-

While municipals were little changed, broader markets remain focused on Jackson Hole and speculating what will be said about tapering.

August 24 -

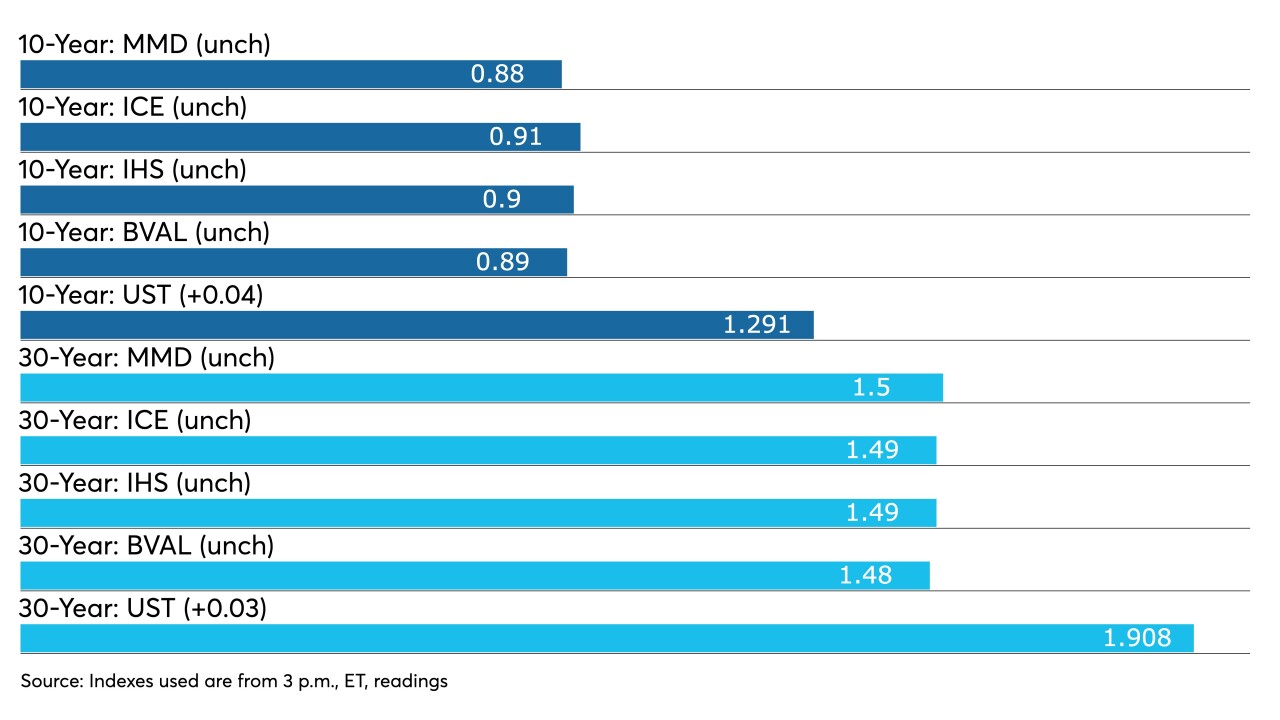

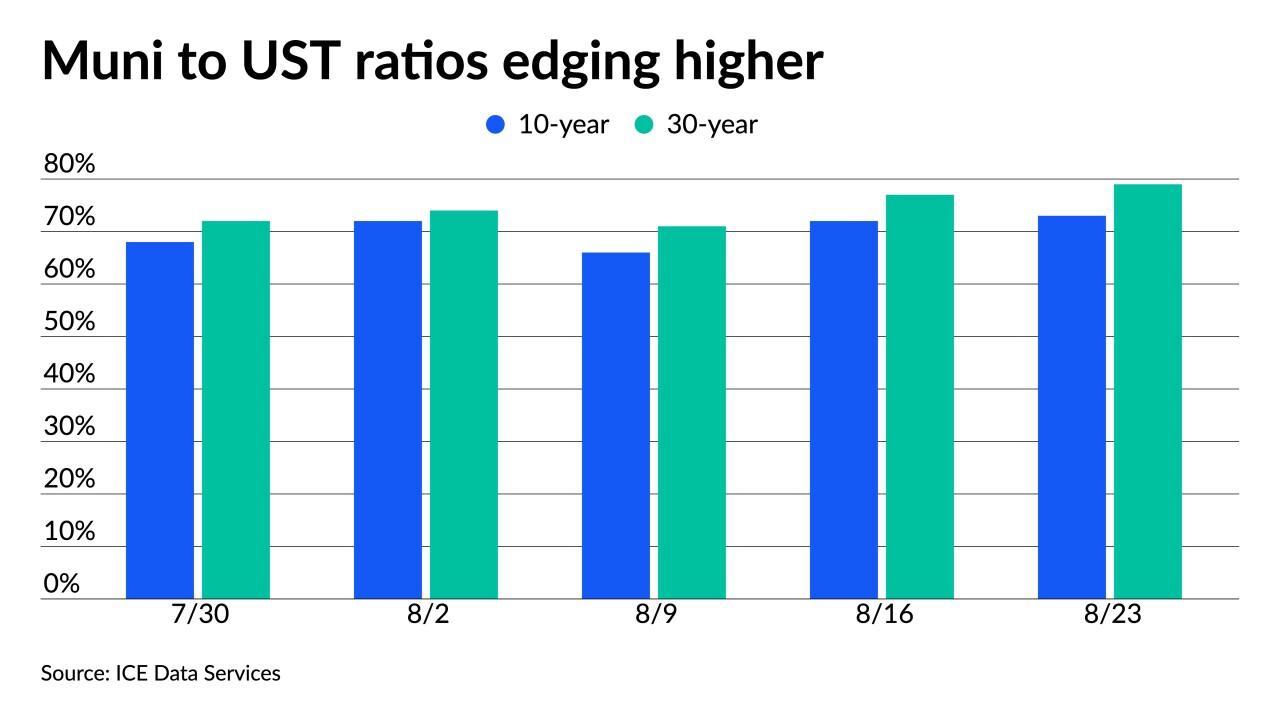

