-

Retail investors may be moving out of municipal bond mutual funds and into separately managed accounts, largely due to the headline shock of the massive outflows from the funds, participants say.

September 23 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

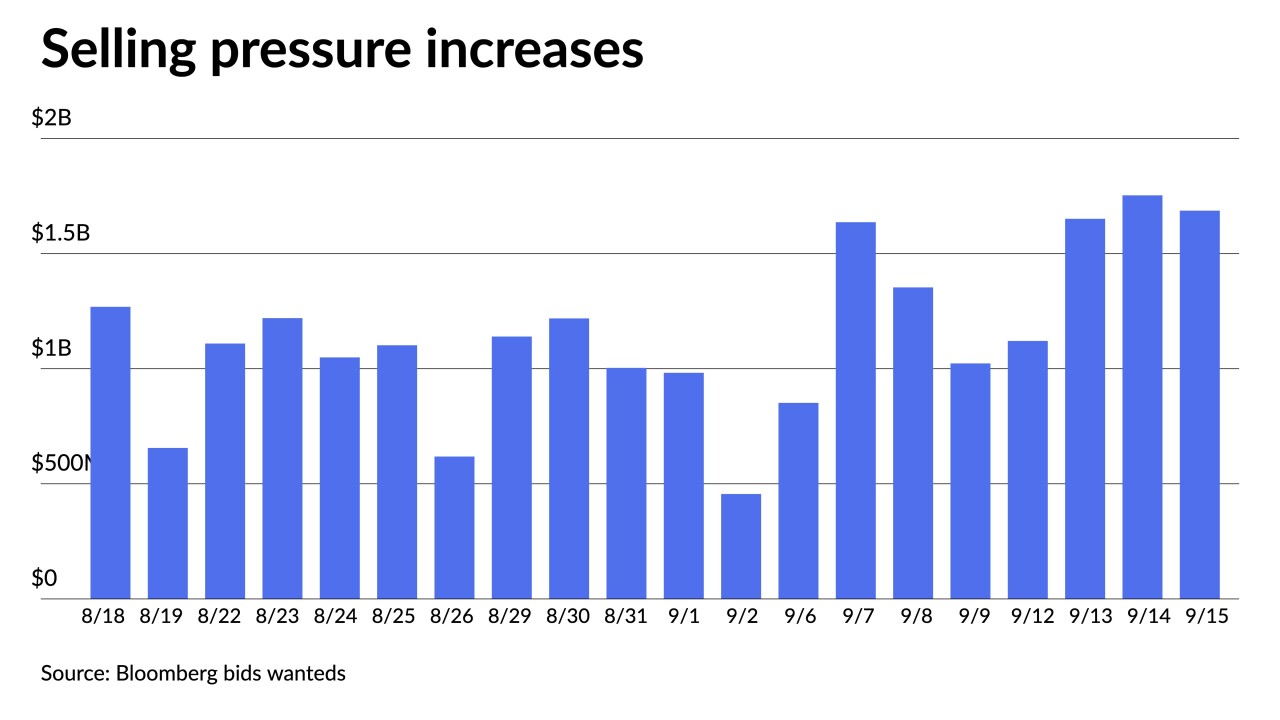

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

"Everyone is trying to figure out when the outflow cycle is over," said Craig Brandon, co-director of municipal investments at Eaton Vance.

