-

U.S. retail sales unexpectedly fell in December, posting the worst drop in nine years in a sign of slower economic momentum at year-end amid financial market turmoil and the government shutdown.

February 14 -

Labor market “activity declined modestly and momentum remained high in January,” as the Federal Reserve Bank of Kansas City Labor Market Conditions Indicators (LMCI) slid to 0.97 from 1.06 in December, the Bank said Wednesday.

February 13 -

A key measure of U.S. inflation was little changed in January while the broader gauge slowed on lower energy costs, underscoring the Federal Reserve's recent decision to be patient on raising interest rates.

February 13 -

U.S. job openings rebounded, reaching a record in December as the rate of those leaving jobs held steady, underscoring robust demand for workers.

February 12 -

Sentiment among U.S. small businesses slumped in January to the lowest level since Donald Trump became president, as the economic outlook weakened amid the longest-ever U.S. government shutdown.

February 12 -

Consumers’ inflation expectations held, while respondents showed more pessimism about the economy.

February 11 -

Consumer credit increased by $16.6 billion in December to $4.010 trillion, the Federal Reserve reported Thursday.

February 7 -

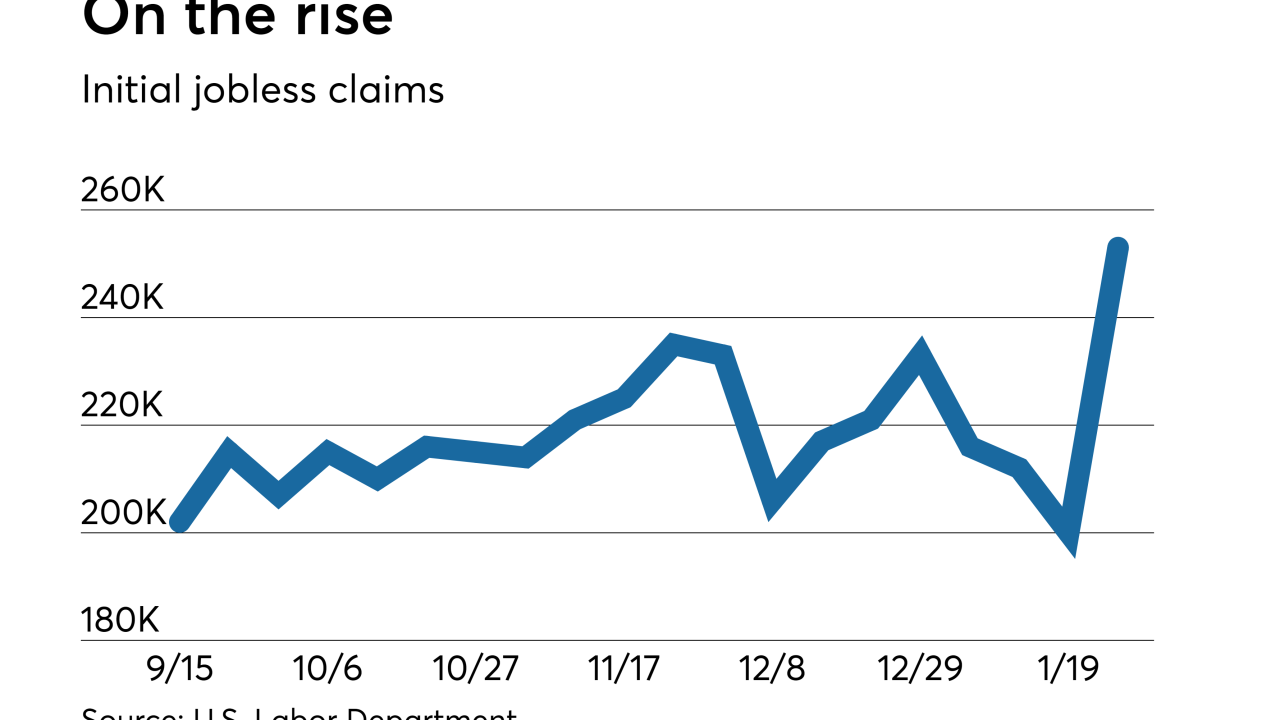

Initial claims for U.S. state unemployment benefits fell by 19,000 to 234,000 in the February 2 week, above expectations for a 221,000 level.

February 7 -

The U.S. international trade gap narrowed to $49.3 billion in November from $55.7 billion in October, the Commerce Department reported Wednesday.

February 6 -

Data for fourth quarter nonfarm productivity and unit labor costs are unavailable due to the delay of GDP data from the Commerce Department.

February 6 -

The U.S. services sector expanded at a slower pace in January as the non-manufacturing index dropped to 56.7 from 58.0 in December.

February 5 -

New orders for manufactured goods decreased 0.6% in November, after dropping an unrevised 2.1% in October.

February 4 -

The Conference Board's Employment Trends Index (ETI) fell to 109.56 in January from a downwardly revised 110.96 in December.

February 4 -

The New York economy slipped in January, with current conditions falling to its lowest level since June.

February 4 -

The Institute for Supply Management index unexpectedly rose last month.

February 1 -

The University of Michigan’s final January sentiment index fell to a two-year low.

February 1 -

U.S. hiring in January topped all forecasts as wage gains cooled.

February 1 -

The MNI Chicago Business Barometer dropped to 56.7 in January, falling 7.1 points from December's downwardly adjusted 63.8.

January 31 -

The employment cost index, a broad gauge monitored by the Federal Reserve, increased 0.7% in the October-December period.

January 31 -

Jobless claims jumped from a five-decade low to 253,000 in the week ended Jan. 26.

January 31