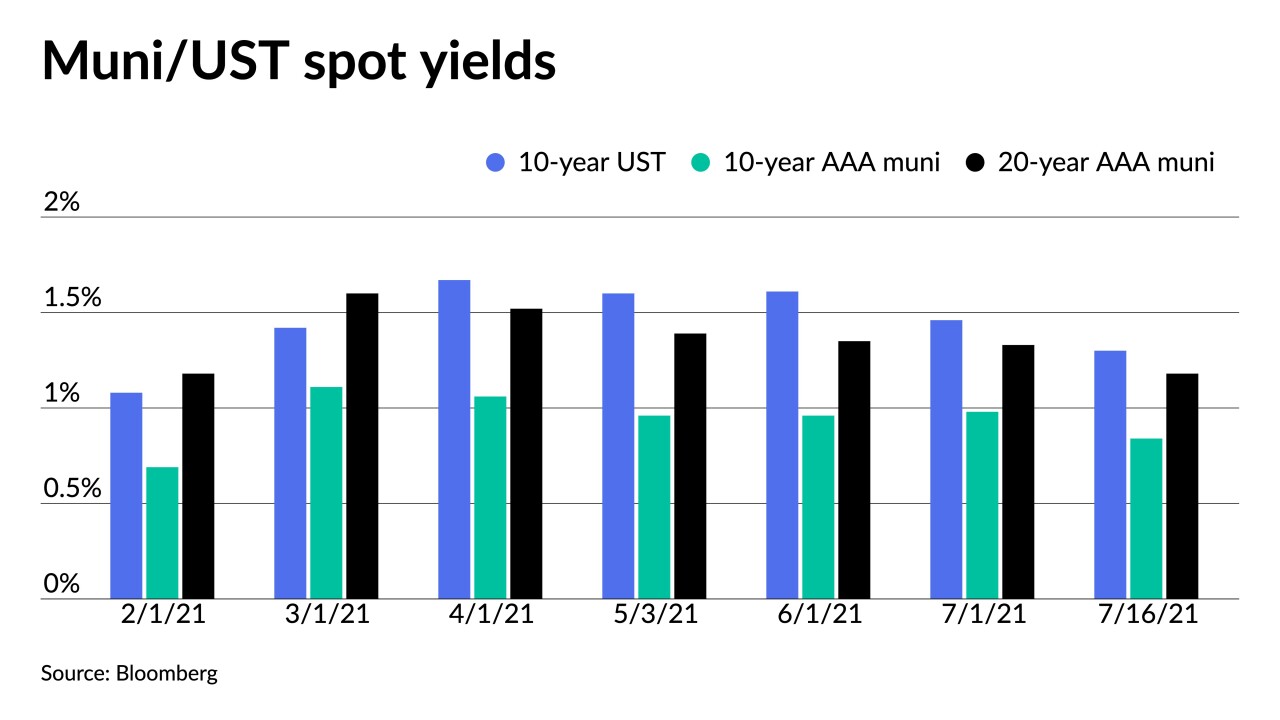

U.S. Treasuries gave little direction Monday, holding ratios and yields steady, leading most participants to argue both are satisfactory to ride out the summer.

