-

U.S. Treasuries have been volatile the past five sessions, with municipals largely ignoring the ride. Participants mostly have accepted current rates and ratios as large amounts of cash slosh around a market with strong technicals.

July 15 -

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

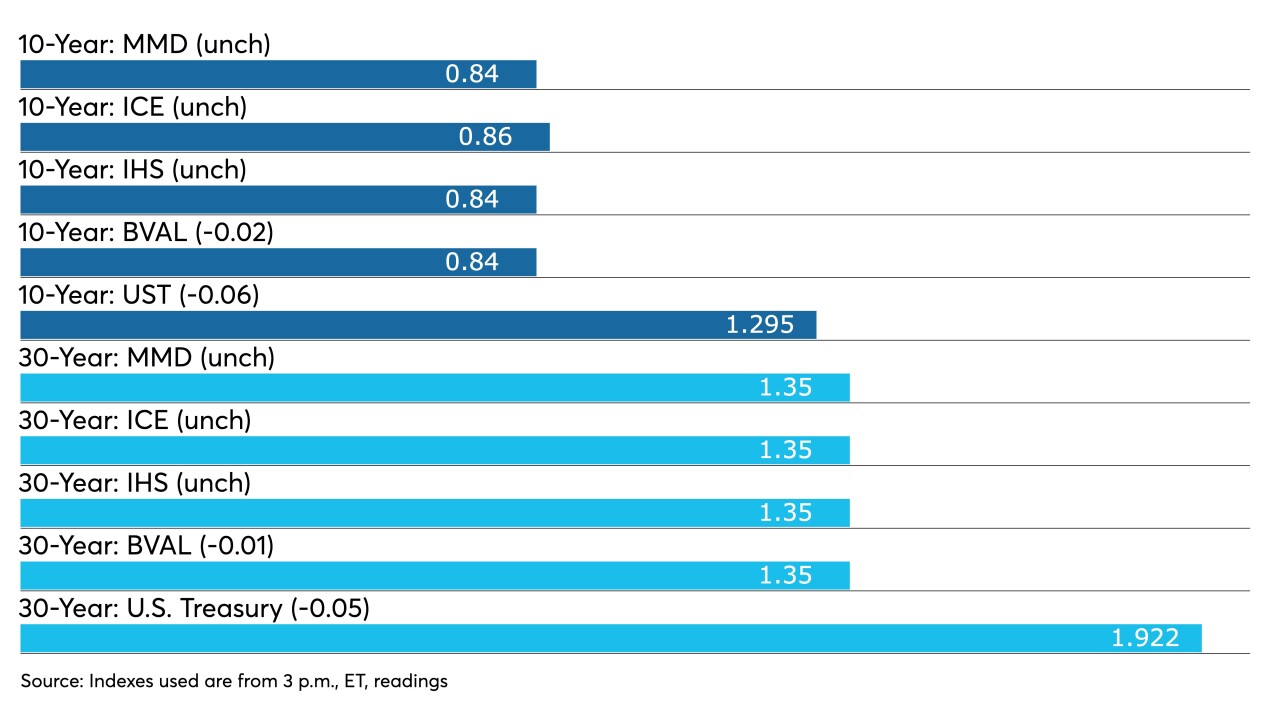

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

President Joe Biden would be well advised to offer Jerome Powell a second term as chair of the Federal Reserve to preserve policy stability as the U.S. economy recovers from the pandemic, said former Fed Vice Chair Alan Blinder.

July 7 -

Federal Reserve Chair Jerome Powell said the price increases seen in the economy recently are bigger than expected but reiterated that they will likely wane.

June 22 -

Federal Reserve Chair Jerome Powell said inflation had picked up but should move back toward the U.S. central bank’s 2% target once supply imbalances resolve.

June 21 -

The Investment Company Institute on Wednesday reported $2.533 billion of inflows into municipal bond mutual funds, the highest since February.

June 16 -

Raphael Bostic, Federal Reserve Bank of Atlanta president, says he hears frequent speculation that he could be nominated to lead the central bank.

May 24 -

While cryptocurrencies could have benefits, they have “not served as a convenient way to make payments, given, among other factors, their swings in value,” said the head of the Federal Reserve. He also detailed imminent Fed research on a central bank digital currency.

May 20 -

A senior White House economic aide said the decision on selecting the next central bank chief will come after a thorough “process.”

