-

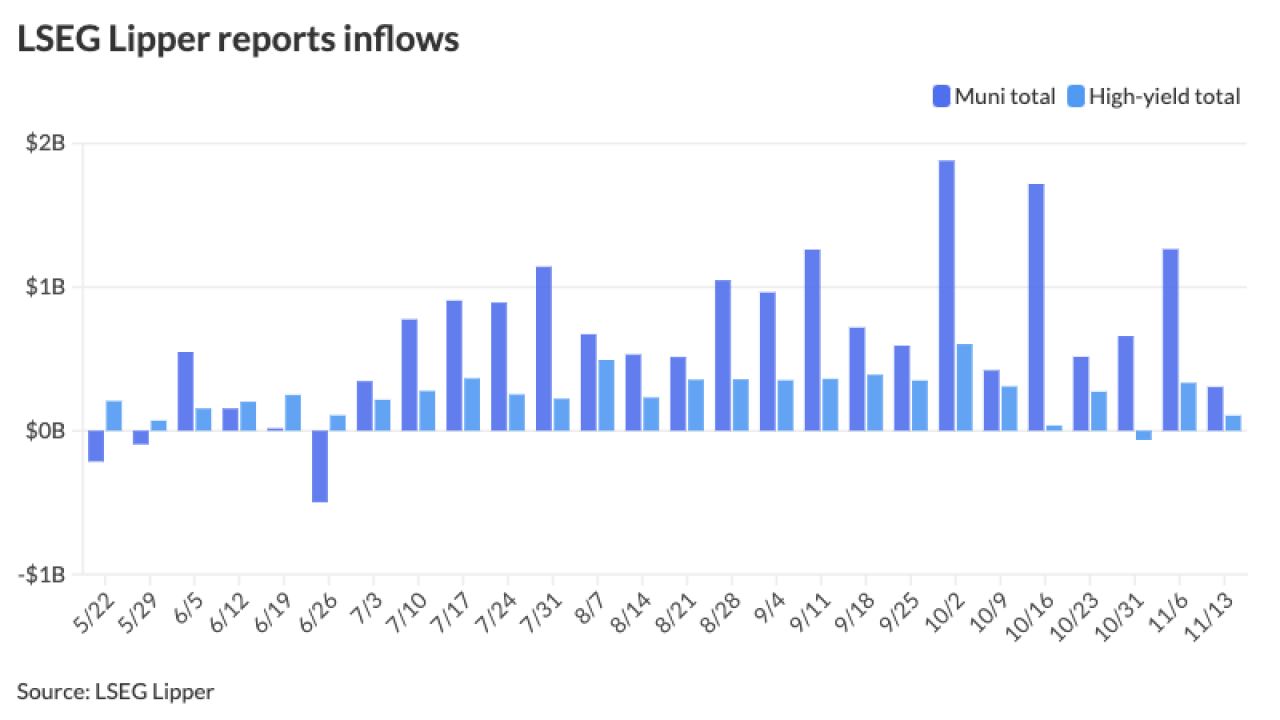

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

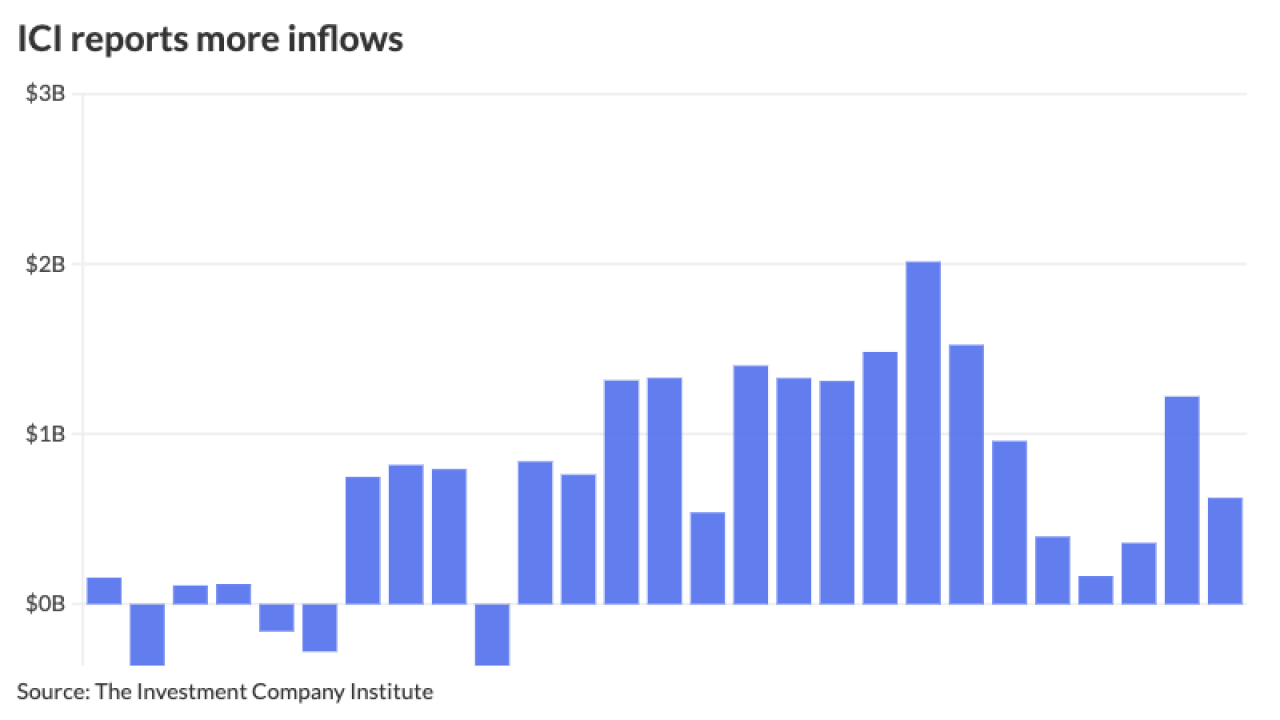

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

December 6 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

With an estimated $13 billion calendar on tap, demand for paper will be bolstered by the $16 billion of redemptions coming Monday while mutual fund inflows, this week at about $560 million and concentrated in the long-end, signal solid investor support. Munis are returning 1.73% in November as of Friday.

