-

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

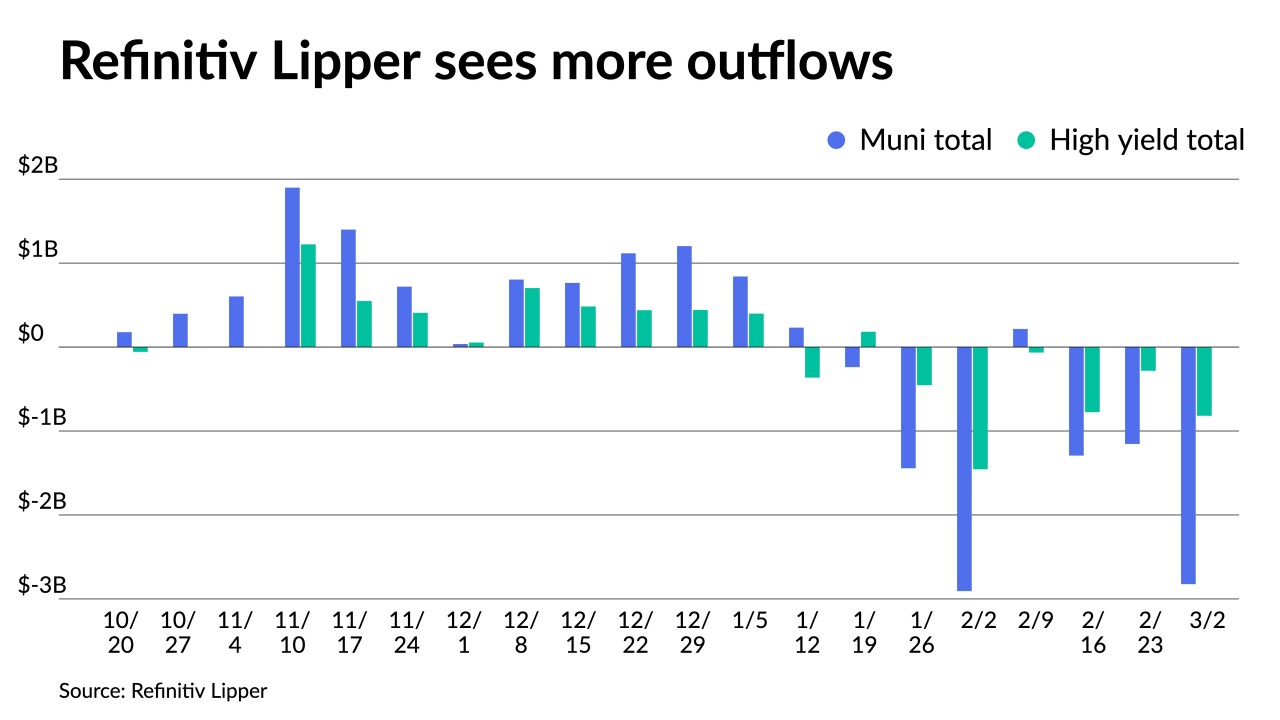

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

Former Treasury Secretary Lawrence Summers said he was concerned the Federal Reserve is still engaging in “wishful thinking” about how much it will take to bring inflation down from four-decade highs.

July 29 -

The Federal Reserve’s Inspector General said Chair Jerome Powell and former Vice Chair Richard Clarida’s trading activity had not broken any laws or rules, but the probe into the former heads of the Dallas and Boston regional Fed banks remained open.

July 14 -

Federal Reserve Chair Jerome Powell said the U.S. economy is in “strong shape” and the central bank can reduce inflation to 2% while maintaining a solid labor market.

June 29 -

Federal Reserve Chair Jerome Powell said no one should doubt the U.S. central bank’s resolve to curb the highest inflation in decades, including pushing rates into restrictive territory if needed.