May 4 -

Federal Reserve Chair Jerome Powell said that while the U.S. economic recovery is “making real progress,” the gains have been uneven following a downturn that cut hard along lines of race and income.

May 3 -

Signs of excess risk taking in financial markets show it’s time for the U.S. central bank to start debating a reduction in its massive bond purchases, said the president of the Dallas Federal Reserve, breaking ranks with Chair Jerome Powell.

April 30 -

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

President Joe Biden, who has an opportunity to reshape the leadership of the Federal Reserve over the next 10 months, is being urged by activists to make potentially significant changes at the U.S. central bank.

April 28 -

The Federal Reserve will likely taper off its bond purchases before considering raising interest rates, Chairman Jerome Powell said.

April 14 -

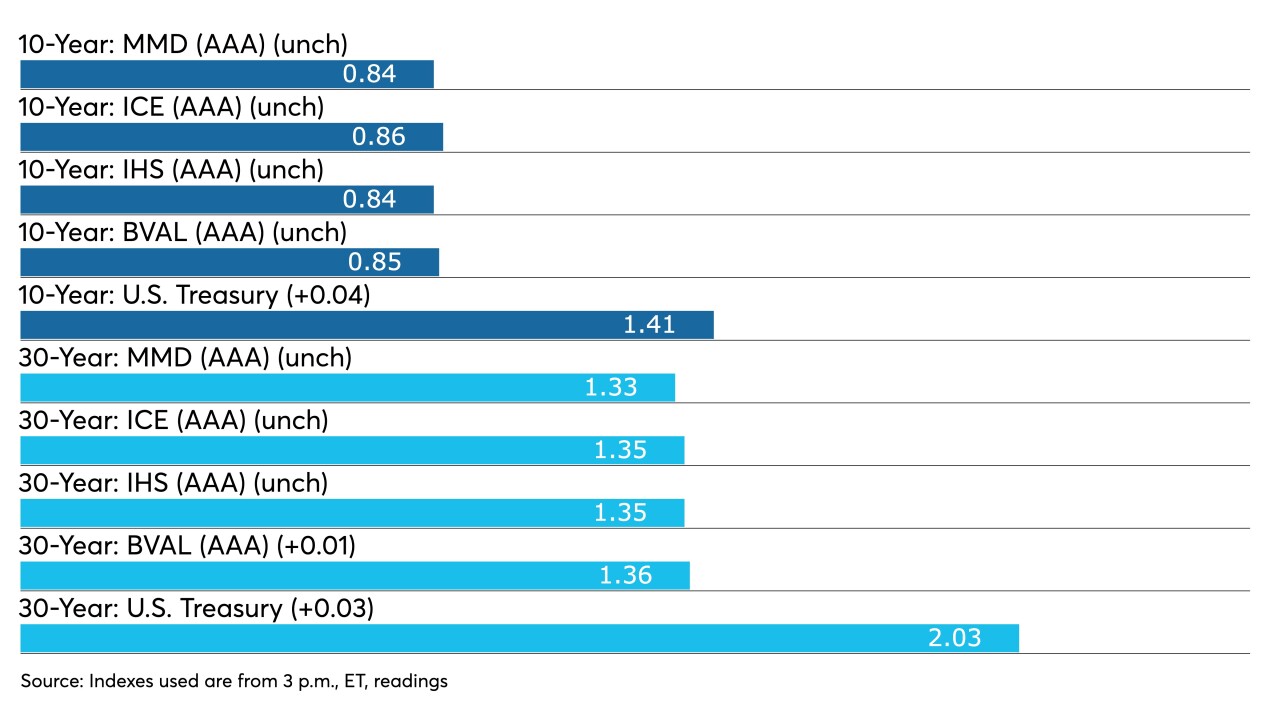

High-yield inflows return to the tune of $821 million. The 10-year triple-A hovers just above 1%.

April 8 -

ICI reported another week of inflows at $2.23 billion. U.S. Treasuries strengthened further as COVID-19 concerns linger with shutdowns in Germany and spreads elsewhere. Equities were mixed.

March 24 -

Federal Reserve Chairman Jerome Powell said prices would rise this year as the pandemic recedes and Americans are able to go out and spend, but he played down the risk that this would spur unwanted inflation.

March 23 -

States and local governments will soon get guidance on how they can spend $350 billion in funds from the last round of coronavirus relief.

March 23 -

The economy seems to be gathering steam, though it is still far from fully recovering from the damage wrought by the pandemic, Federal Reserve Chairman Jerome Powell said.

March 22