-

The April producer price index grew less than expected, suggesting inflationary pressure will remain weak.

May 9 -

The debate over the success of quantitative easing continues, even as the threat of recession slips.

May 8 -

Federal Reserve Vice Chairman Richard Clarida pushed back against speculation in financial markets the central bank will cut interest rates to boost softening inflation up to its 2% target.

May 7 -

U.S. interest rates are “in the right place” and don’t need to be lowered, although weak inflation merits close watching, according to Robert Kaplan, president and CEO of the Federal Reserve Bank of Dallas.

May 7 -

Change is always difficult, and the Federal Reserve’s attempt to find a better monetary policy framework is no exception.

May 6 -

A posse of Federal Reserve policymakers met with skepticism last week when they described ways to potentially improve their management of the economy.

May 6 -

The White House asked former domestic policy adviser Paul Winfree if he was interested in joining the Federal Reserve Board of Governors.

May 6 -

The April employment report topped estimates for jobs created, while the jobless rate fell to a 49-year low; wage increases missed projections.

May 3 -

Federal Chair Jerome Powell doused market hopes for a rate cut, but it was not the result of a shift in Fed policy.

May 2 -

The announcement comes after several news reports that Stephen Moore would not back down from his anticipated nomination to serve on the Fed despite growing concerns from Republican senators.

May 2 -

The Fed Chair said the FOMC is “comfortable with our current policy stance,” which he termed “appropriate.”

May 1 -

President Donald Trump suggested Tuesday that if the Federal Reserve cut interest rates by one percentage point and resumed bond purchases it would boost the economy “like a rocket,” as central bank policy makers met to decide on where to set borrowing costs.

April 30 -

The benchmark targeted by the Federal Reserve is on the rise again and that’s leading some to question whether the central bank could make adjustments as soon as this week to maintain control of the rate.

April 30 -

After its sudden pivot on monetary policy, the Fed chair recently said the central bank's so-called dot plot has become a “source of confusion” for investors.

April 29 Penn Mutual Asset Management

Penn Mutual Asset Management -

President Donald Trump’s top economic adviser said the White House still backs Stephen Moore for a position on the Federal Reserve Board despite growing criticism over past comments deriding Midwestern cities and women.

April 29 -

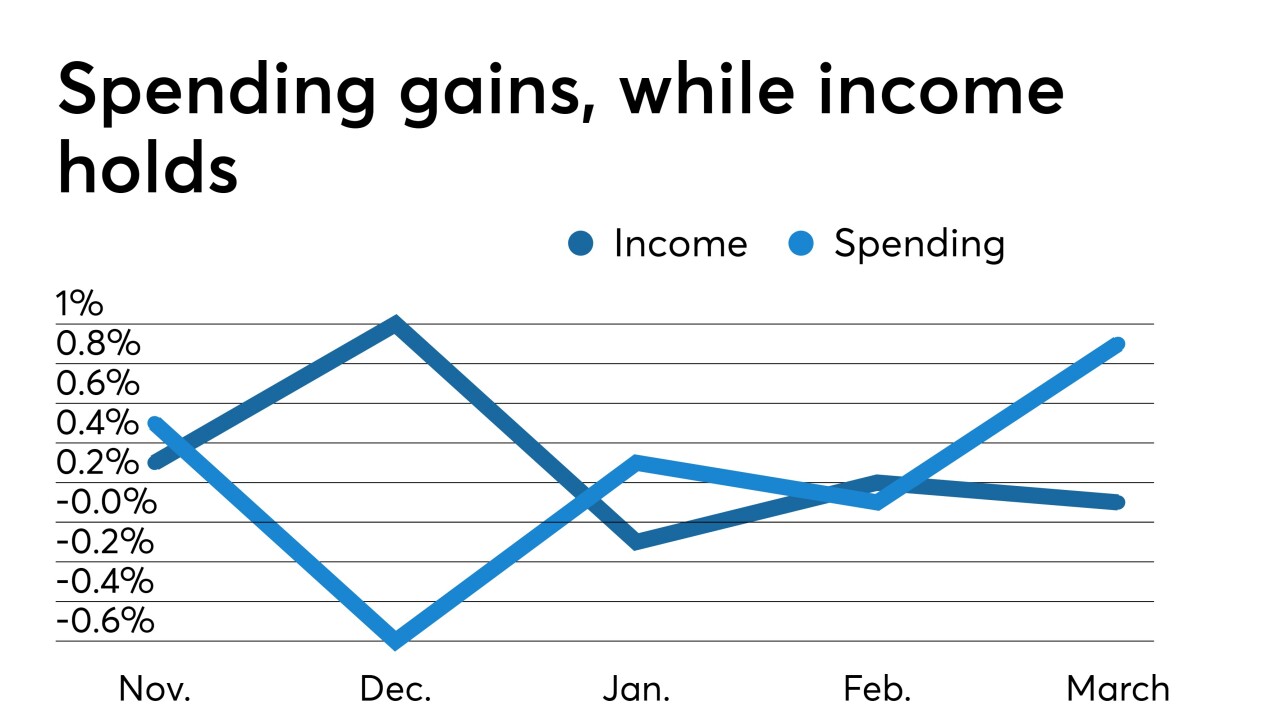

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29 -

Respondents to the a Bloomberg poll saw the target range for the benchmark federal funds rate staying right where it is — at 2.25% to 2.5% — through 2020.

April 26 -

Andrew Dassori, CIO of Wavelength Capital Management, discusses why it’s getting harder to predict the economy; yield curve inversion; mixed economic signals and headwinds; and how new ideas from the upcoming conference on monetary policy could help transform the Fed. Gary Siegel hosts.

April 25 -

President Donald Trump said he won’t nominate Herman Cain for a seat on the Federal Reserve Board after opposition from his own Republican party appeared to sink the former pizza company executive’s hopes for Senate confirmation.

April 22 -

An inverted Treasury yield curve is no longer a reliable signal of recession, and what matters more is the level of the curve.

April 22