-

Chicago is a standout as the "worst" among its big city peers in key pension system measurements, according to a new S&P Global Ratings pension report.

March 9 -

Former Washington State Treasurer Jim McIntire has joined Star Mountain Capital, a lower middle-market asset management firm, as a strategic advisor serving public pensions and other institutional investors.

March 9 -

OppenheimerFunds will acquire Seattle fund manager SNW Asset Management to expand its high-quality municipal bond offerings.

March 8 -

Alexandra Lebenthal has sold a 49% stake in Lebenthal & Co., an iconic firm in in the municipal market, to South Street Securities.

March 7 - Texas

President Donald Trumps plan to rely on private prisons to house federal inmates and immigration detainees is reviving interest in the high-yield bonds that financed the lockups.

March 6 -

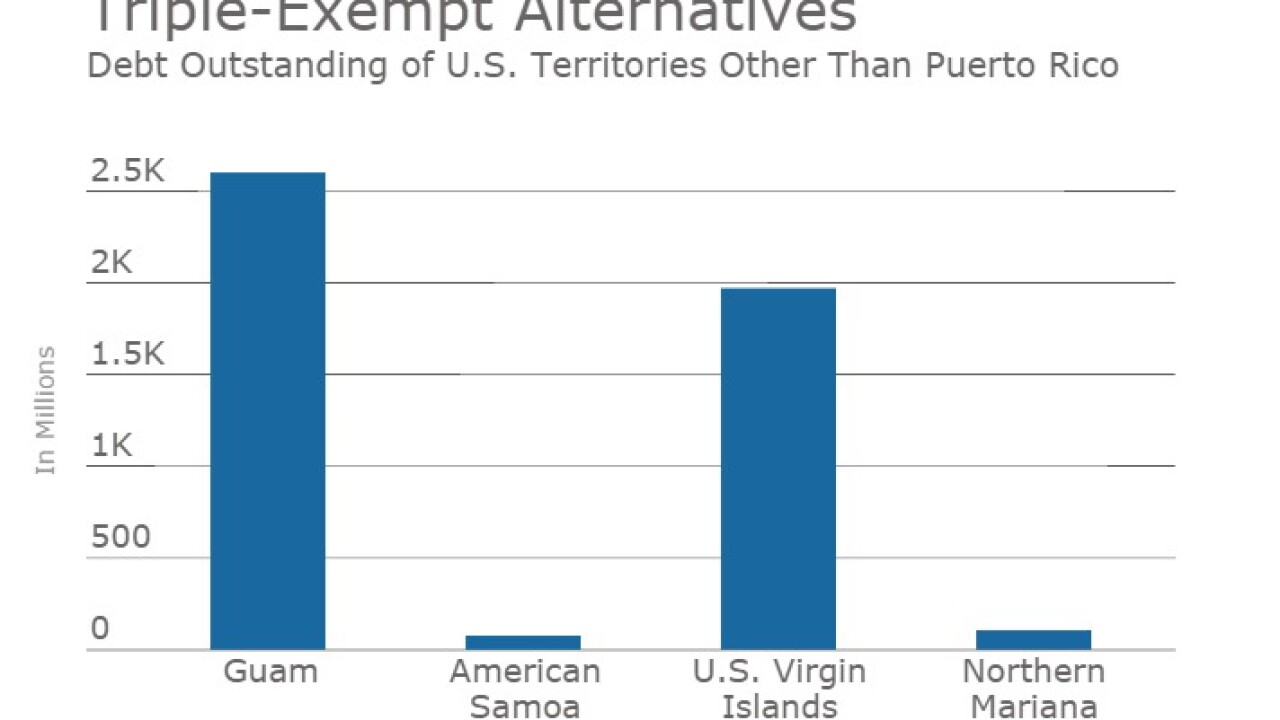

Investors are mindful of the lessons of Puerto Ricos financial distress as they chase higher yields and the benefits of interest payments that arent taxable by the federal government or by any U.S. state or municipality.

March 6 -

In the week ended March 2, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index fell one basis point to 4.25% from 4.26% in the previous week. The BB40 Index is based on the price of 40 long-term bonds.

March 2 -

Despite the U.S. Attorney Generals reversal of plans to end use of private, for-profit prisons, the bonds used to finance the facilities still bear the risk of abrupt policy changes, according to S&P Global Ratings.

February 27 -

Some analysts see an opportunity in hospital bonds, as the spreads in that sector have continued to widen even as the push to repeal the Affordable Care Act loses steam.

February 27 -

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell two basis points to 4.26% in the latest week from 4.28% in the previous week.

February 23