November 29 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

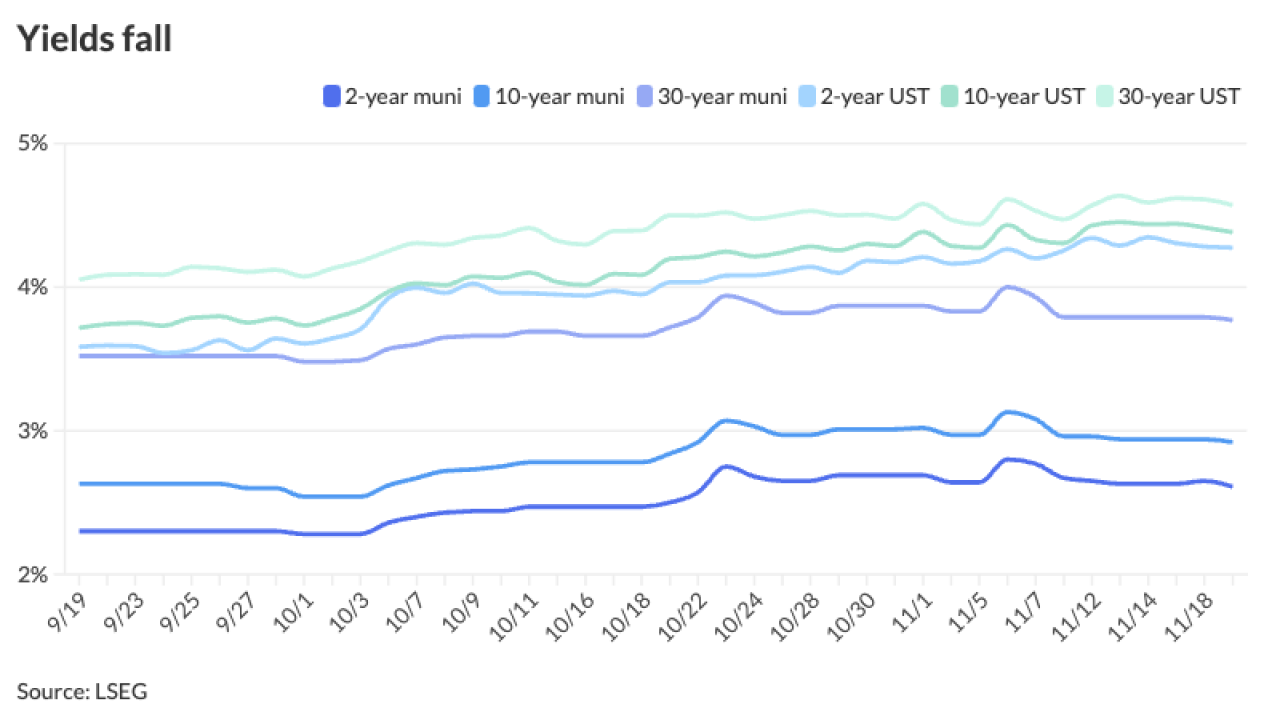

Municipals are outperforming USTs to a large degree this month, with investment grade munis seeing positive 0.81% returns in November and 1.63% year-to-date. USTs are in the red at -0.40% in November with only 0.96% positive returns in 2024.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

Dan Close, Head of Municipals at Nuveen and Margot Kleinman, Director of Research at the firm, joins The Bond Buyer's Lynne Funk to delve into the high-yield market as the New Year — and new rate environment — kick off.

