-

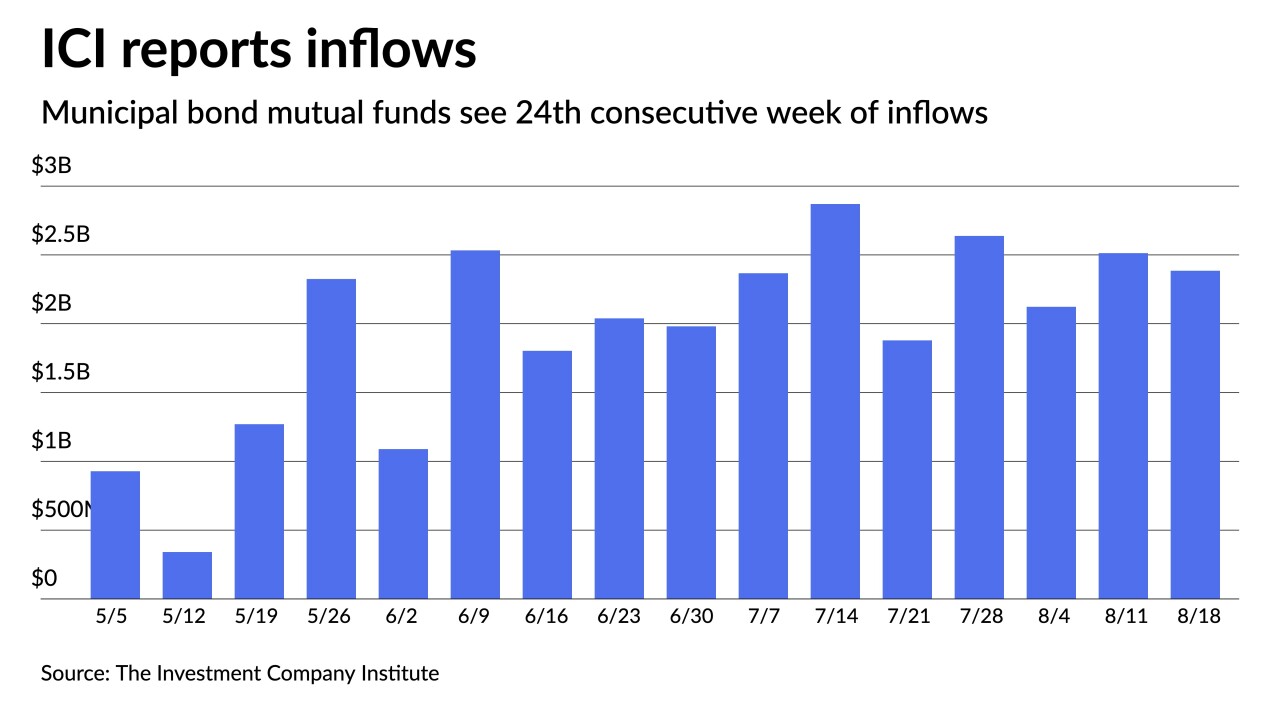

The Investment Company Institute reported $385 million of inflows while ETFs fell to $124 million.

October 20 -

Another round of inflows was reported from the Investment Company Institute — the 31st consecutive week — but they came in at $308 million for the week ending Oct. 6, the lowest since outflows in March.

October 13 -

Volatility in the U.S. Treasury market continues to pull on municipal bond valuations, despite little trading volume.

October 12 -

For 31 consecutive weeks investors put cash into municipal bond mutual funds but saw just $36.87 million of inflows in the latest reporting period while high-yield funds saw $460 million of outflows after $103 million of outflows a week prior.

October 7 -

ICI reported $704 million of inflows, a $1.1 billion drop from the week prior, bringing the total to $76 billion year to date.

October 6 -

The lower inflows and high-yield outflows can be tied to the correction over the past week and may point to uncertainty from retail investors over broader market volatility.

