-

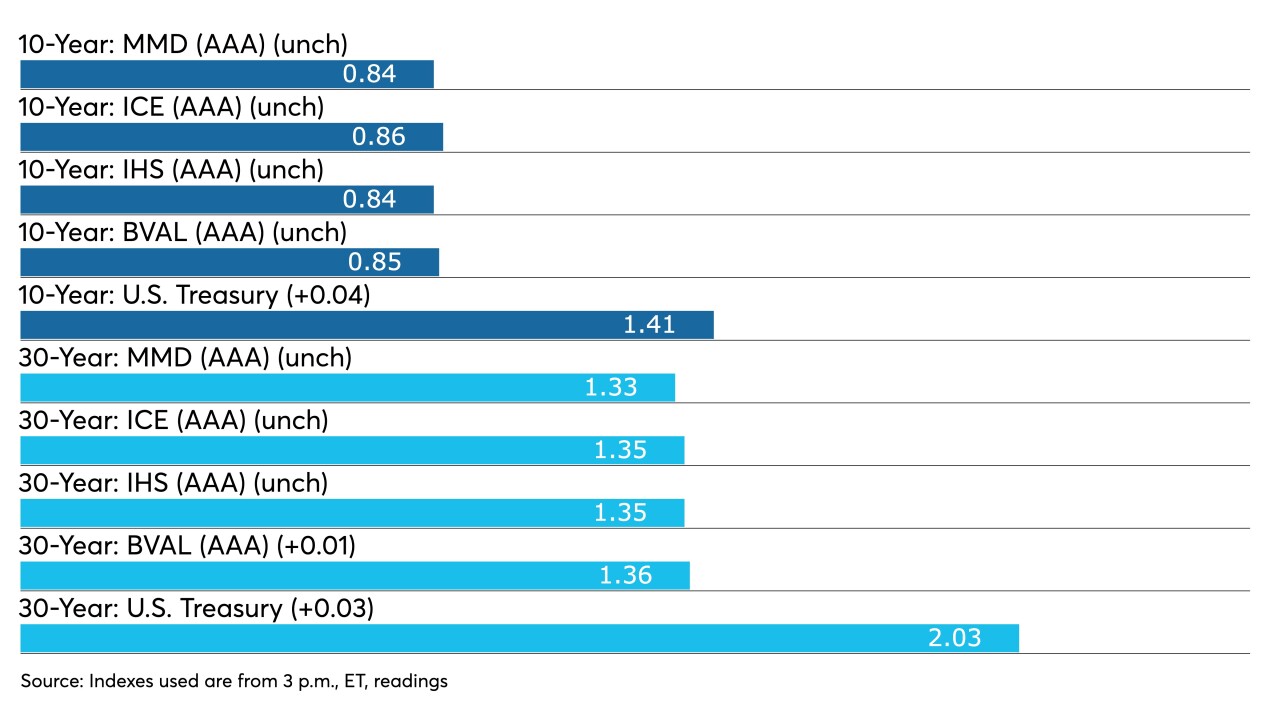

Spreads have been widening, but secondary trading was on the light side and triple-A benchmarks were cut by only a basis point in spots even as U.S. Treasury yields once again rose on the 10- and 30-year.

October 19 -

Municipals have mostly held steady as bid-wanteds have risen, but so have yields and ratios, making for a more satisfactory range for investors getting into the market at these new higher levels.

October 14 -

Volatility in the U.S. Treasury market continues to pull on municipal bond valuations, despite little trading volume.

October 12 -

CB President Christine Lagarde said Wednesday that inflation “is largely attributable to the reopening of the economy.”

September 29 -

Large new issues from California, New York utilities and airport deals were repriced to lower yields and remained the focus for the municipal market, again ignoring a swing by U.S. Treasuries.

September 14 -

Refinitiv Lipper reported $1.1 billion of inflows into municipal bond mutual funds, with high-yield falling to $144 million. Even with the lower reported inflows, funds still raked in record billions so far in 2021.

September 9 -

COVID has impacted so many sectors of life over the past two years. Its presence has spiked a sudden increase in inflation, and whether it is a blip or a long-term trend is still unknown.

August 25 tru Independence

tru Independence -

Treasury Secretary Janet Yellen said that by the end of this year, monthly price changes will be running at a level consistent with the Federal Reserve’s target, even if year-over-year numbers continue to show uncomfortably high inflation.

