-

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

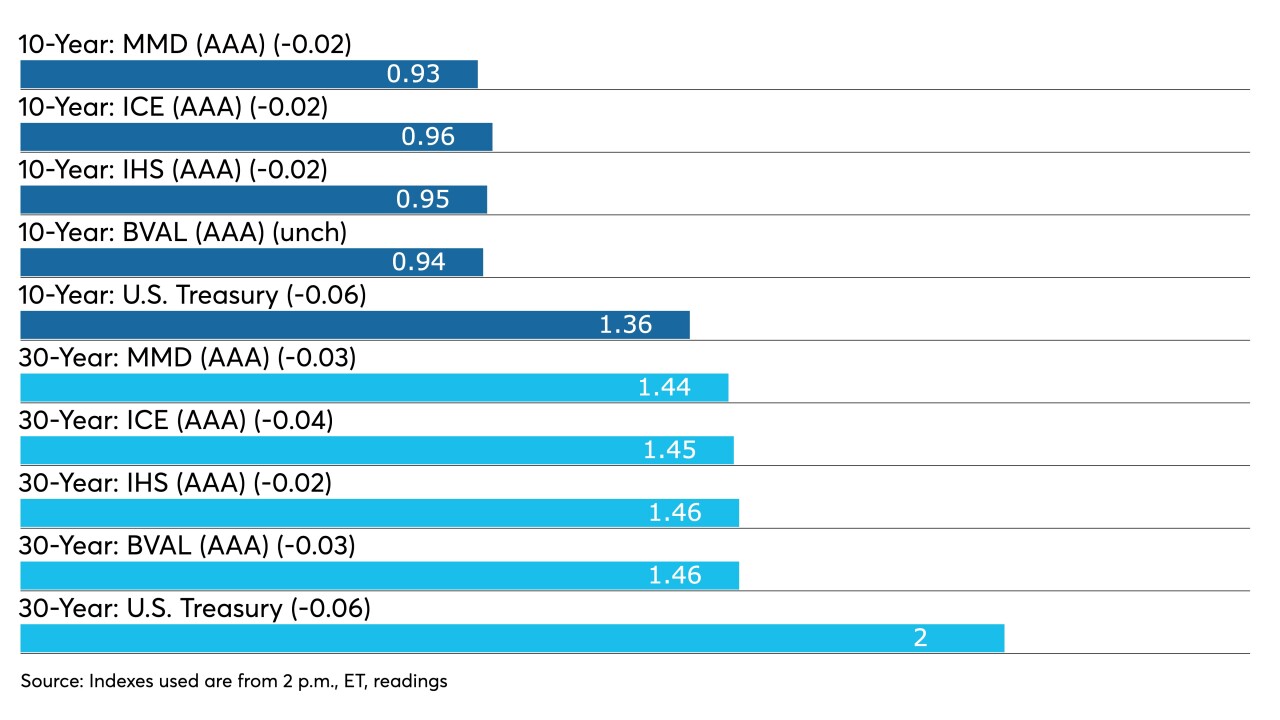

Tighter bidding on bonds 10 years and in pushed high-grade benchmark curves to bump yields.

