-

Dan Close, Head of Municipals at Nuveen and Margot Kleinman, Director of Research at the firm, joins The Bond Buyer's Lynne Funk to delve into the high-yield market as the New Year — and new rate environment — kick off.

-

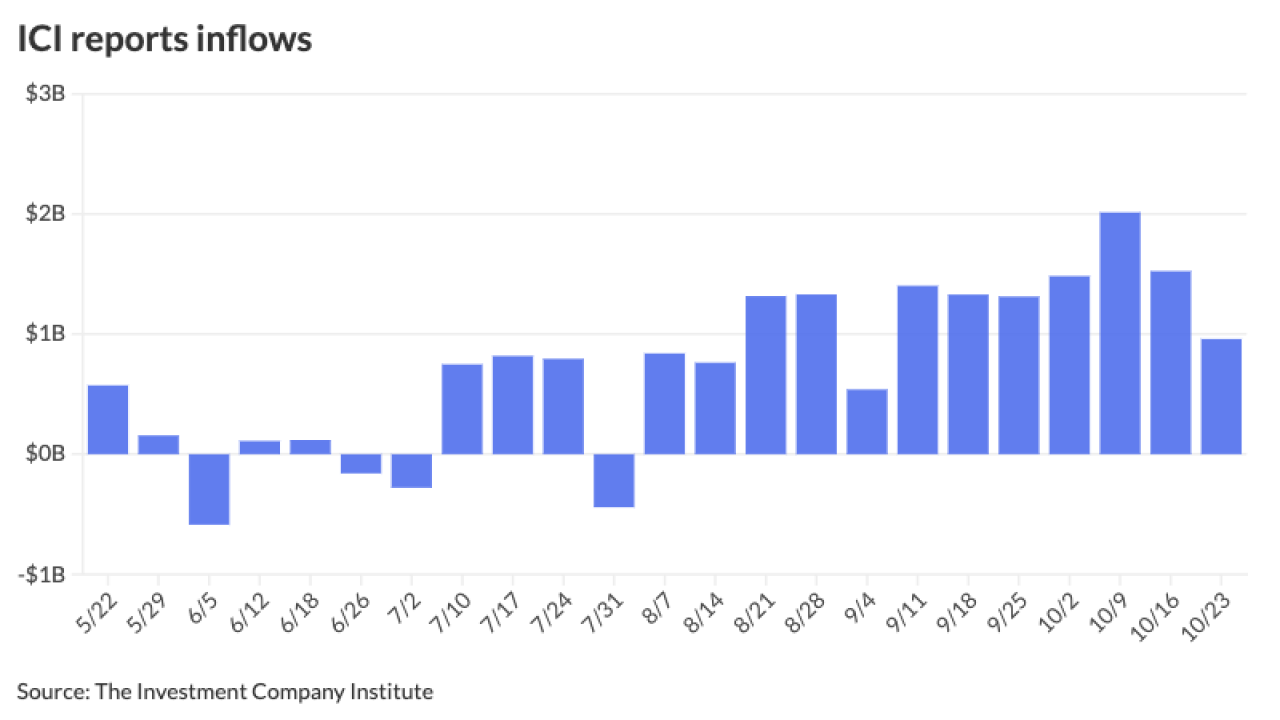

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

While fundamentals remain strong — with credit upgrades outpacing downgrades by 3.5 times so far in 2024 — technical factors have been "less supportive," Principal Asset Management strategists said in a report.

October 24 -

"Coming off rich muni-Treasury ratios, the market has swiftly repriced," said 16Rock Asset Management's James Pruskowski. "With now cheaper benchmark yields and wider credit spreads, fresh capital is flowing in, and a strong bottoming opportunity looks to be emerging."

October 23 -

"Buyer interest comes as forward supply is projected around $20 billion (the high water mark over the last year) while offsetting calls and maturities sit about $2 billion lower, creating a net supply surplus," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

October 17 -

The muni market enters the last quarter of 2024 in "excellent shape," said GW&K Investment Management partners John Fox, Brian Moreland, Kara South and Martin Tourigny.

October 16 -

Mutual funds saw inflows to the tune of $1.88 billion last week, marking 14 consecutive weeks of positive fund flows, according to LSEG Lipper. This brings year-to-date inflows to nearly $17 billion.

October 8 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3 -

This surge in demand "is no coincidence — it's the result of weeks of relentless inflows, further amplified by the Federal Reserve's recent rate cut," said 16Rock Asset Management CIO James Pruskowski.

October 3 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

October 1 -

High-yield muni issuance totals $20 billion year-to-date, "reflecting normalization from relatively depressed levels in 2023 ($7.6 billion over the comparable period), and now virtually equal to the trailing five-year average for the period ($20.1 billion)," said J.P. Morgan strategists, led by Peter DeGroot.

September 26 -

Nuveen LLC reached an agreement to sell its 11% equity stake in Vistra Vision to Vistra Corp., that started as municipal bonds ensnared in a bankruptcy.

September 20 -

Despite the underperformance to USTs, munis saw positive momentum during the first two weeks of September with the asset class returning 0.68% so far this month and 1.99% year-to-date.

September 16 -

While supply falls next week as investors await their first Fed rate cut in four years, it should pick up after the FOMC, Barclays PLC said, adding the 30-day visible pipeline "is at relatively manageable levels at the moment." Bond Buyer 30-day visible supply is at $10.09 billion.

September 13 -

Household ownership of individual bonds was the largest category of muni ownership at 44.6%, mutual funds at 19.2%, exchange-traded funds at 3.1% and U.S. banks at 12.4%. While not detailed in the Federal Reserve data, SMAs may hold up to $1.6 trillion currently.

September 13 -

Municipal bond mutual funds saw inflows as investors added $1.258 billion to funds — the second-largest inflow figure year-to-date after $1.413 billion of inflows for the week ending Jan. 31.

September 12 -

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

Municipal supply continues to grow as Bond Buyer 30-day visible supply sits at $20.02 billion and the municipal market will see one of the largest weeks of new-issuance at an estimated $13.35 billion, led by three billion-plus deals from Washington, D.C. ($1.6 billion), the New York City Transitional Finance Authority ($1.5 billion) and Illinois ($1 billion).

September 6