-

The COVID-19 pandemic pushed the Henry Ford Village continuing care retirement community over the fiscal cliff and into a Chapter 11 filing.

November 9 -

TMI Trust agreed to a settlement that allows bondholders to be paid interest during the Chapter 11 case of the Roman Catholic Archdiocese of New Orleans.

November 5 -

Detroit is selling $80 million of its speculative grade-rated GO paper with more on tap should voters sign off on $250 million of blight borrowing.

October 14 -

Details of the pending investigation are sketchy but the legislation improved the value of a then-bankrupt FirstEnergy subsidiary's municipal bonds.

September 17 -

The Oversight Board said that it expects to know by Oct. 25 whether it can propose a new plan of adjustment.

September 11 -

Laura Taylor Swain said she will decide some of the bond insurers' arguments when she resolves continuing adversary proceedings.

September 9 -

Federal authorities arrested Ohio House Speaker Larry Householder on charges he took bribes to support legislation that benefited bankrupt FirstEnergy.

July 22 -

The bond-financed Chicago-area hotel and conference center remains shuttered as a result of the coronavirus health crisis.

July 16 -

A bankruptcy judge will be asked to sign off on the sale of BHF's Shoreline portfolio in Chicago and will hold an initial Chapter 11 hearing on another portfolio.

June 19 -

The chapter had financial difficulty before the pandemic and wanted to refinance its debt.

June 4 -

California Public Utilities Commission approval is one hurdle for PG&E, which must exit bankruptcy by June 30 to qualify for a $21 billion bond fund.

May 29 -

Fairfield, Alabama, weighed down by fiscal problems long before the coronavirus hit, filed for bankruptcy saying it is insolvent.

May 21 -

Developers say construction will continue on the 310-unit apartment complex in Gainesville, near the University of Florida, during the Chapter 11 process.

May 13 -

The Westin Lombard hotel and conference center in Chicago's suburbs dipped into debt reserves to cover operations after closing in response to the pandemic.

May 11 -

The court filings could directly impact about $6 billion of bonds and $15 billion more indirectly.

May 1 -

California's response to COVID-19 became a factor in Verity Health System's Chapter 11 proceedings.

April 30 -

The Center on Budget and Policy Priorities said bankruptcy "could significantly raise states' cost of issuing bonds to pay for major transportation projects and other investments that boost the economy."

April 24 -

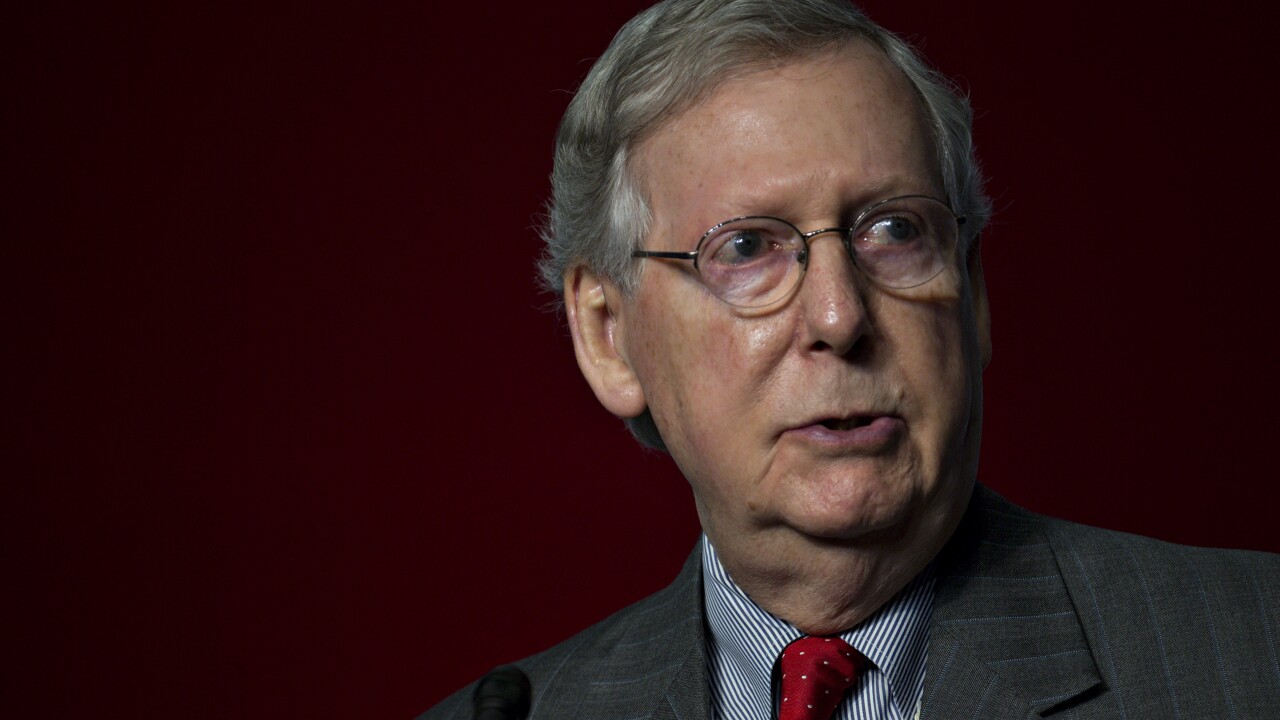

Senate Majority Leader Mitch McConnell said Wednesday he favors allowing states struggling with high public employee pension costs amid the burdens of the pandemic response to declare bankruptcy rather than giving them a federal bailout.

April 22 -

The Puerto Rico Oversight Board had asked for the postponement, citing the impact of COVID-19 and its possible financial impact on PREPA.

April 2 -

Smith, who headed the restructuring practice at Chicago-based McDermott Will & Emery, worked on nearly every major muni bankruptcy of the past 20 years.

March 26