August 4 -

Joe Kalish, chief global macro strategist at Ned Davis Research, discusses his thoughts on when the Federal Reserve will announce it will cut back on its asset purchases, the possibility of Chair Jerome Powell’s re-nomination and what to expect from the Jackson Hole summit. Gary Siegel hosts (27 minutes)

August 3 -

Fundamentally, much of the price inflation we’ve experienced over the past year can be attributed to the trillions of dollars of new money pumped into the economy that’s been looking for a home ever since.

July 27 MaxMyInterest

MaxMyInterest -

What bond-market guru Mohammed El-Erian said Friday was enough to make bond investors listen like they’re in an old E.F. Hutton commercial.

July 23 -

Increasing attention to whether inflation is a problem for the U.S. economy and financial markets isn’t resolved easily by looking at the most recent economic and financial market data.

July 21 Keel Point

Keel Point -

Ed Moya, senior market analyst for the Americas at OANDA, talks with Bond Buyer Managing Editor Gary Siegel about the upcoming FOMC meeting, inflation, the possibility of tapering and the future make-up of the Fed in a wide-ranging discussion on the economy and monetary policy. (31 minutes)

July 20 -

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

July 19 -

President Joe Biden said he believes the surge in U.S. inflation is temporary and that he has told Federal Reserve Chairman Jerome Powell that he respects the central bank’s independence.

July 19 -

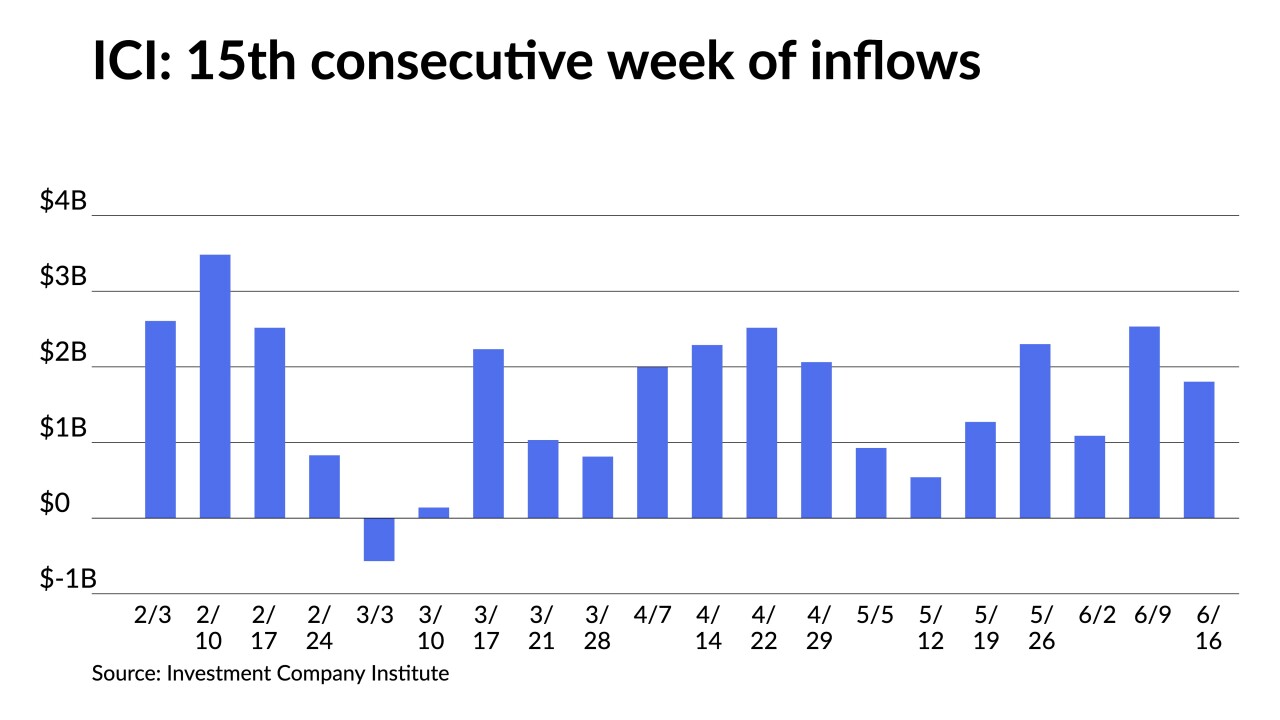

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

Edward Al-Hussainy, senior interest rate and currency analyst at Columbia Threadneedle, will discuss the economy, inflation and the Federal Reserve.

-

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

June 23