-

It is most certainly an issuers' market as rates are low, credit spreads continue to tighten, money pours into municipal bond mutual funds at record levels and a net negative supply of more than $11 billion.

January 29 -

Chicago Board of Education bonds were repriced to lower yields by as much as 37 basis points, showing just how far investors will go for any incremental yield.

January 28 -

New issues priced with ease with high-grade issuers tight to triple-A benchmarks. It was the first time the municipal yield curve saw such noticeable movement, following little changed secondary activity for nearly the past two weeks.

January 26 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

A 'perpetual calm' continues to fall over the municipal market as inflows into municipal funds, combined with the shortage of traditional tax-exempt supply, is directing most aspects of daily market activity.

January 22 -

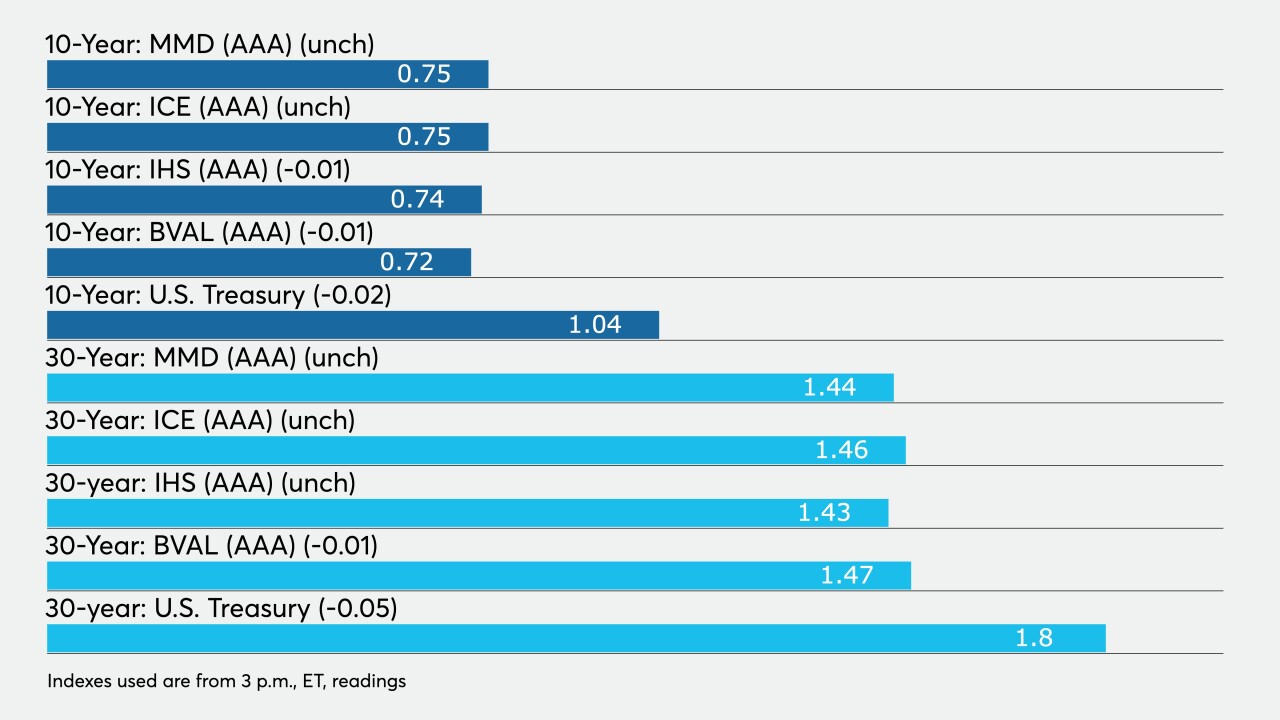

Muni yields have been in a nine-basis point range since the beginning of the year while UST yields have fluctuated more than 20 basis points. With so little supply, muni credit spreads continue to compress.

January 20 -

Friday’s data showed economic weakness. Consumers, the drivers of the economy, pulled back during the holiday season and have exhibited weakening sentiment.

January 15 -

Powell, speaking on a livestreamed event, said interest rates will be raised "no time soon" and there will be plenty of notice "well in advance of active consideration."

January 14 -

Municipal bonds continue to ignore UST and ICI reports $2.67 billion of inflows. While CPI should stay soft through the first quarter, expectations for future inflation should be considered.

January 13 -

Municipals were little changed Monday as participants await the larger new-issue calendar while equities and U.S. Treasuries react to news out of Washington and COVID-19 ravages the globe.

January 11