-

It will take some time to see how both tax reform and infrastructure makes an impression on the muni market, said panelists at The Bond Buyer's National Outlook 2018 Conference.

January 31 -

In the week ended Jan. 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.88% from 3.86% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 25 -

The cloud-based application is designed to help smaller firms access data on a broader universe of bonds.

January 23 -

The index's yield to maturity ticked up two basis points to 3.86%, while the 11-bond, 20-bond, and revenue bond indexes dipped a pair.

January 18 -

In the week ended Jan. 11, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.84% from 3.81% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 11 -

Dawn Mangerson, senior portfolio manager at McDonnell Investment Management talks about the ramifications of the new tax legislation and articulates her concerns for municipals in 2018. Aaron Weitzman and Chip Barnett co-host.

January 11 -

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell 10 basis points to 3.81% in the week ended Jan. 4, from 3.81% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

January 5 -

While the new tax law may portend a difficult year for the municipal market, higher short-term rates and low supply should propel demand in 2018.

December 29John Hallacy Consulting LLC -

In the week ended Dec. 28, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell to 3.91% from 3.93% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

December 28 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to 3.93% from 3.91% last week.

December 21 -

In the week ended Dec. 14, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index nudged up to 3.91% from 3.90% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

December 14 -

BondWave LLC, a financial technology firm focused on fixed income solutions, is bring on Pete Newman as vice president of sales.

December 11 -

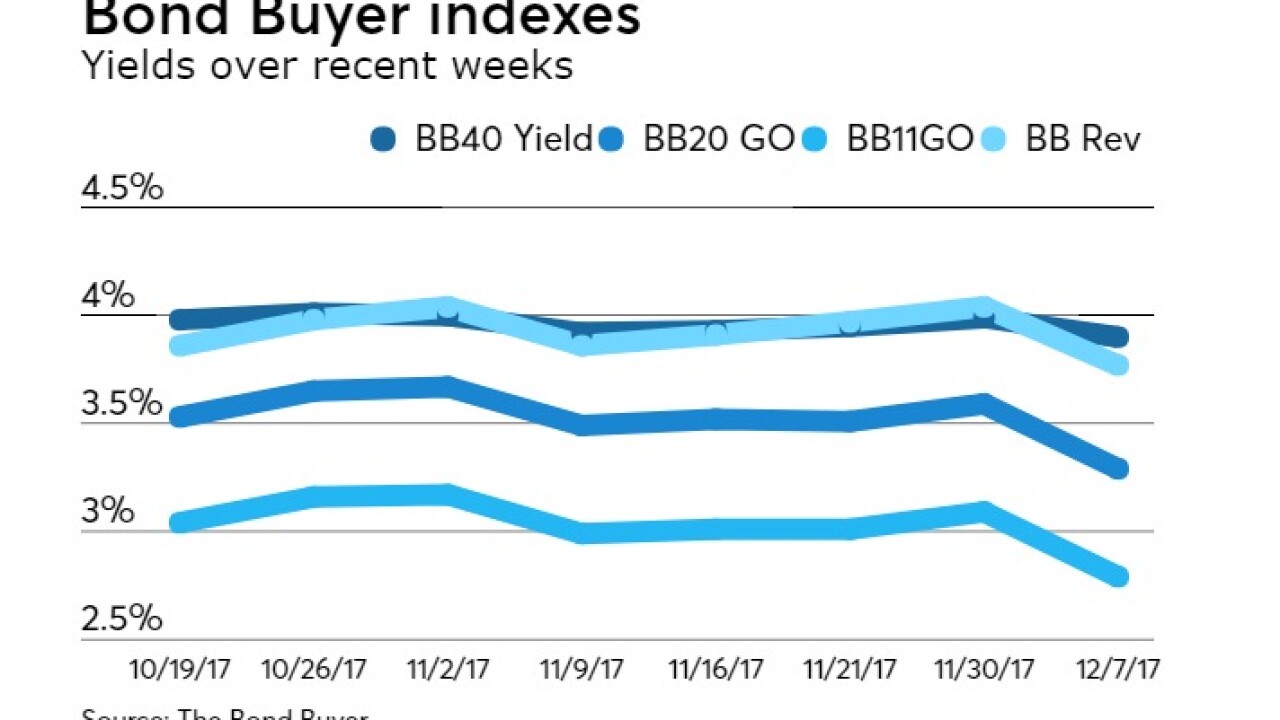

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dropped to 3.90% from 3.99% last week.