August 23 -

The short end of the muni market saw trading of larger blocks at or below benchmarks but yield curves were little changed on a summer Friday.

August 13 -

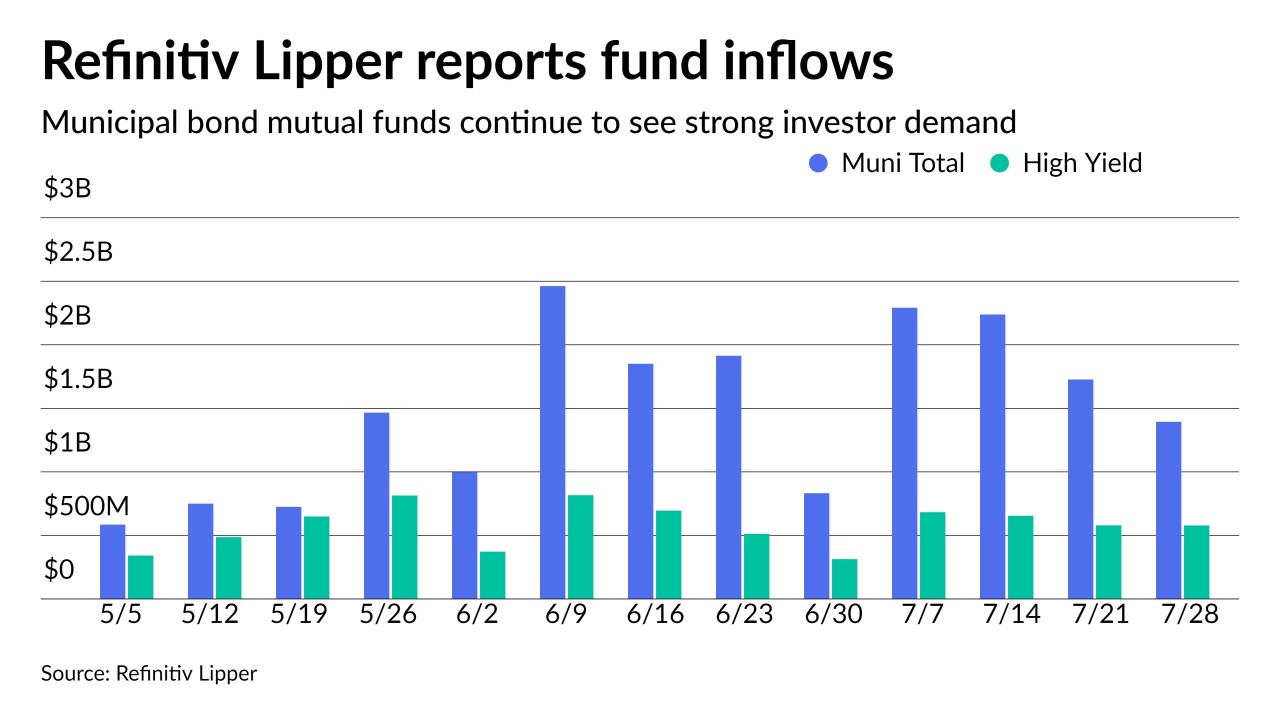

Refinitiv Lipper reported $1.87 billion inflows. A solid demand component for the market, but some suggest the move into bonds from equities is more an asset reallocation than investors keen on fixed income.

August 12 -

Another $2 billion-plus was reported flowing into municipal bond mutual funds in the latest week, continuing to be a supportive demand component for munis.

August 11 -

Municipals are tethered to Treasuries, more so in recent sessions, and have cheapened, but strong technicals — $18.5 billion of net negative supply and large reinvestment needs — still hang overhead.

August 10 -

Triple-A benchmarks saw cuts of one to two basis points across the curve, but still outperformed two days of UST weakness and have outperformed UST losses since the start of the month.

August 9 -

Better-than-expected job gains, a rising UST complex and an increase in supply to test municipals' resolve.

August 6 -

Secondary trading petered off into Thursday afternoon, holding triple-A benchmarks steady as most participants await Friday's nonfarm payrolls.

August 5 -

The short end of the market has little room to fall lower.

August 5 -

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

Tighter bidding on bonds 10 years and in pushed high-grade benchmark curves to bump yields.

August 3 -

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

August 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

The pandemic was strikingly different than Sept. 11, financial meltdowns and other disasters, according to Robert Mujica.

July 29 -

Low ratios, low yields and massive demand are leading to a market that is mostly on its own. Refinitiv Lipper reported $1.7 billion of inflows.

July 22 -

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

July 19 -

Supply, however, is still less than the massive amounts of cash on hand. Bond Buyer data shows 30-day visible supply at $12.53 billion.

July 16 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8