-

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

While fundamentals remain strong — with credit upgrades outpacing downgrades by 3.5 times so far in 2024 — technical factors have been "less supportive," Principal Asset Management strategists said in a report.

October 24 -

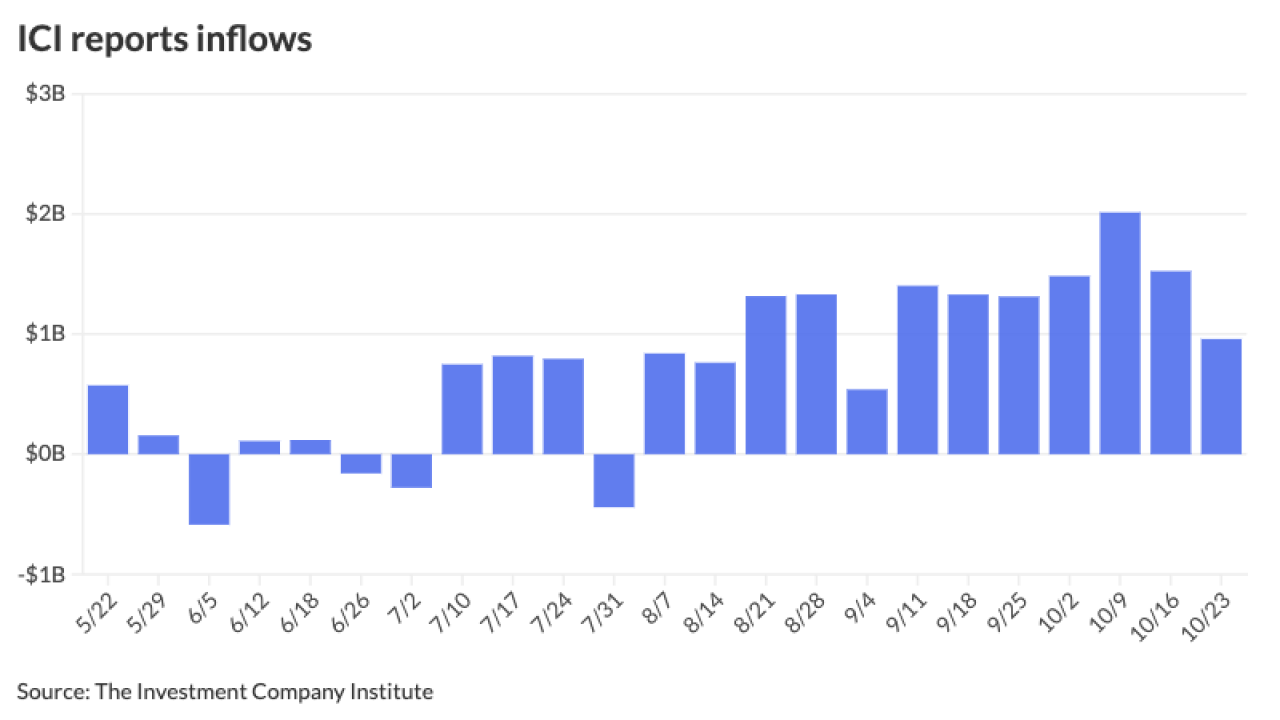

"Coming off rich muni-Treasury ratios, the market has swiftly repriced," said 16Rock Asset Management's James Pruskowski. "With now cheaper benchmark yields and wider credit spreads, fresh capital is flowing in, and a strong bottoming opportunity looks to be emerging."

October 23 -

"Buyer interest comes as forward supply is projected around $20 billion (the high water mark over the last year) while offsetting calls and maturities sit about $2 billion lower, creating a net supply surplus," said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

October 17 -

The muni market enters the last quarter of 2024 in "excellent shape," said GW&K Investment Management partners John Fox, Brian Moreland, Kara South and Martin Tourigny.

October 16 -

Mutual funds saw inflows to the tune of $1.88 billion last week, marking 14 consecutive weeks of positive fund flows, according to LSEG Lipper. This brings year-to-date inflows to nearly $17 billion.

October 8 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

October 3