-

Even though interest rates have not risen as fast as the bond insurance industry hoped for, and 2017 saw the contraction of an active insurer, the bond insurance wrap remains relatively stable in terms of market share.

February 26 -

Volume of $48.05 billion indicated a strong short-term need on both the buy-side and sell side of the municipal market.

February 26 -

Long-term issuance in the municipal market virtually matched its record high set in 2016, against the backdrop of tax reform that produced an end-of-year flood of volume, but the outlook for 2018 is less rosy.

February 26 -

Northeast municipal bond issuance was up 4% from 2016 to $121.3 billion.

February 23 -

A state-by-state review of first half 2017 issuance in the Far West.

August 25 -

Primary market volume in California and the Far West region rose in the first half even as the national figure was down.

August 24 -

A state-by-state review of first half 2017 issuance in the Southeast .

August 24 -

Regional bond issuance slipped by 31% in the first half and volume was down sharply in Florida.

August 23 -

A state-by-state review of first half 2017 issuance in the Midwest .

August 23 -

Refunding deals were down substantially and new money volume also slipped.

August 22 -

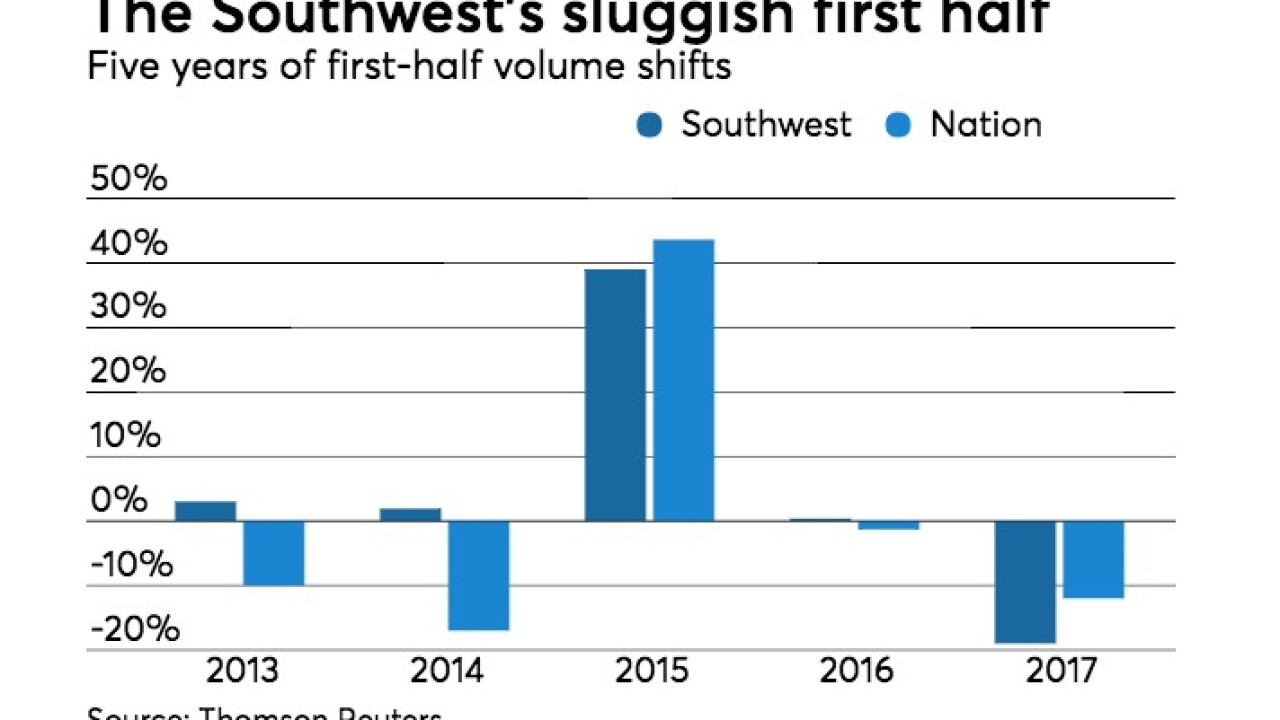

A state-by-state review of first half 2017 issuance in the Southwest.

August 22 -

A big drop-off in Texas and a decline in refundings took a bite out of the municipal bond business in the Southwest.

August 21 -

2017 first-half volume lagged last year's levels.

August 21 -

A state-by-state review of first half 2017 issuance in the Northeast.

August 21 -

The development sector grew by 36% and public facilities climbed by 11%, making them the sectors that grew by the largest percentage in the first half of the year. The sectors with the biggest declines were electric power at 55% and utilities at 23%.

August 21 -

The municipal market got off to a fast start in terms of issuance this year, picking up in January right where it left off from 2016’s record-setting totals. However, the pace of issuance has since slowed, leaving 2017 first-half volume lagging last year's levels.

August 21 -

Short-term note issuance rose less than 5% in the first half of 2017 as municipalities relies less on cash flow needs.

August 21 -

Although market conditions and a still relatively low interest rate environment continue to hamper the bond insurance industry, there continue to be encouraging signs including a slight uptick in the insurance penetration rate.

August 21 -

The region's slipping volume reflected a national trend.

August 18 -

Long-term municipal volume ascends to an all-time high in 2016

February 13