-

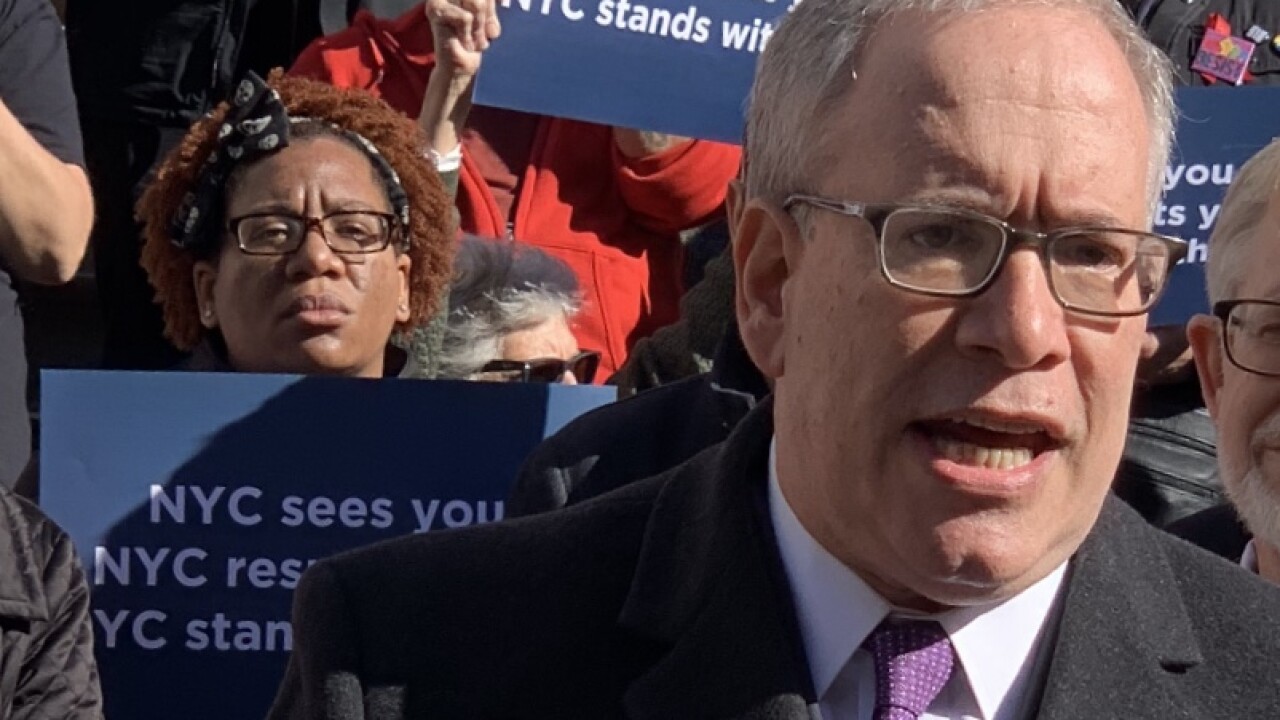

New York City’s economy grew 3.0% in the first quarter, Comptroller Scott Stringer reported on Monday.

May 20 -

Some municipal market observes hope the mayor's run won't take attention away from the city's $92.5 billion budget.

May 16 -

Council Speaker Corey Johnson hints budget talks will go down to the wire.

May 8 -

New York Mayor Bill de Blasio won praise for cost-cutting but drew criticism for failing to go far enough in preparing for an economic downturn.

April 29 -

The municipal bond market is facing $100 billion of municipal bond redemptions and implied reinvestments.

April 1 -

Green bonds and sustainable offerings are on tap this week as several sales are set to hit the market. Buyers are expected to snap up the paper that aims to fund clean water, school and housing initiatives.

April 1 -

New York City's gross city product grew 3.9% in the fourth quarter of 2018.

February 19 -

Ipreo forecasts weekly bond volume will surge to $7.2 billion from a revised total of $3.8 billion this week.

February 1 -

Municipal bonds were stronger with Treasurys as the Chicago O’Hare airport deal came to market as Detroit sold GOs.

December 4 -

Municipal bonds were stronger with Treasuries at mid-session.

December 4