-

The U.S. current account deficit widened to $170.5 billion in the second quarter from a revised $111.5 billion gap in the previous quarter, data released Friday by the Commerce Department showed.

September 18 -

Jobless claims declined, but remain elevated, housing starts and building permits also slid, while manufacturing in the Philadelphia region expanded at a slower pace.

September 17 -

Most panelists don't expect rates to budge in the three-year projection horizon.

September 16 -

With a need to replenish inventories, experts expect the manufacturing recovery to continue.

September 15 -

Consumers’ view of the economy was less pessimistic in August, according to the Federal Reserve Bank of New York’s Survey of Consumer Expectations.

September 14 -

August prices climbed as the recovery from the coronavirus-induced shutdown progressed, but inflation is not a concern to most economists.

September 10 -

Despite a positive employment report last week, Chair Powell predicted a slow recovery with COVID-19 still not under control.

September 8 -

The August employment report was better than anticipated, which could impact the stimulus package being negotiated in Washington, analysts say.

September 4 -

Charles Evans, president of the Federal Reserve Bank of Chicago, said the economy won't be back at pre-pandemic levels until near the end of 2022.

September 3 -

The Fed will have to "pivot from stabilization to accommodation" during the pandemic, Fed governor says.

September 1 -

The pace of recovery will not only be fragmented, but will take a lot longer than originally thought, according to Raphael Bostic, Federal Reserve Bank of Atlanta president.

August 31 -

Federal Reserve Board Chair Jerome Powell announced the group's new policy framework, but didn't explain why it would work.

August 28 -

The economy continues on a fragmented recovery from the pandemic, with the housing market being a positive sign and labor having issues.

August 27 -

The big gain suggests the manufacturing sector will be a positive for economic growth in the near term.

August 26 -

Consumer confidence sputtered even as new home sales surged, highlighting an uneven economic recovery.

August 25 -

Observers expect the Fed to use the gathering, virtual this year, to release the new monetary policy framework it's been working on.

August 24 -

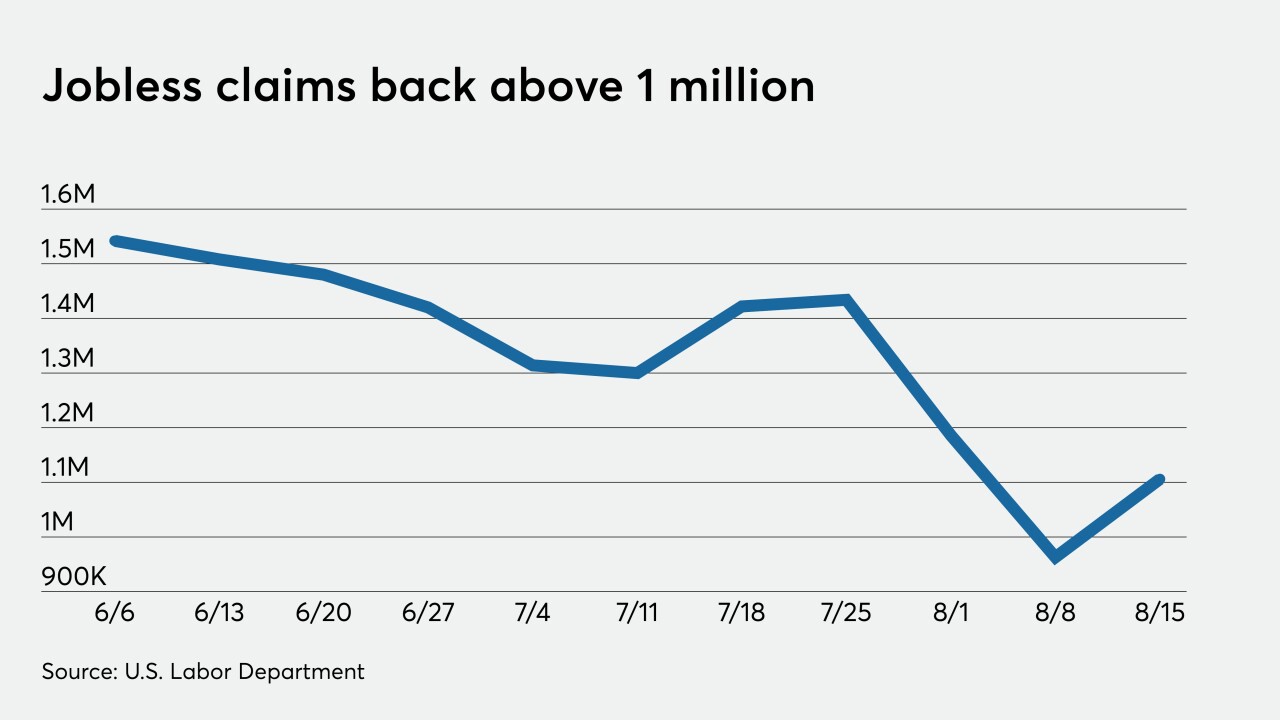

Jobless claims grew, manufacturing expansion weakened and leading indicators grew less than last month.

August 20 -

New residential construction figures surpassed generous expectations, with low mortgage rates fueling the gains, which could be a boon for economic growth.

August 18 -

Monday's economic indicators were mixed, as the National Association of Home Builders reported the housing market index is at an all-time high but the New York Fed reported that business activity edged slightly higher in New York, but the general business index dropped sharply.

August 17 -

The latest retail report released Friday encapsulates the rebound its made the last three months.

August 14