-

The deep freeze, and Texas power market structure, left the state's public utilities with sky-high wholesale power bills and a trail of burst water pipes.

February 22 -

The firm's leaders say Hilltop Securities sees growth opportunity in municipal bond underwriting, while financial advisory services will "grow selectively."

February 12 -

The January sales tax report shows that Texas is recovering but still hurting on some revenue streams, Comptroller Glenn Hegar said.

February 2 -

This year's pension debt volume could match that of 2020, which was the highest since the financial crisis year of 2008, industry leaders say.

February 1 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

January 25 -

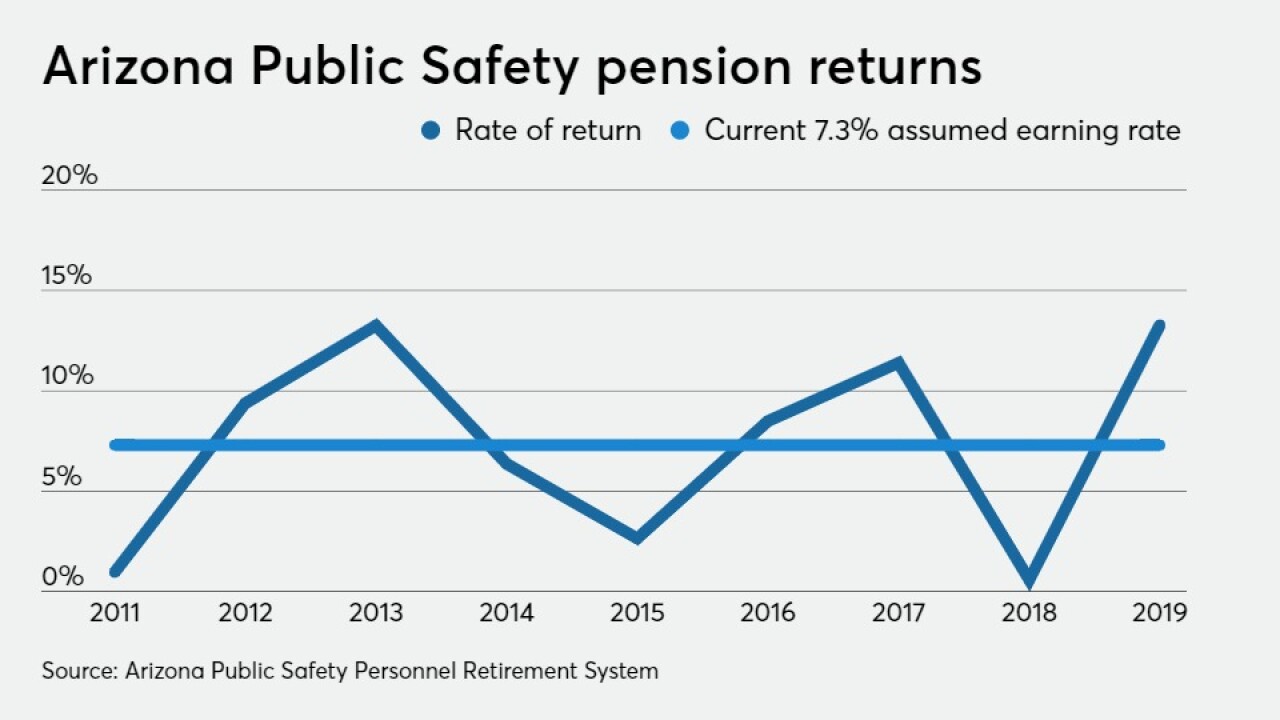

With interest rates at historic lows and stock market returns at record highs, Tucson sees a ripe opportunity to issue pension debt.

January 25 -

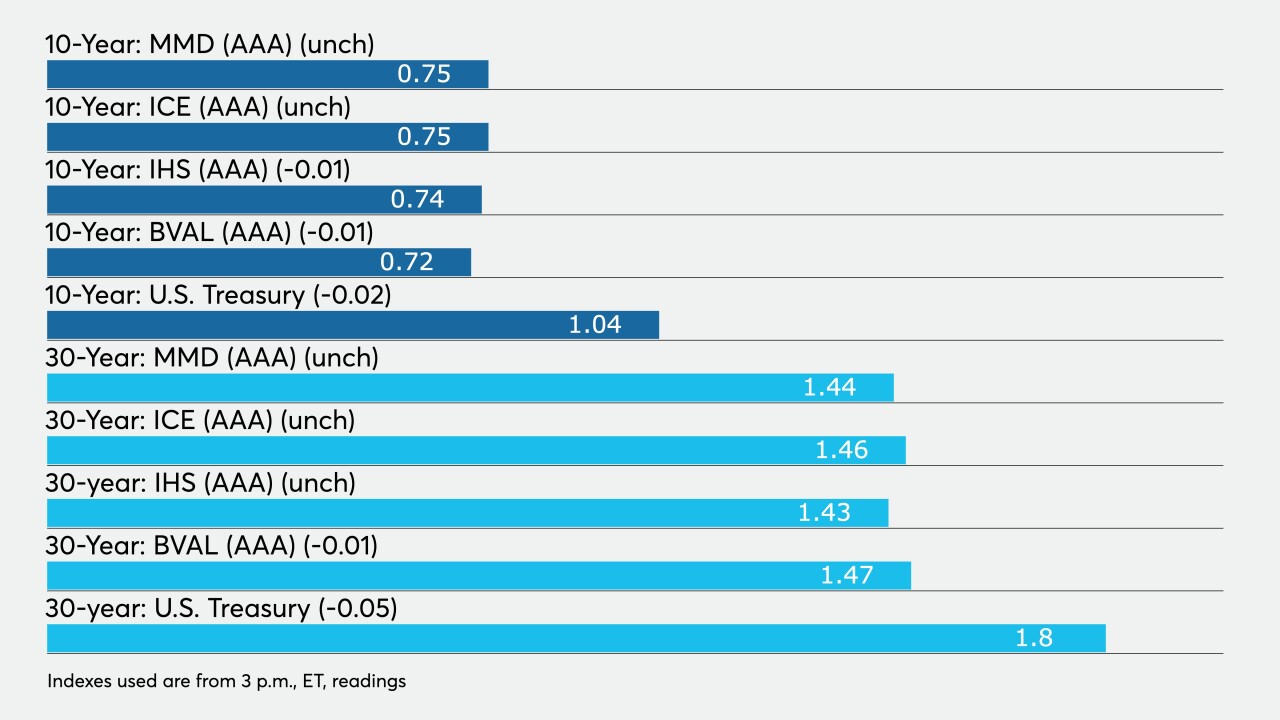

A 'perpetual calm' continues to fall over the municipal market as inflows into municipal funds, combined with the shortage of traditional tax-exempt supply, is directing most aspects of daily market activity.

January 22 -

The bonds are coming in three tranches, mixing tax-exempt new money and a taxable refunding.

January 15 -

Federal aid and budget cuts could erase Texas's nearly $1 billion revenue shortfall, state Comptroller Glenn Hegar says.

January 11 -

The $125 million deal from the Colorado Housing Finance Authority carries a third-party social bond opinion from Kestrel Verifiers.

January 4