-

Municipal triple-A benchmarks held steady as the focus was on the primary in which large new issues repriced to lower yields while secondary trading was light.

April 20 -

Four out of the six economic indicators released on Thursday surpassed expectations, with consumers tapping their savings to quench pent-up demand. U.S. Treasuries made gains but municipals stood on their own in an impressive two-day rally with insatiable demand.

April 15 -

The economy grew faster from late February through early April while consumer spending increased, with a possible rise in inflation in the near term, according to the Federal Reserve’s Beige Book released on Wednesday.

April 14 -

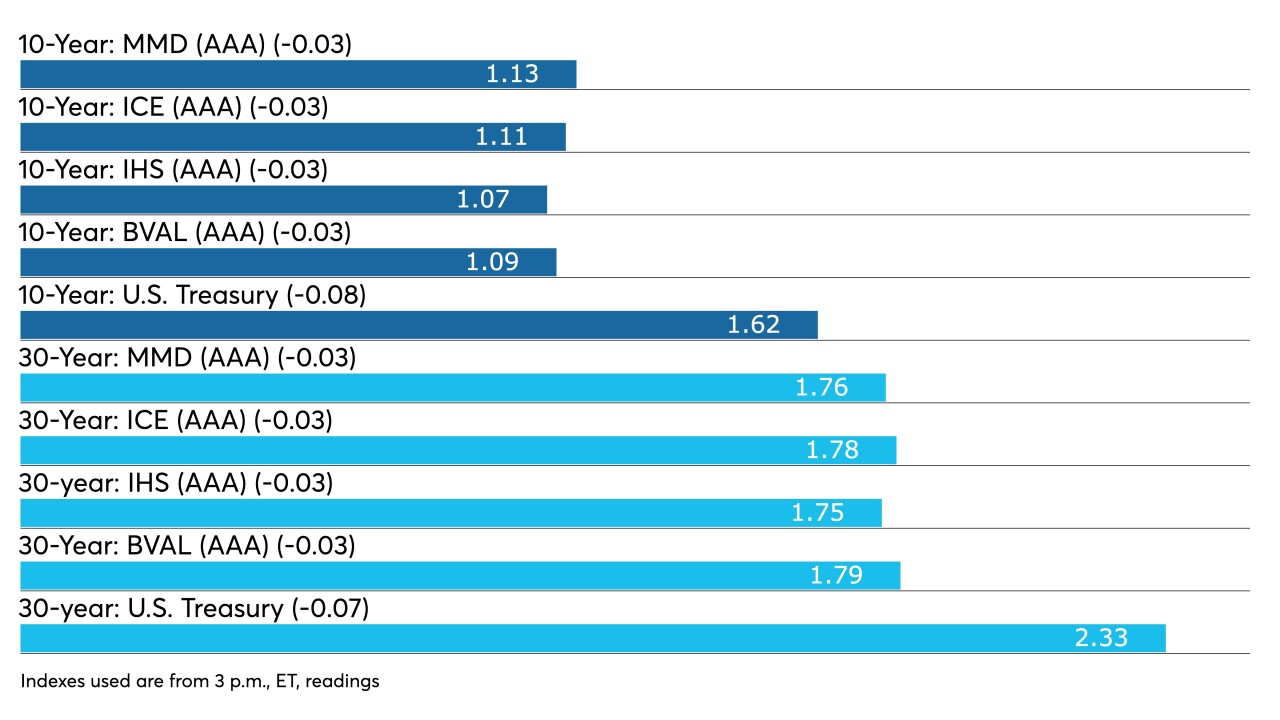

One-year municipal debt has fallen to record lows with benchmark yield curves at 0.05% and the 10-year muni has fallen below 1% while 30-year muni benchmark yields at or less than 10-year UST.

April 13 -

Rating agency moves on credits across the spectrum are pushing spread-tightening in munis, but the broader economy is still two years away from pre-pandemic levels, according to Federal Reserve Bank of Boston President Eric Rosengren.

April 12 -

Ratios aren't budging as municipal to UST outperformance is not abating. The three largest deals of the week will be taxable, increasing the demand component for exempt paper.

April 9 -

High-yield inflows return to the tune of $821 million. The 10-year triple-A hovers just above 1%.

April 8 -

The Investment Company Institute reported another week of inflows, $800-plus million, as participants focus on that part of the market as an indicator of how munis will fare during tax season.

April 7 -

The services sector showed improvement and employment made big gains in March, but economists note the labor market remains far from full employment.

April 5 -

Nonfarm payrolls rose 916,000 last month while the unemployment rate fell to 6%, and the workforce participation rate edged higher.

April 2 -

Biden's $2 trillion infrastructure proposal, combined with the shortened week and the arrival of the second quarter, took attention away from the muni market.

March 31 -

Larger fund flows, lower supply and optimism surrounding issuer credit post-stimulus allowed for a March price reversal that avoids posting two consecutive months with losses. The consumer confidence index jumped to its highest reading in a year in March.

March 30 -

Municipals continue to outperform Treasuries amid a light holiday-shortened week led by a California tobacco deal.

March 29 -

Both personal income and expenditures dropped in February, while personal consumption expenditures also came in weaker than expected, meaning inflation remains in check for now.

March 26 -

Refinitiv Lipper reported more inflows into municipal bond mutual funds to the tune of $592.4 million. Initial jobless claims fell to the lowest point since the pandemic began, moving Treasuries weaker while equities saw gains.

March 25 -

ICI reported another week of inflows at $2.23 billion. U.S. Treasuries strengthened further as COVID-19 concerns linger with shutdowns in Germany and spreads elsewhere. Equities were mixed.

March 24 -

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

March 23 -

Monday’s economic data suggested weakness, with existing home sales declining for the first time in four months and the Federal Reserve Bank of Chicago’s National Activity Index slipping into negative territory, but economists are not concerned.

March 22 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

March 18 -

A repricing of Illinois GOs saw the bonds bumped by 12 to 20 basis points from Tuesday's preliminary pricing wires and 17 to 25 basis points from Monday's price talk.

March 16