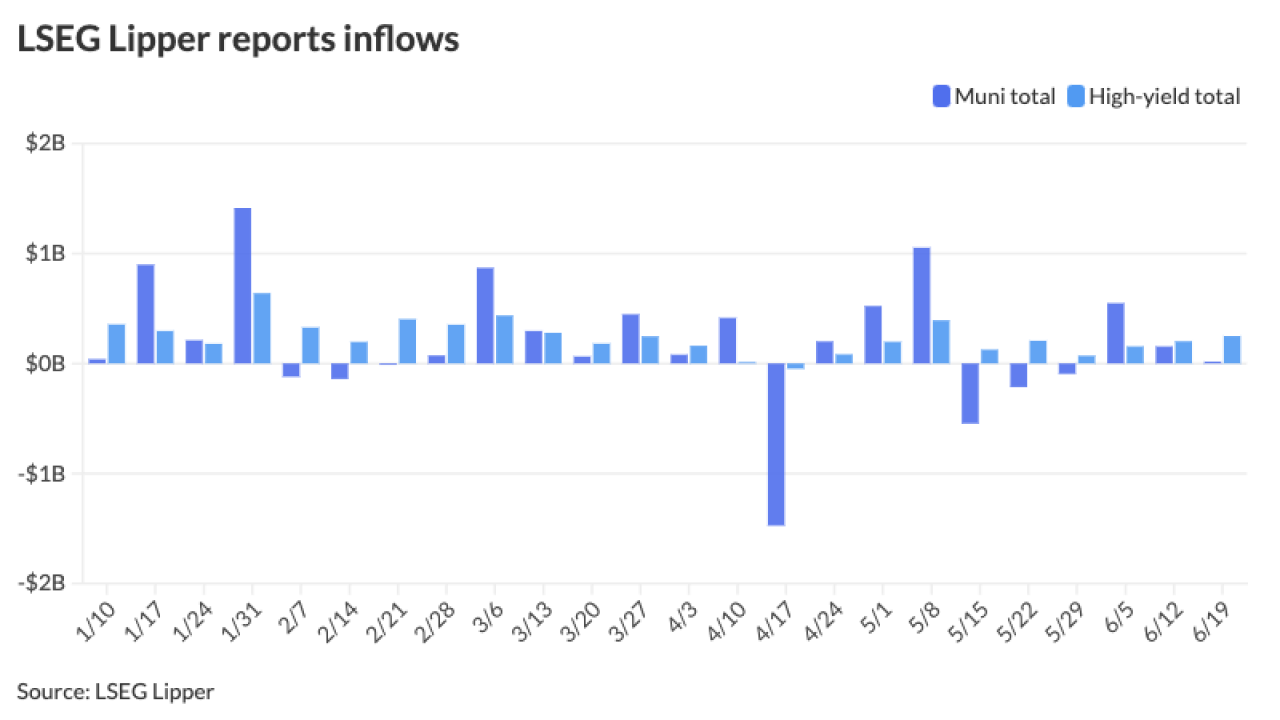

The high-yield sector continues to show strength, with inflows of $364.4 million for the week ending Wednesday, marking 13 straight weeks of inflows, according to LSEG Lipper.

July 22 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Municipal bond mutual funds saw outflows as investors pulled $498 million from funds after $16 million of inflows the week prior, according to LSEG Lipper. High-yield funds still saw inflows.

