-

The ultimately unrealized threat to the municipal bond tax-exemption and infrastructure needs were among the drivers of bond sales.

August 22 -

Dan Hartman of PFM attributed the drop to fewer prepaid gas deals, one-time large transactions last year like Jefferson County's and normal timing variations.

August 21 -

Midwest municipal bond volume surged more than 29% year-over-year to $46.05 billion for the first half of 2025.

August 20 -

Bond sales in the eight-state region totaled $54.9 billion, trailing the nation with an 8.1% gain year-over-year as Texas issuance slipped 7.6%.

August 19 -

Municipal issuers in the Northeast sold $72.25 billion of bonds in the first half of 2025, up 14.7% year-over-year, propelled by new money and GO deals.

August 18 -

Midwest bond sale volume peaked in the third quarter of 2024.

February 26 -

Issuers in five Far West states increased their borrowing the first half of the year, while four saw sizable decreases.

August 23 -

The region's municipal bond volume grew by 42.4%, outpacing the nationwide 32% increase in a first-half marked by gas prepay deals and Brightline's big sale.

August 22 -

Issuers in the eight-state region sold $50.6 billion of bonds with Texas accounting for 65% of the volume.

August 20 -

New York state's issuers topped the Northeast charts as issuance rose in nearly every sector of the market during the first half of 2024.

August 19 -

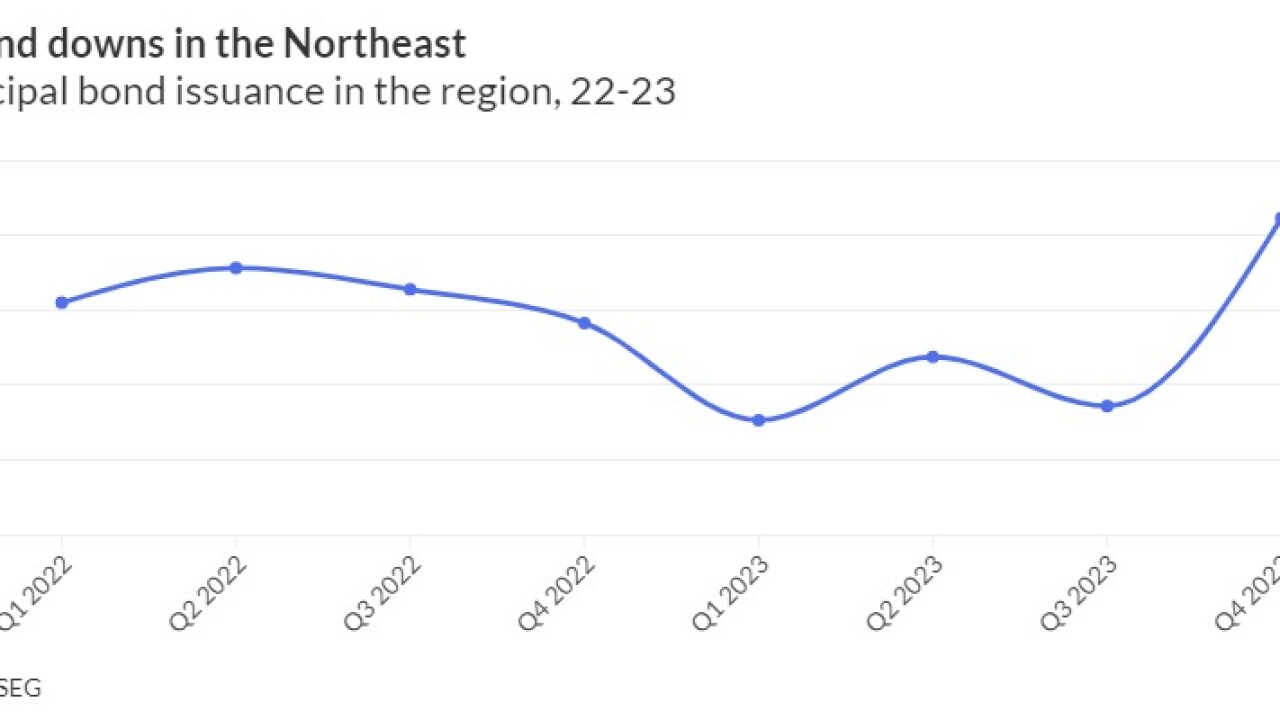

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

"I think we are starting toward higher volume," said Raul Amezcua, senior director at Samuel A. Ramirez & Co.