September 30 -

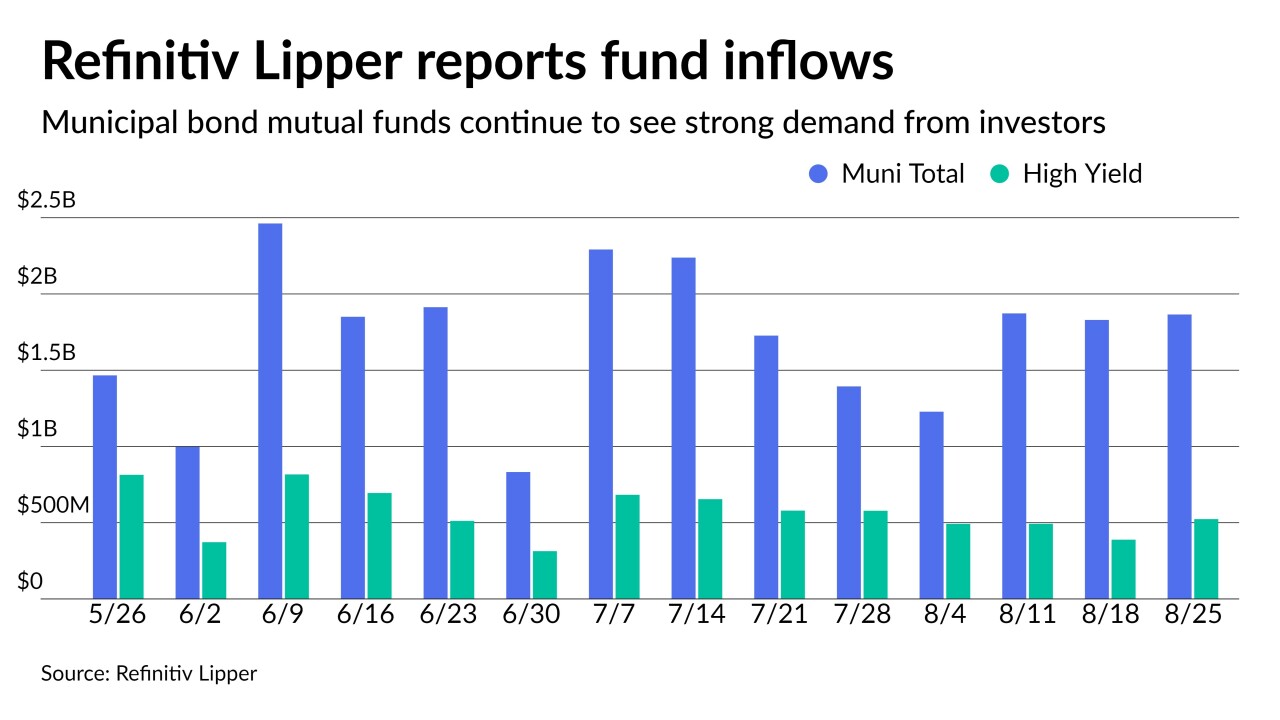

U.S. Treasuries sold off by double digits while municipals cut levels by one to three basis points. Refinitiv Lipper reported another $1.55 billion of inflows for the 29th consecutive week.

September 23 -

Municipals continue to stay in their own lane. ICI reported $1.4 billion of inflows in the 28th consecutive week.

September 22 -

Municipals have been distracted by the robust primary market and that trend will continue next week when another large new-issue calendar greets investors.

September 17 -

Refinitiv Lipper reported $1.3 billion of inflows and an increase in high-yield flows, marking the 28th consecutive week the fund complex saw inflows.

September 16 -

The fund focuses on investment-grade state and local government debt funding sustainable development, including affordable housing, green spaces and hospitals.

September 10 -

The Federal Reserve said Wednesday in its Beige Book report that U.S. economic growth slipped to a more moderate pace between early July and the end of August.

September 8 -

Refinitiv Lipper reported just over $1 billion of inflows into municipal bond mutual funds, an $800 million drop from a week prior, moving the four week moving average to $1.6 billion.

September 2 -

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

August 26 -

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

August 25 -

An influx of investment into high-yield munis has created challenges for fund managers forced to compete against each other to get in on new bond offerings.

August 20 -

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

August 12 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

August 11 -

The increasing influence of institutional market participants is even stronger in the taxable muni sector, a Municipal Securities Rulemaking Board report finds.

August 11 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21