-

Ipreo estimates weekly bond volume at $9.2 billion, consisting of $7.5 billion of negotiated deals and $1.7 billion of competitive sales.

July 13 -

Munis finished mixed as California State, Los Angeles Airport and L.A. County Facilities Inc. hit the market.

July 12 -

Municipals were mixed at mid-session as the last of the week’s big deals came to market, led by a bond offering out of California and a note sale from Colorado.

July 12 -

Requests for municipal bond identifiers rose in June for the fourth month in a row as the Dormitory Authority of New York sold $1.79 billion of bonds to a supply-starved market.

July 11 -

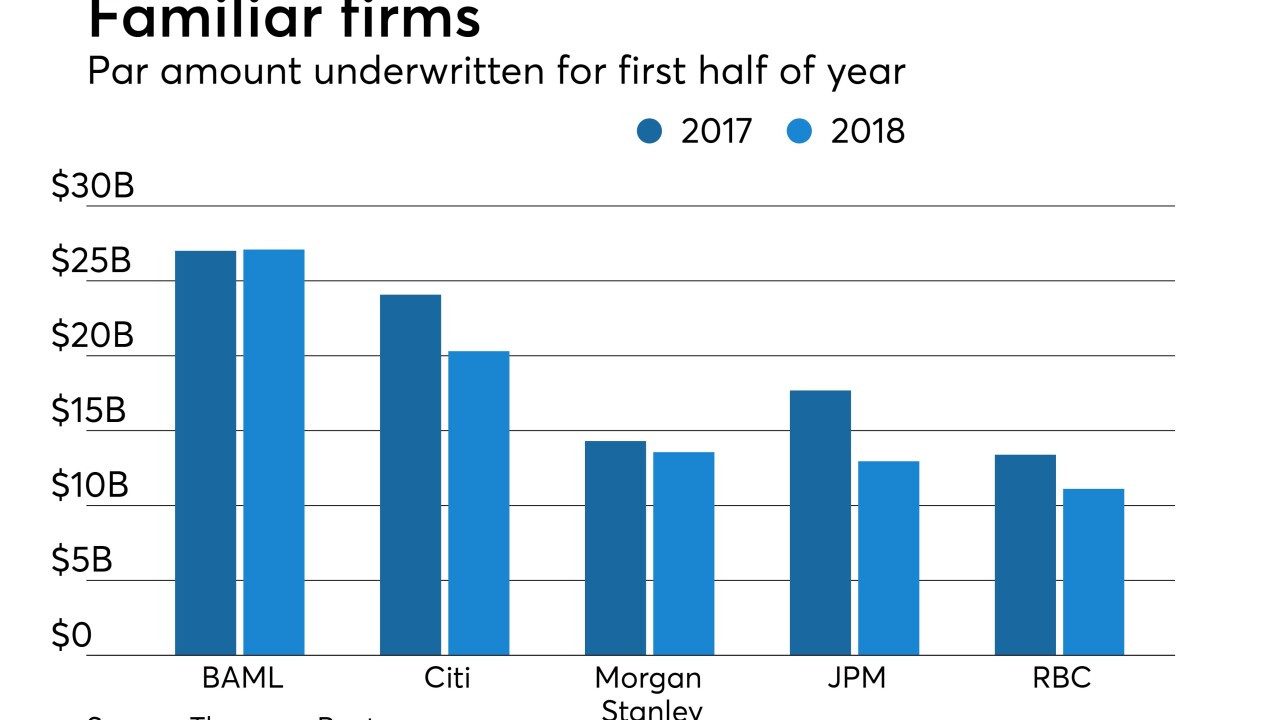

The league tables show a return to normal from the first quarter, when PFM, Citi and JPMorgan all placed lower than usual.

July 11 -

Municipal bonds were stronger at mid-session as a swell of supply swept into the market on Wednesday.

July 11 -

BlackRock says relative valuations and historical seasonal trends suggest favorable conditions for municipals.

July 10 -

Municipal bond buyers were seeing the first of the week’s deals come to market as two big competitive issues sold.

July 10 -

While munis turned in a mostly solid performance on Monday, a Charles Schwab & Co. report said they are less likely to outperform Treasurys in the second half.

July 9 -

Munis were firm at mid-session as traders get set to see some much-anticipated supply hit the screens this week.

July 9