August 3 -

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

August 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

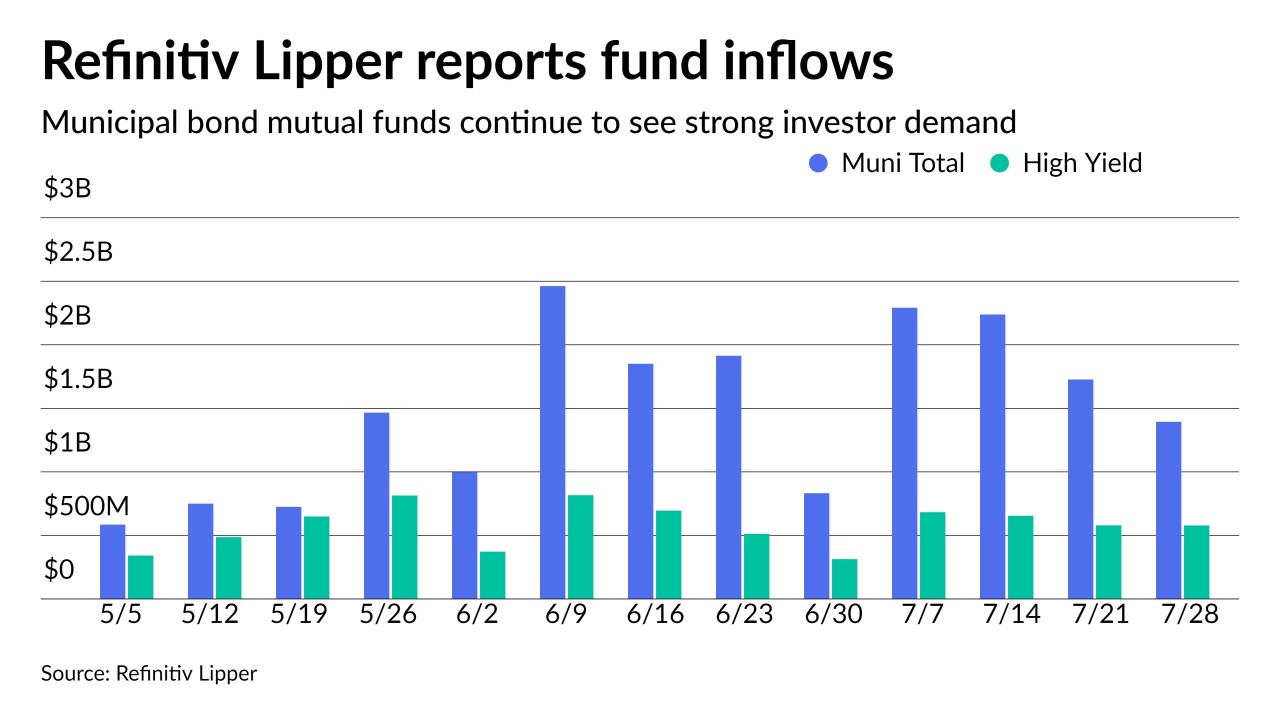

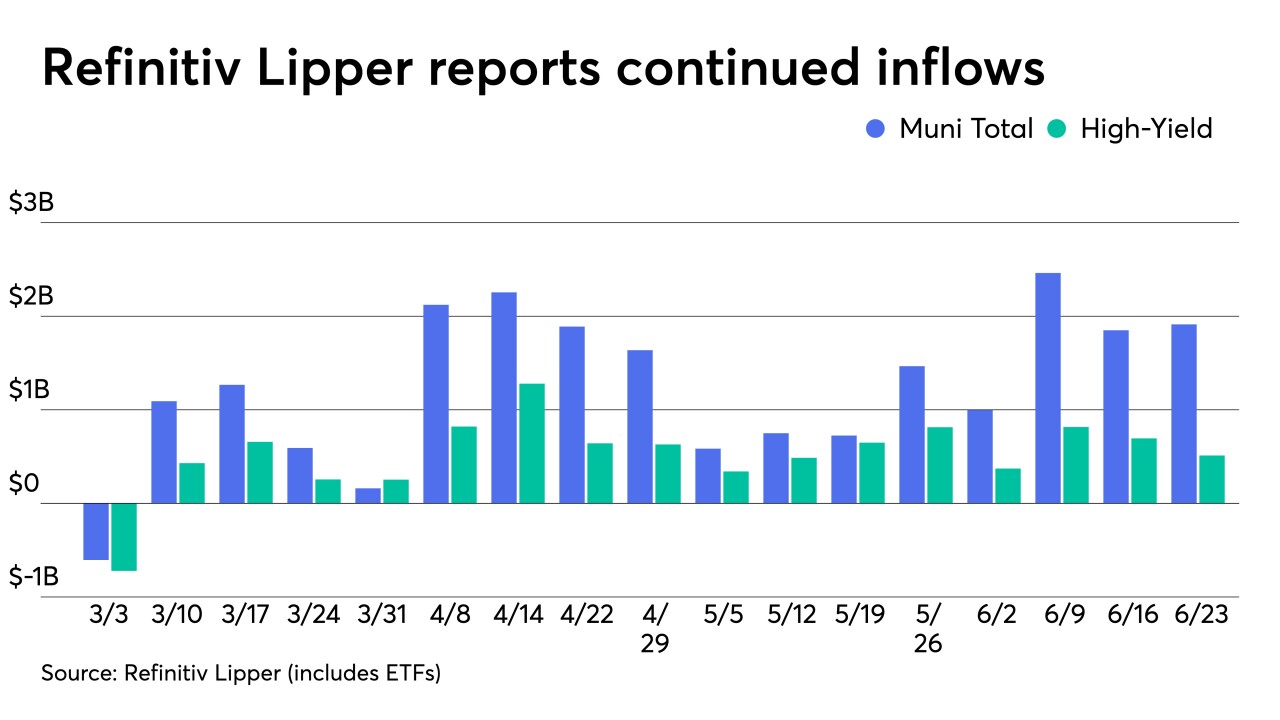

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

The pandemic was strikingly different than Sept. 11, financial meltdowns and other disasters, according to Robert Mujica.

July 29 -

Low ratios, low yields and massive demand are leading to a market that is mostly on its own. Refinitiv Lipper reported $1.7 billion of inflows.