February 23 -

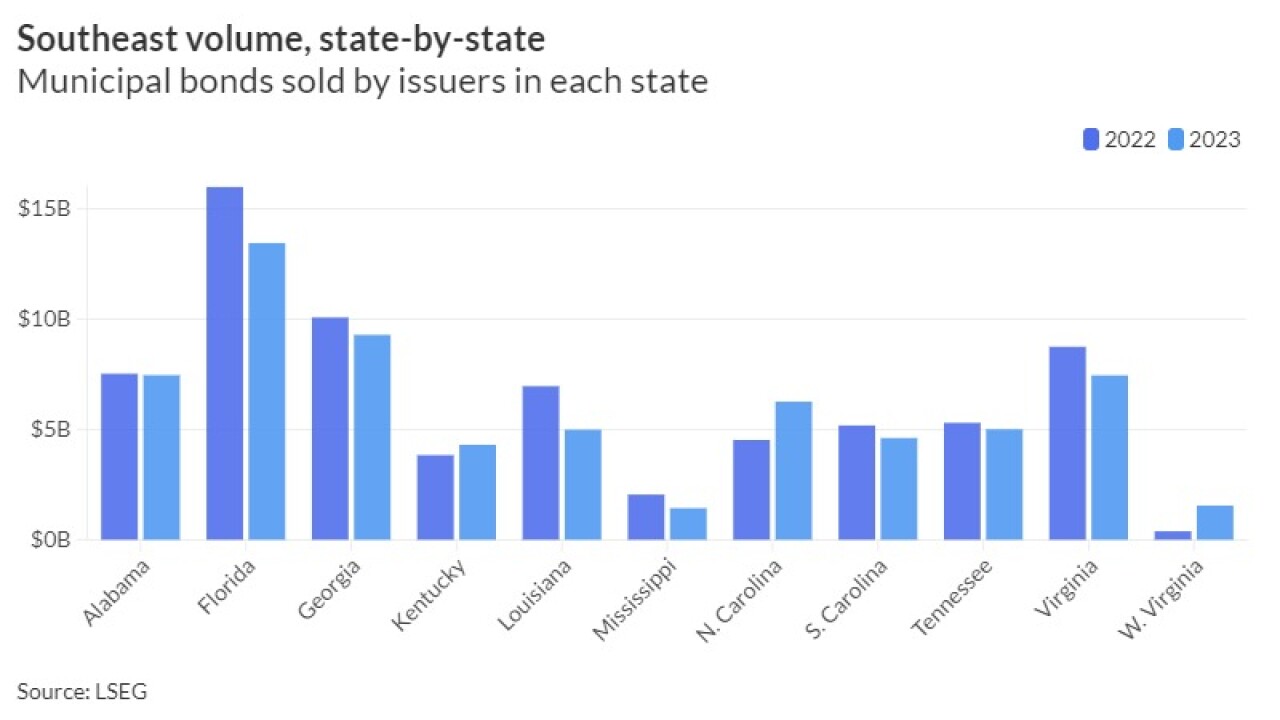

Natural gas prepayment deals helped drive the utilities sector to top the Southeast in an overall down year for municipal bond sales across the region.

February 22 -

Larger deals, fewer issues: those were the overarching municipal bond sale trends, along with a surge in tax-exempt deals, across the Midwest in 2023.

February 21 -

Texas bond volume climbed 22.5% to lead the nation in a year when issuance in the eight-state Southwest region increased by only 0.6%.

February 20