-

Ed Moya, senior market analyst for the Americas at OANDA, talks with Bond Buyer Managing Editor Gary Siegel about the upcoming FOMC meeting, inflation, the possibility of tapering and the future make-up of the Fed in a wide-ranging discussion on the economy and monetary policy. (31 minutes)

July 20 -

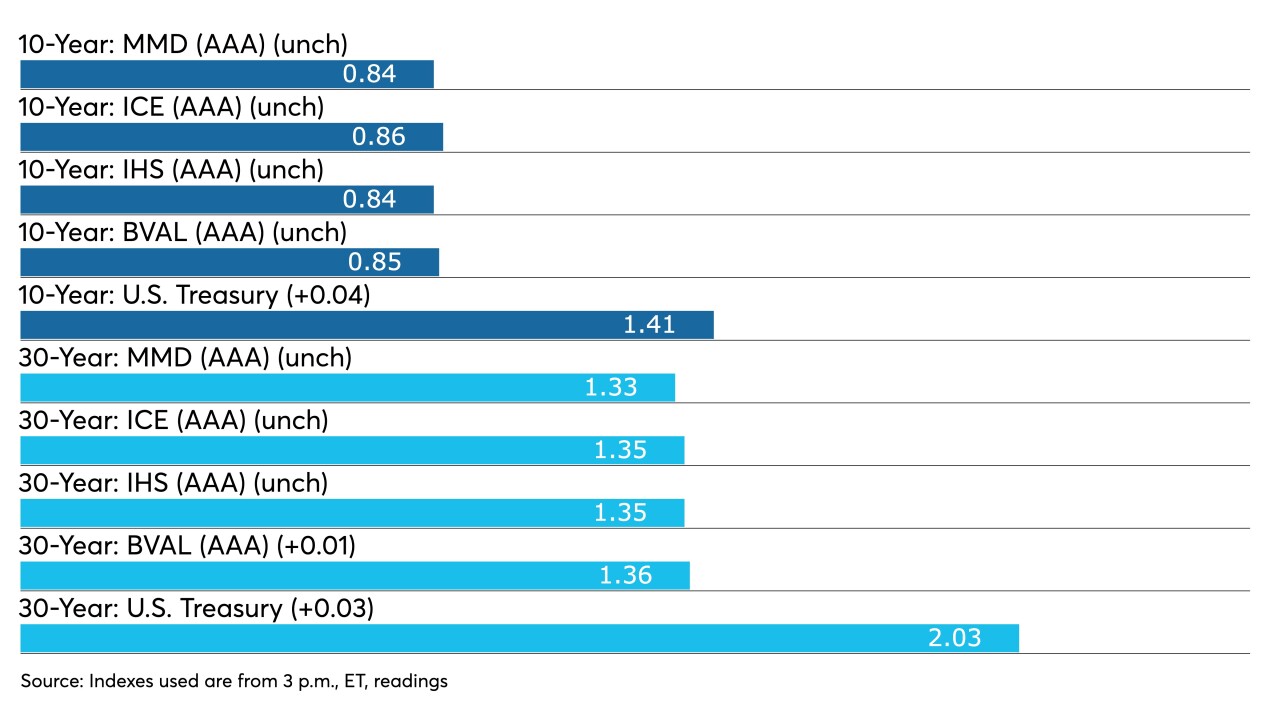

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

July 19 -

President Joe Biden said he believes the surge in U.S. inflation is temporary and that he has told Federal Reserve Chairman Jerome Powell that he respects the central bank’s independence.

July 19 -

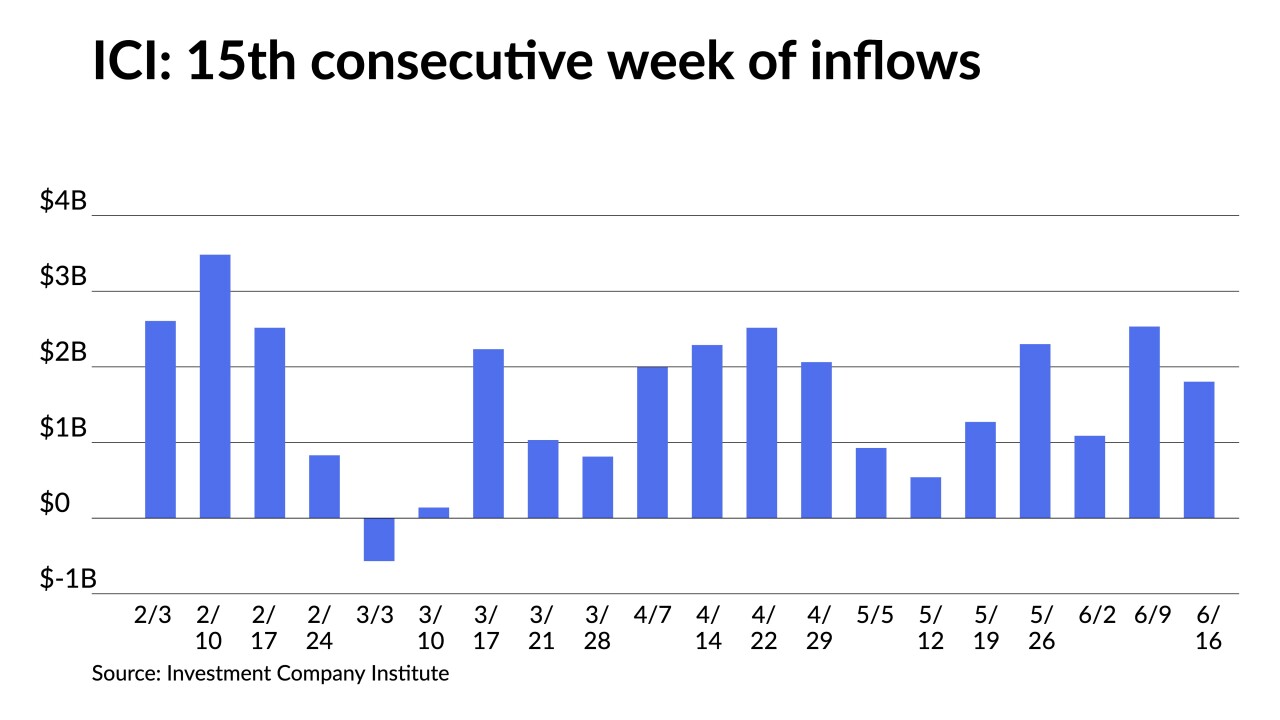

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

Edward Al-Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, will discuss the economy, inflation and the Federal Reserve.

-

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

June 23 -

John Hallacy, founder of John Hallacy Consulting LLC, talks with Chip Barnett about the pandemic’s lingering credit impacts on state finances in a wide-ranging discussion of the many issues affecting the municipal market today. (17 minutes)

June 22 -

A reported preliminary 25.8% drop in May issuance shows how strong fund inflows, improving credit and the reopening of governments are keeping the muni market issuer friendly.

May 26