May 17 -

The Senate voted to confirm Jerome Powell for a second four-year term as Federal Reserve chair on Thursday, trusting him to tackle the highest inflation to confront the country in decades.

May 12 -

Ongoing turmoil in the Ukraine is roiling markets, municipals included. Refinitiv Lipper reported more outflows, with high-yield seeing $818.218 million pulled out in the latest week.

March 3 -

Senate Democrats insist the GOP's boycott of President Biden's picks for the Federal Reserve is interfering with the central bank's handling of an economic crisis. But GOP lawmakers say the Fed is functioning fine and their concerns about nominee Sarah Bloom Raskin are material.

March 3 -

The Investment Company Institute on Wednesday reported $2.637 billion of outflows in the week ending Feb. 23, down from $3.120 billion of outflows in the previous week.

March 2 -

The statement offered no surprises, but Fed Chair jerome Powell's refusal to denounce more hawkish scenarios hurt market sentiment.

January 26 -

Newly released transcripts of Federal Reserve policy meetings in 2016 show then-Governors Jerome Powell and Lael Brainard were quick to pivot away from planned interest-rate hikes in the face of risks posed by a stumbling Chinese economy.

January 14 -

Federal Reserve Board Chair Jerome Powell would not commit to timing for liftoff, stressing decisions would be data-based and the Fed will not allow inflation to become entrenched.