December 7 -

In the week ended Nov. 30, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.99% from 3.95% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

November 30 -

With ever-changing rules and regulations making an advisor's job harder, 280 CapMarkets launched with the goal of not only saving an advisor's time but making the job easier. 280's Gurinder Ahluwalia and Jason Ware sit down to discuss how technology allows both institutions and issuers to bring different types of value to the table that wasn't necessarily there before. Hosted by Aaron Weitzman.

November 30 -

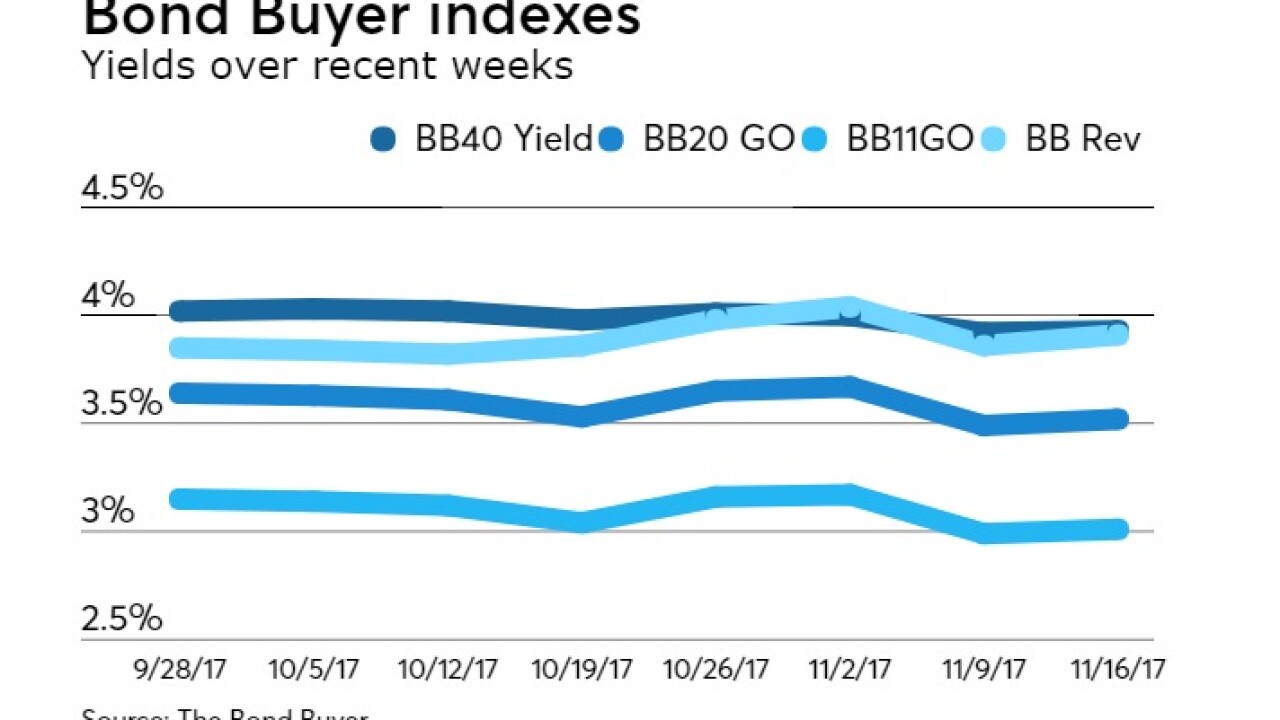

In the week ended Nov. 16, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index rose to 3.93% from 3.92% the previous week. The BB40 Index is based on the price of 40 long-term bonds.

November 16 -

Daryl Clements, Portfolio Manager of Alliance Bernstein, discusses strategies for sound performance in tobacco, healthcare, senior living, and stressed entity bonds. He focuses on the importance of spreads to relative value. In the wrap up, he focuses on the benefits of active versus passive management. Hosted by John Hallacy.

November 14 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was lower to 3.92% from 4.00% last week.

November 10 -

While yields on the 20-bond, 11-bond, and revenue bond indexes climbed two basis points in the week ended Nov. 2, the Bond Buyer 40 index's yield declined one.

November 2 -

BondWave LLC, announced the launch of Effi, a fixed income data warehouse platform aimed at bringing transparency to the marketplace.

October 20