June 27 -

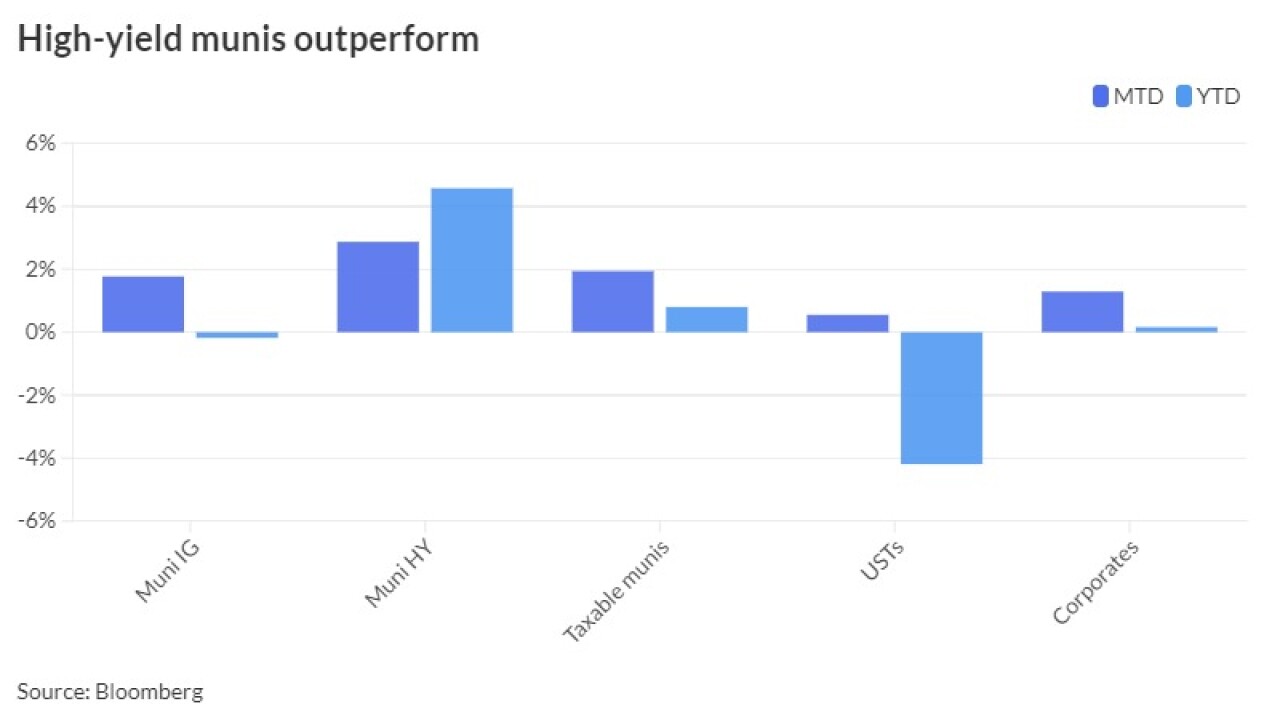

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

June 21 -

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20 -

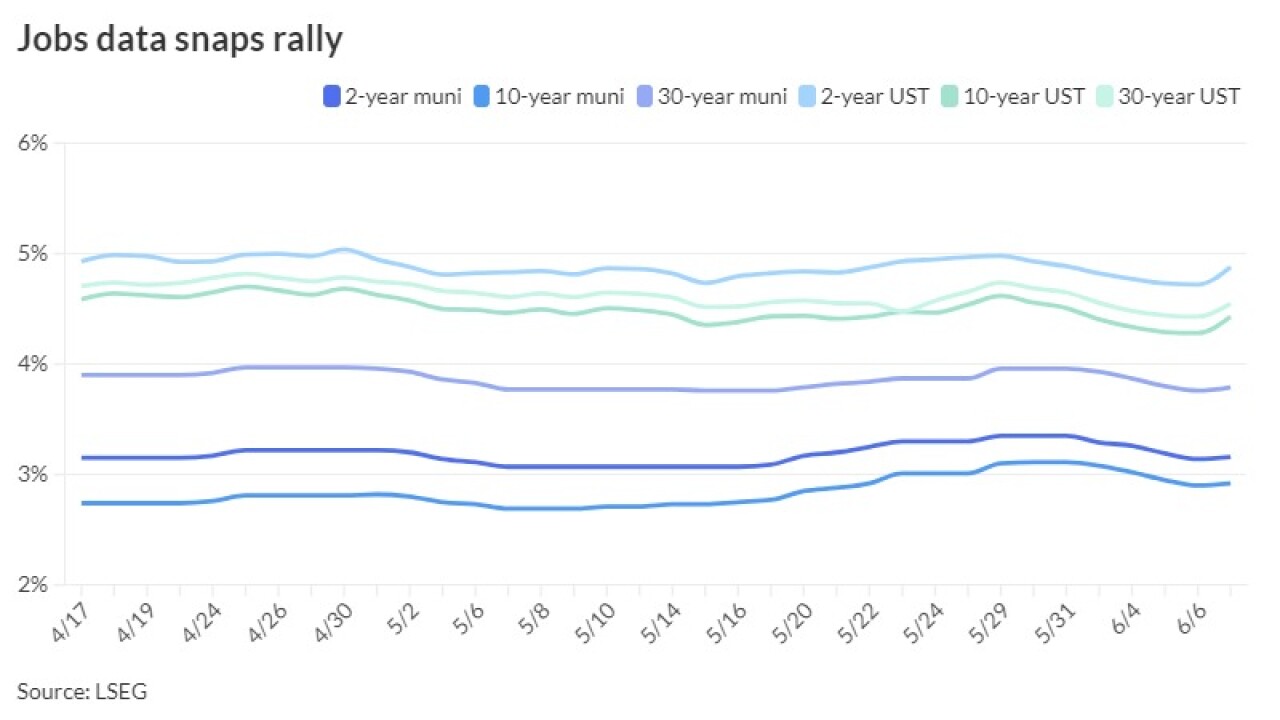

"Even after this week's rally, absolute yields look attractive in the context of the trading range over the past three years, May's underperformance versus taxable fixed-income, and our longer-term projections for lower rates this year," J.P. Morgan strategists said.

June 13 -

Household ownership of munis — which includes direct ownership of individual bonds in brokerage accounts, fee-based advisory accounts and SMAs — rose to $1.779 trillion, up 0.3% from Q4 2023 and from 5.6% in Q1 2023.

June 13 -

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7 -

Municipal bond mutual funds saw inflows as investors added $549.2 million after $94.9 million of outflows the week prior, according to LSEG Lipper.

June 6 -

Despite losses, munis are "being set up nicely" as the summer season approaches, said Jeff Lipton, a research analyst and market strategist.

May 30 -

Municipal bond mutual funds saw the second week of outflows as investors pulled $217.6 million from the funds after $546.2 million of outflows the week prior, according to LSEG Lipper. High-yield saw inflows again.

May 23 -

"In terms of credit quality, high-yield funds proved resilient" while investment-grade funds saw outflows of $673 million, noted J.P. Morgan's Peter DeGroot in a market note.

May 16 -

Muni exchange-traded funds are "dominated" by retail and are "momentum driven," said David Litvack, a tax-exempt strategist and chief investment officer at BofA.

May 16 -

The "historical runway" heading into Memorial Day is favorable, rolling into the summer redemption months of June through August, said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 2 -

Munis posted losses in April, returning negative 1.24%. The asset class is also seeing losses of 1.62% year-to-date.

May 1 -

"Bond market investors are all wishing that April was behind us as they are anxious to hear the Fed's statement at its next FOMC meeting," noted BofA Global Research. "The statement should be no surprise as the market consensus has converged to 'higher for longer' rates.

April 26 -

Inflows returned to muni mutual funds as investors added $200.3 million for the week ending Wednesday after $1.474 billion of outflows, according to LSEG Lipper.

April 25 -

The new-issue calendar will be a "good test to see if the higher absolute yields can pull buyers off the sidelines or if underwriters need to widen spreads significantly enough to reprice the entire market to clear the deals," according to Birch Creek strategists.

April 22