-

A disappointing jobs report gives credence to the Federal Reserve’s concern about slack in the labor market.

May 7 -

Refinitiv Lipper reported $584 million of inflows, $341 million of which went to high-yield, as investors pull back on reinvesting to pay tax bills with the May 17 tax filing deadline looming.

May 6 -

Pennsylvania's competitive GO deal saw its yields fall further from recent trading while the North Texas Tollway Authority benefited from positive credit news on the transportation sector and repriced 25 basis points lower. ICI reported another round of $2-billion-plus inflows.

May 5 -

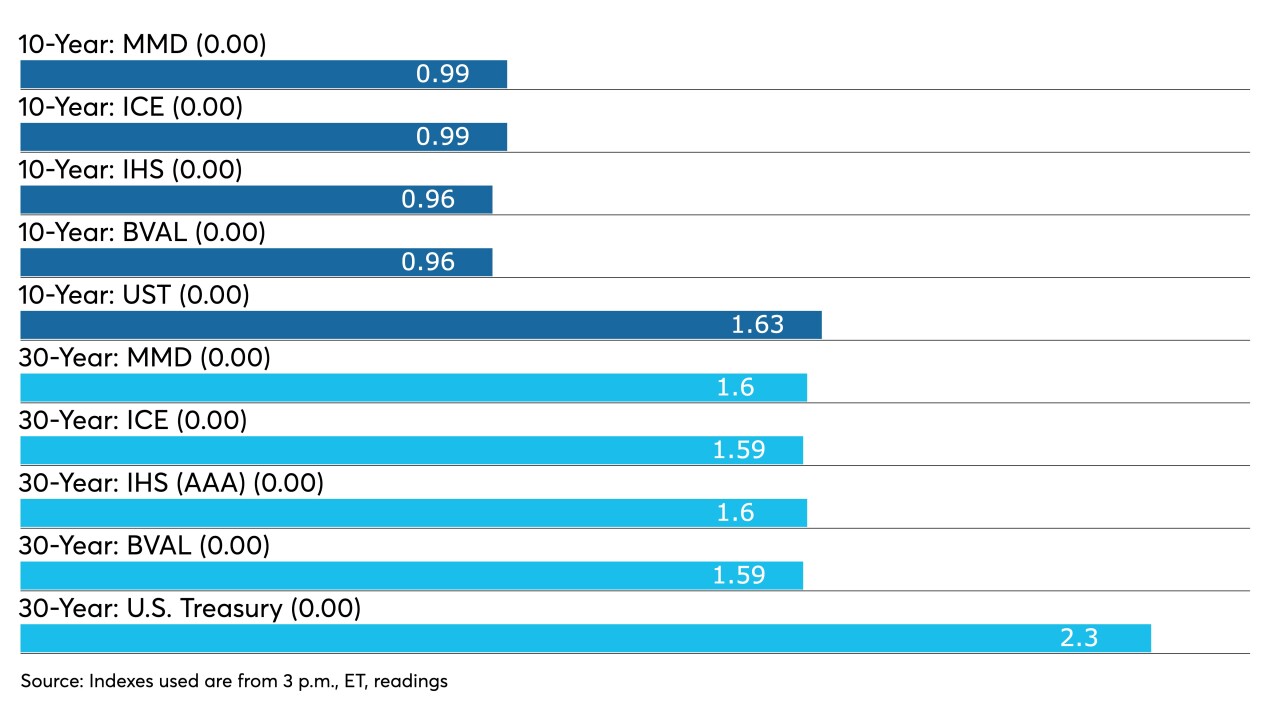

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

May 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

April 29 -

Data released Tuesday show an improving economy, which continues to stoke fears of impending inflation. Muni investors await New Jersey's $1.57 billion transportation deal.

April 27 -

The dearth of supply will likely hold down rates and keep certain investors out of the muni market. High-yield municipal bonds, still the most in-demand sector, tightened again.

April 26 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

April 22