September 15 -

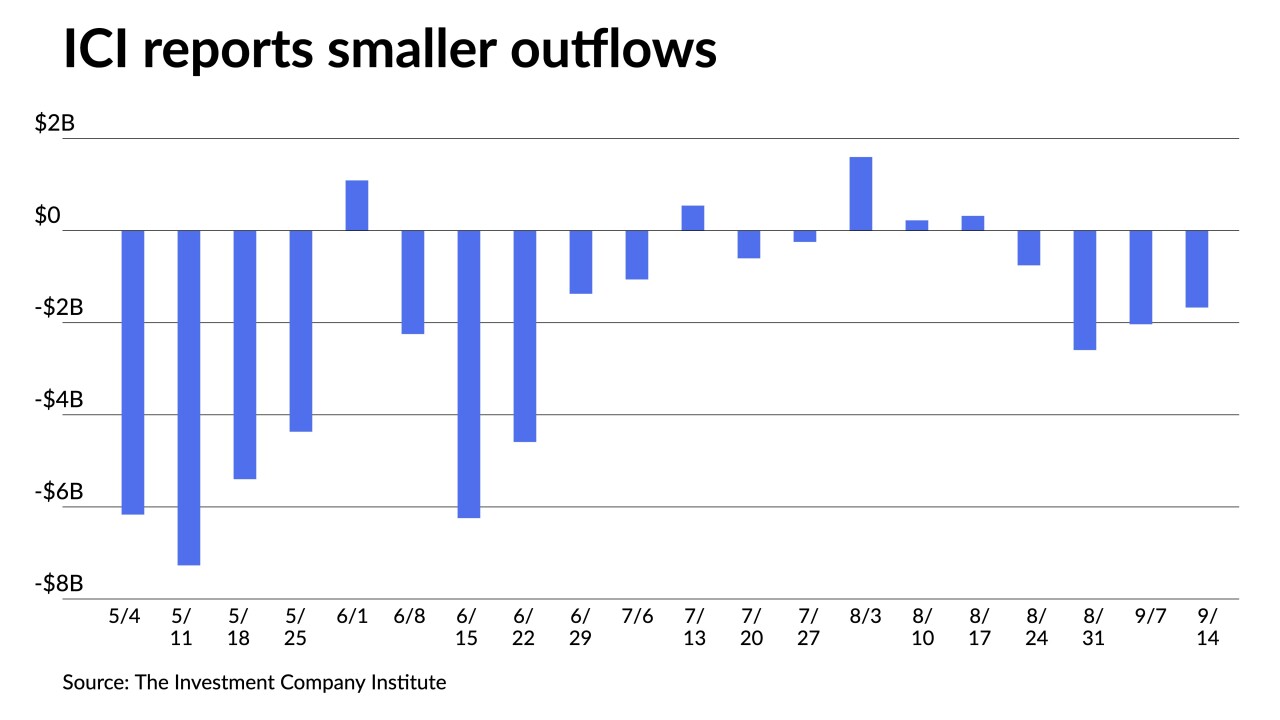

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14 -

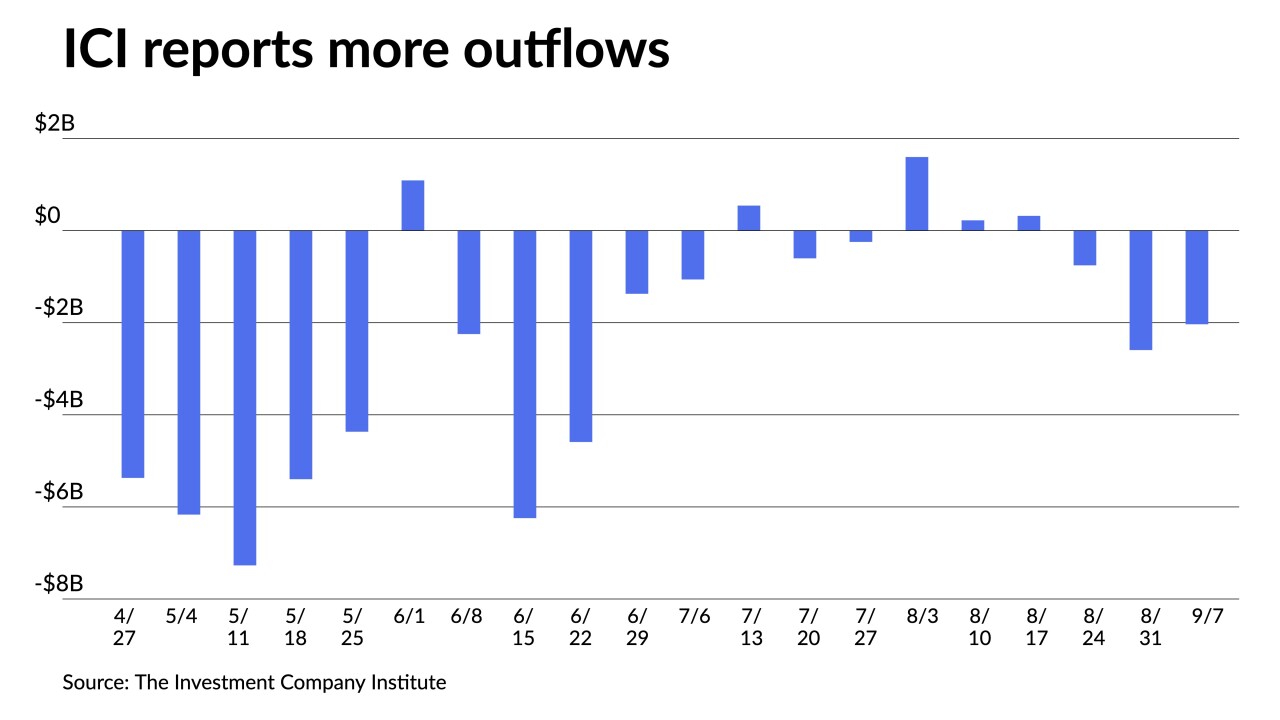

The Investment Company Institute reported $2.527 billion of outflows from muni bond mutual funds in the week ending Aug. 31 compared to $765 million of outflows the previous week.

September 7 -

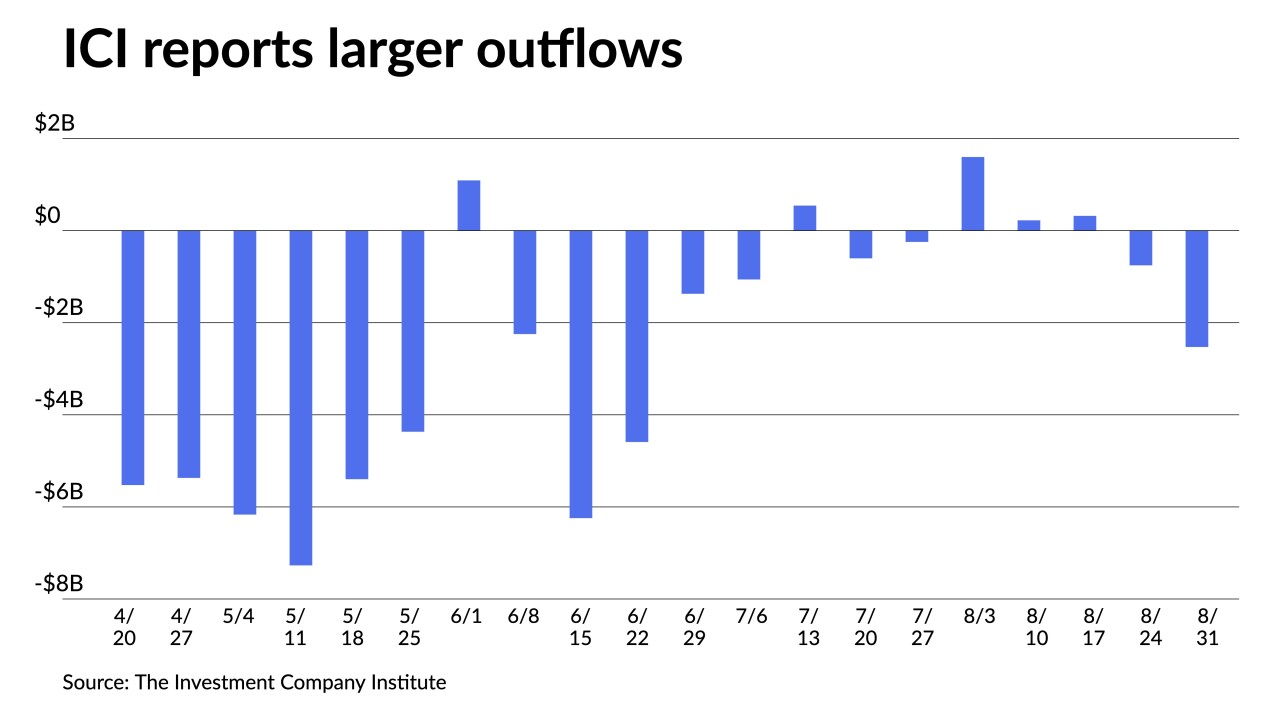

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

The Investment Company Institute reported $230 million of inflows into muni bond mutual funds in the week ending August 17. ETFs see second week of outflows.

August 24 -

Join Peter O'Neill, Director and Senior Fixed Income Portfolio Manager, at Bank of America, and Blake Lynch, Head of Business Development, IMTC, as they discuss the role of separately managed accounts in the muni market with The Bond Buyer's Lynne Funk.

-

Losses for August climbed last week, with month-to-date returns in the red at negative 1.40% on the Bloomberg muni index, high-yield seeing 0.99% losses, taxables at 2.01% losses and the impact index losing 1.70%.

August 22