-

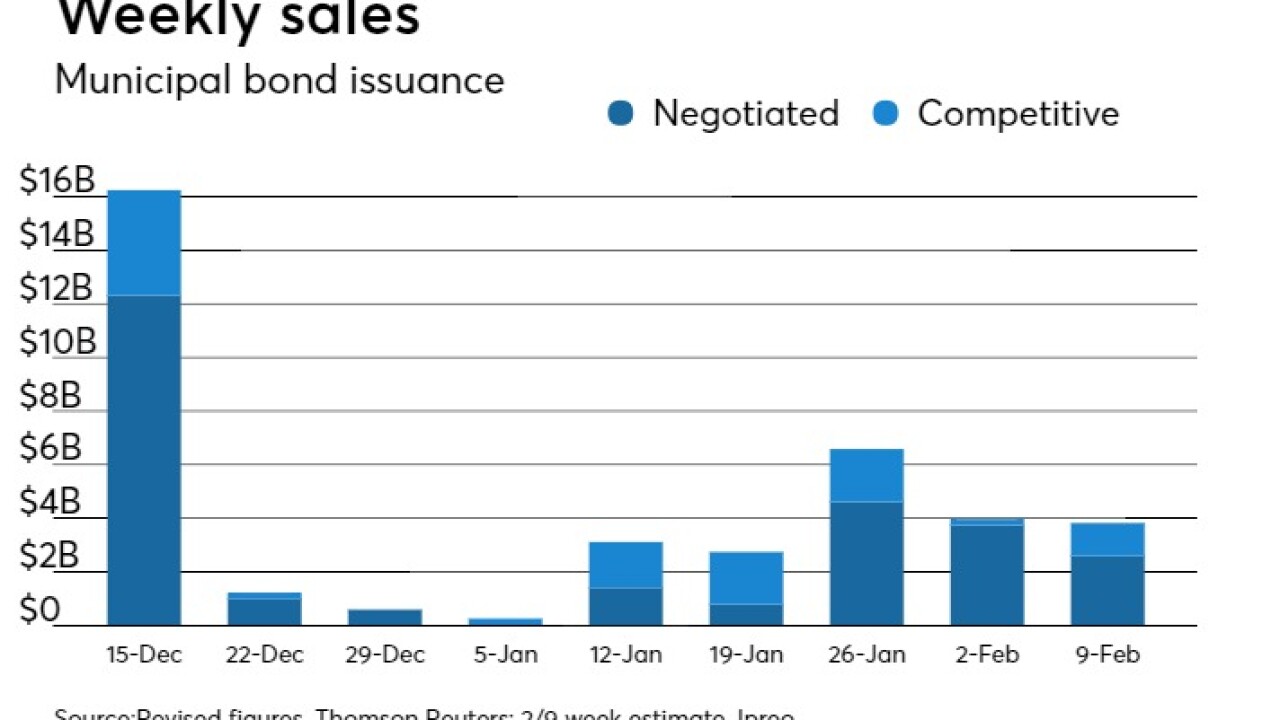

This week's miniature muni slate of under $3 billion means deals should have little trouble attracting investors.

March 19 -

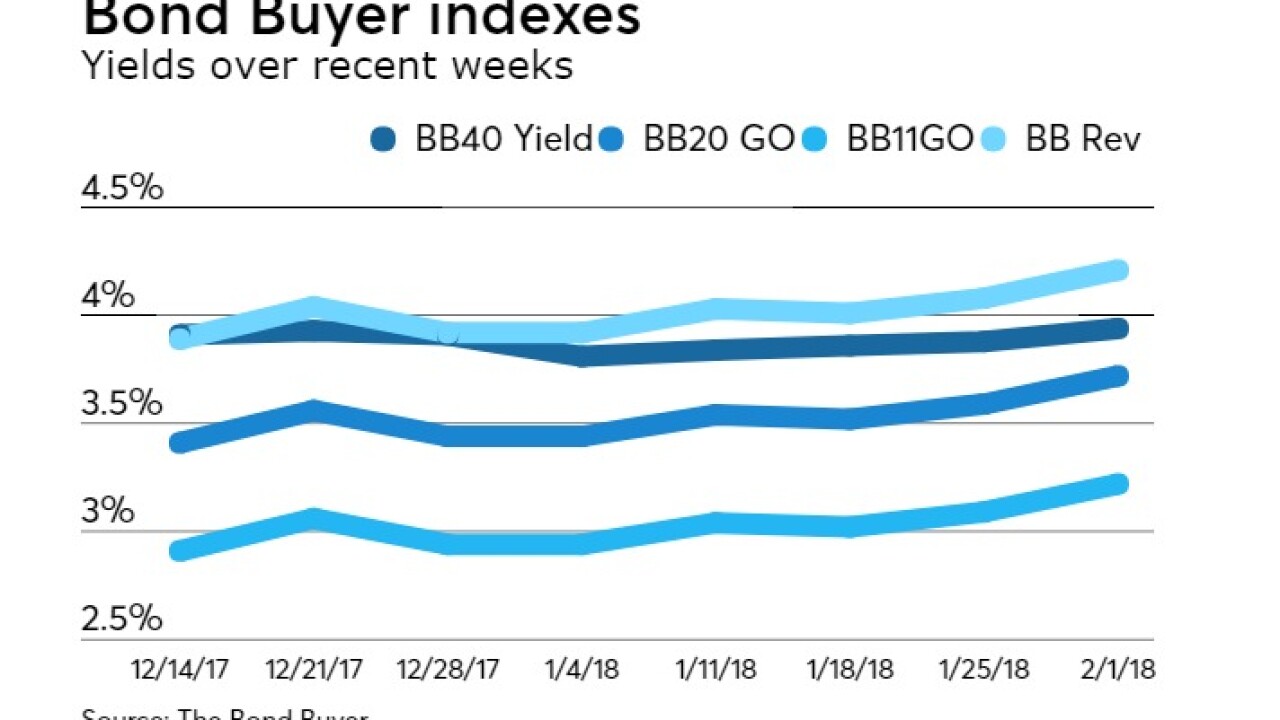

In the week ended March 15, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 4.02% from 4.01% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 15 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged for the second week in a row at 4.01%.

March 8 -

Inaction, significant new debt and failure to control labor costs and other cost drivers could pose major bondholder risks, says a Gurtin report.

February 20 -

“Given the recent market volatility, it’s imperative that you stress test potential purchases under various rate scenarios,” says Jonathan Law at Advisors Asset Management.

February 16 -

Analysts say states' and cities' unfunded infrastructure should be viewed as a liability, along with debt, pensions and other post-employment benefits.

February 14 -

Wisconsin is conducting a request for qualifications to establish senior- and co-manager underwriting pools.

February 6 -

Although market conditions are not pristine, with rising yields and little primary action, market participants expressed reason to believe the first week of February will be a positive one.

February 2 -

Ronald Schwartz of Seix Investment Advisors resolves to upgrade credit, keep duration neutral to shorter, and remain selective about investments.

February 2 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.94% from 3.88% last week.

February 1