-

The Senate's approval of the Kansas banking commissioner leaves the board with two remaining seats to fill as the administration's nominees for the vacancies await votes.

November 15 -

The Treasury Department Inspector General for Tax Administration plans to audit the IRS' use of a much-feared enforcement tool under which it can impose penalties for the misconduct of municipal bond transaction participants such as underwriters, lawyers, municipal advisors or their firms.

October 31 -

Recently announced streamlining and rumored budget cuts and layoffs at SIFMA are causing market participants to worry about its commitment to municipal securities.

October 12 -

With municipal yields rising more than they have in years, investors see a rare opportunity for fourth-quarter tax swaps.

October 9 -

Another wave of states is expected to begin implementation Jan. 1, according to the National Conference of State Legislatures.

October 2 -

The amount of outstanding variable rate demand bonds rose to $142.4 billion in the second quarter of this year, a gain over $142.2 billion in the first quarter and the end of a decade-long decline, Moody’s Investor Service said in a recent report.

September 26 -

Muni market groups claimed victory after federal banking regulators moved to treat munis like all other types of Level 2B HQLA.

August 23 -

A report on cyber-related risks released Wednesday by S&P Global warned that “a successful attack on an entity with limited resources could have a credit impact.”

August 22 -

The central bank's survey of loan officers said banks are easing their credit standards for commercial and industrial loans as competition heats up.

August 6 -

Sen. John Kennedy, R-La., suggested he and Sen. Elizabeth Warren, D-Mass., may introduce a bill that would require MSRB to elect public members who represent consumers and are not just retired industry executives.

July 24 -

Kroll says the use of rating ceilings can "subvert fundamental credit analysis."

July 24 -

RBC is adding to its team even as smaller underwriting spreads have driven some players to reduce staff.

July 20 -

Changes the Federal Reserve Board made in 2016 to its Liquidity Coverage Ratio rules would treat munis more restrictively than other, similar Level 2B high quality liquid assets.

July 17 -

The city's voters will decide in November if it will establish the public bank.

July 5 -

The latest Federal Reserve data shows the first decline in bank holdings of municipal securities in nearly a decade, a result of tax reform, according to experts.

June 7 -

The muni market officially got much of what it has spent years fighting for on Thursday, when President Trump signed the banking bill that makes tradable, investment grade municipal securities high-quality liquid assets under federal banking rules.

May 24 -

Muni market groups got a long-awaited win when the House passed banking legislation classifying certain munis as high-quality liquid assets, even if it wasn't as big a win as hoped.

May 23 -

The bank deregulatory bill passed by Congress on Tuesday would also make fewer banks systemically important and close a legal loophole that had allowed banks to defraud Puerto Rico investors.

May 22 -

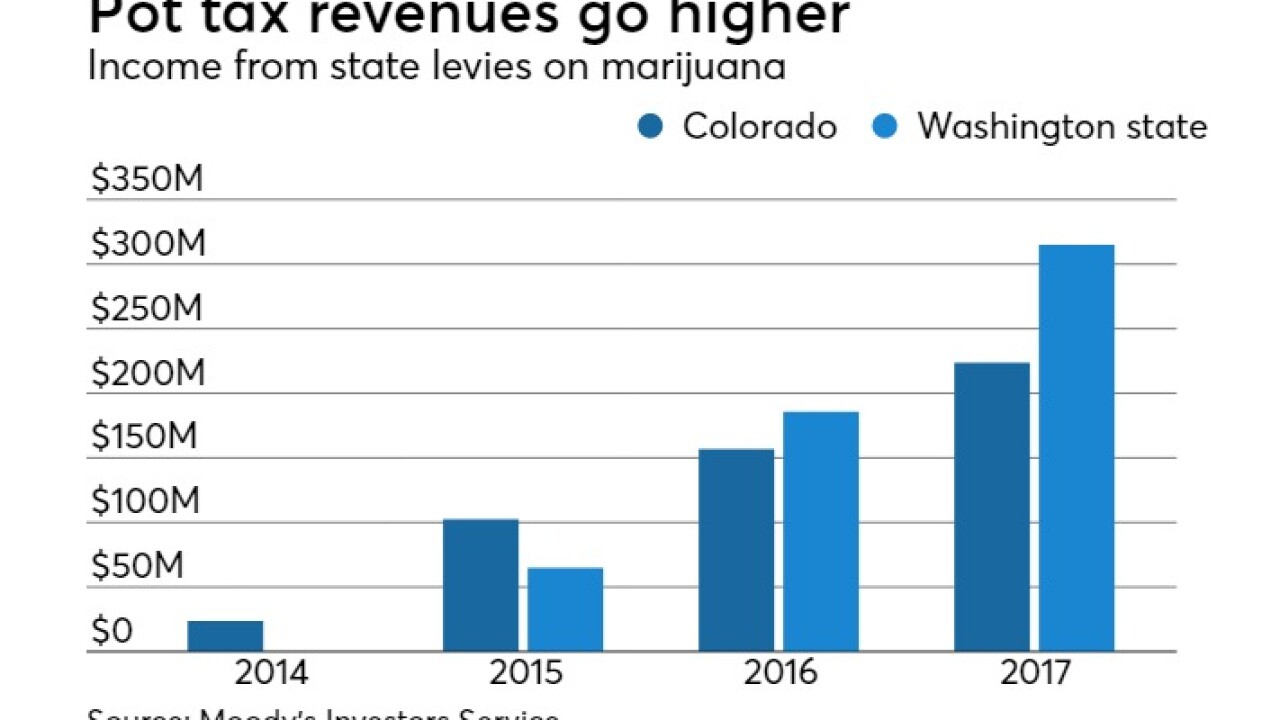

Moody's sees minimal, but still credit positive, revenue effects for governments that tax legal cannabis.

May 14 -

A deal struck between House and Senate leaders could lead to a vote as soon as next week on a banking bill that would classify munis as high-quality liquid assets and make them more attractive investments for banks.

May 11