January 11 -

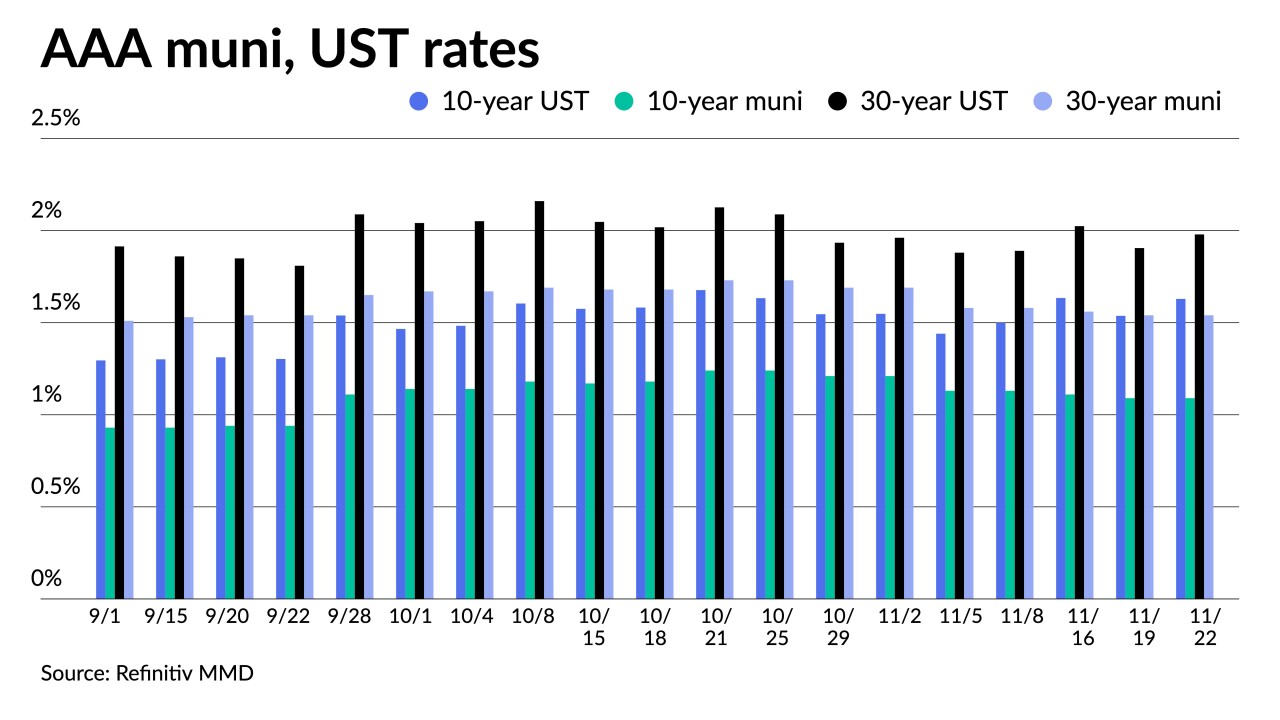

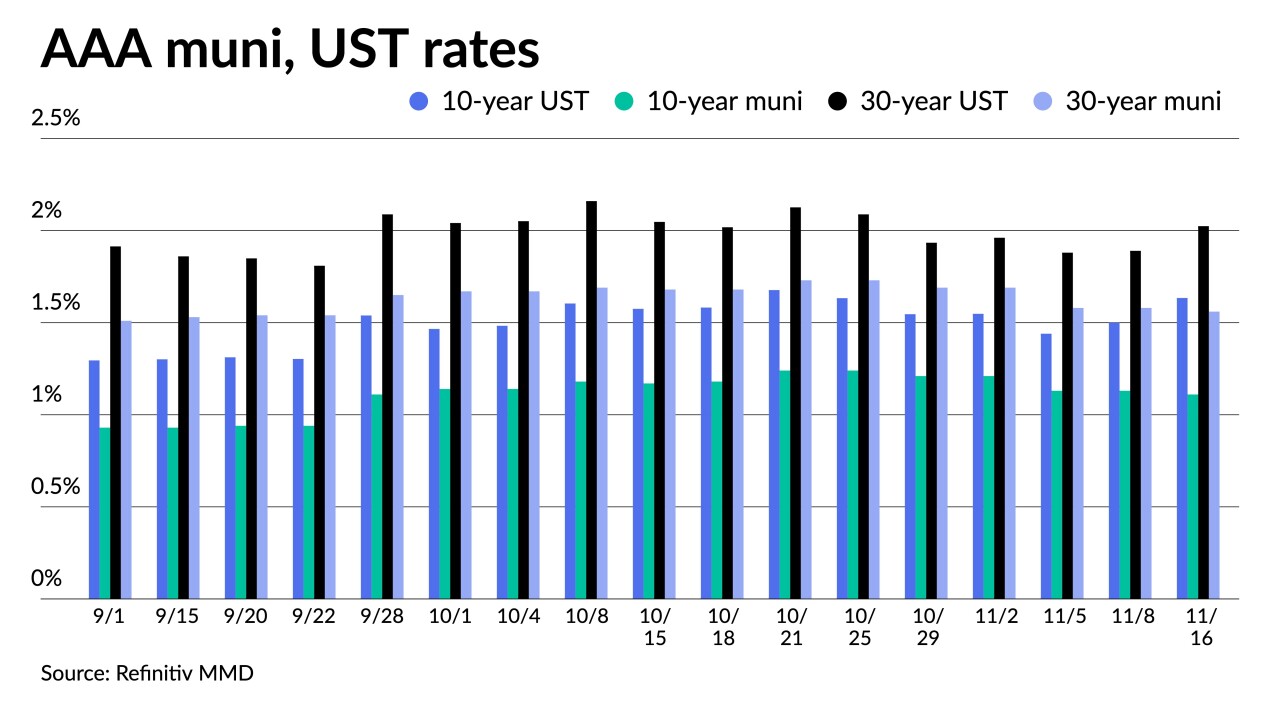

Pressures from inflation concerns and broader rising rates weigh on munis in the second week of 2022.

January 10 -

Until supply comes, market participants appear to be content to sit back and let the calendar flip to a new year without making any big moves.

December 27 -

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

November 30 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

November 22 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

President Joe Biden met separately with Federal Reserve Chairman Jerome Powell and Fed Governor Lael Brainard at the White House on Thursday as he considers who will lead the central bank next year.

November 5