July 22 -

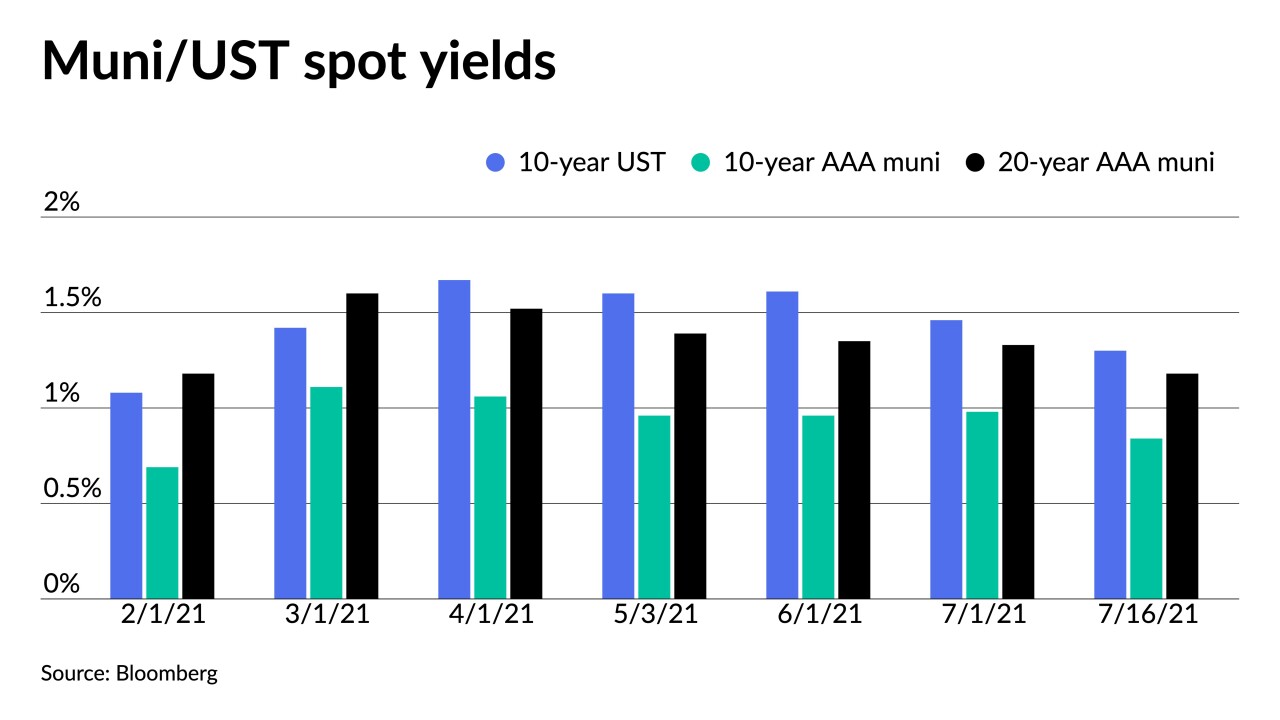

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

July 19 -

Supply, however, is still less than the massive amounts of cash on hand. Bond Buyer data shows 30-day visible supply at $12.53 billion.

July 16 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8 -

U.S. Treasury 10- and 30-year yields hit February lows. Large blocks of high-grades in secondary trading led triple-A benchmarks to lower yields by two to four basis points across the curve.

July 6 -

With better-than-expected payrolls, economists still caution full recovery is a ways away. Muni participants are closely following how the Fed's action — or inaction — will affect the municipal market going forward.

July 2 -

The broader market awaits Friday’s nonfarm payrolls report, but Thursday brought some helpful labor news — unemployment claims dropped to the lowest since before the pandemic-caused economic shutdowns and layoffs plunged in June.

July 1 -

Gilt-edged munis fell as much as two basis points Wednesday as the month ended and the first half stats were put into the record books.

June 30 -

The Board of Elections acknowledged a major error in Tuesday's update. Outgoing Mayor Bill de Blasio and the City Council, meanwhile, are finalizing a $98.7 billion FY22 budget.

June 30 -

A majority of the week's largest new issues priced at yields mostly at or around benchmarks as secondary trading did little to move scales. In economic data released Tuesday, the June consumer confidence index climbed, suggesting spending will rebound.

June 29 -

With various Federal Reserve officials airing their views since the Federal Open Market Committee’s latest meeting, it may take a while for members to reach agreement on tapering, a boon for municipals.

June 28 -

Making it a summer Friday, munis were quiet. Participants contemplate why the market underperformed taxables to the degree they did when fundamentals are objectively strong and little has changed since before the FOMC.

June 25 -

The final new issues of the week close with some bumps in repricings while the secondary was quiet.

June 24 -

A volatile U.S. Treasury market and month-end positioning are pressuring municipal yield curves.

June 22