-

President Donald Trump renewed his attack on the Federal Reserve Monday.

June 10 -

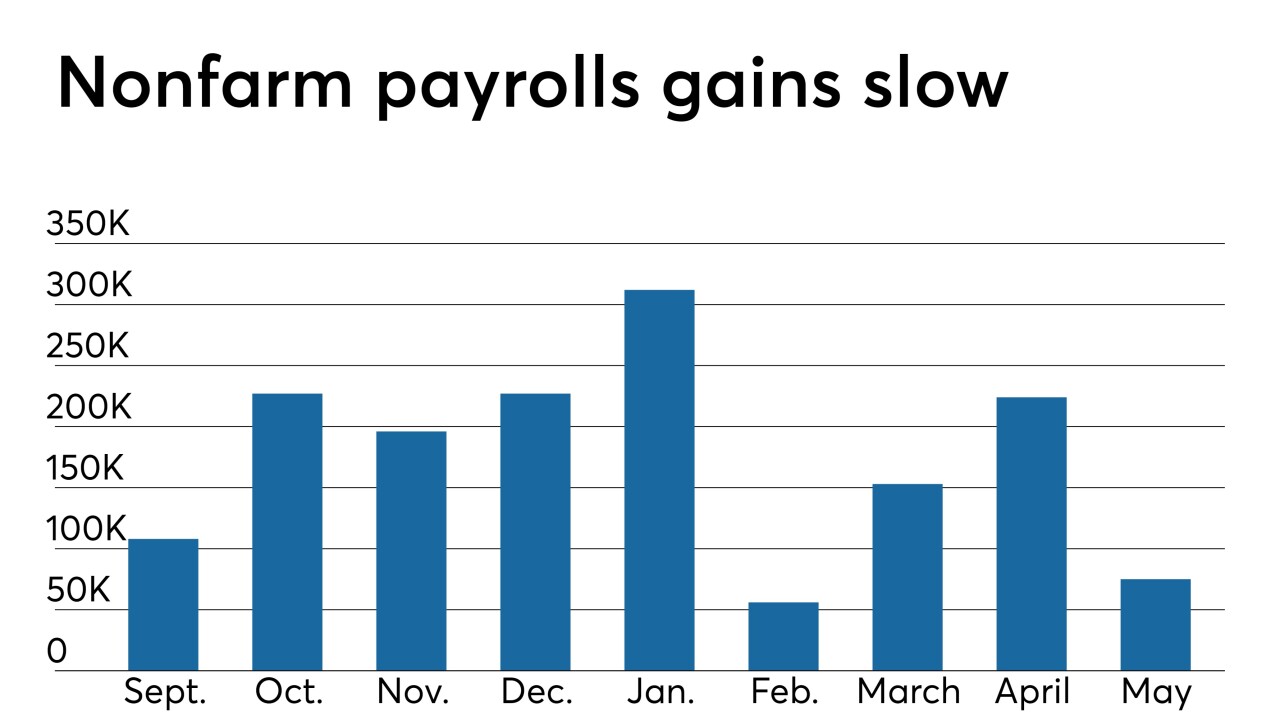

Bonds rallied as market observers gauged whether Friday’s weak employment report will spur the Federal Reserve to cut rates.

June 7 -

The standoff continues as the Fed won't talk rate cuts and the market continues to expect more.

June 6 -

Brian Rehling, co-head of global fixed income strategy for Wells Fargo Investment Institute, discusses trade issues, the growing yield curve inversion and Fed rate cut prospects. Gary Siegel hosts.

June 6 -

A disappointing read from the ADP employment report overshadowed a positive read on the service sector, and the markets upped expectations for rate cuts through next year.

June 5 -

Under the right conditions, Federal Reserve Board Chair Jerome Powell hinted he would be willing to consider lowering interest rates.

June 4 -

The St. Louis Fed's James Bullard and the San Francisco Fed's Mary Daly said economic conditions may justify lower interest rates.

June 3 -

An uptick in inflation may be a sign that Federal Reserve Chair Jerome Powell was right when he said a dip in prices could be brief, allowing patience on rates.

May 31 -

A decline in pending home sales and a widening trade deficit suggest growth will slow this year.

May 30 -

Judy Shelton, a conservative economist whom the Trump administration is considering for a vacancy on the Federal Reserve, said the central bank should avoid restraining growth while the U.S. is engaged in a trade war with China.

May 29