-

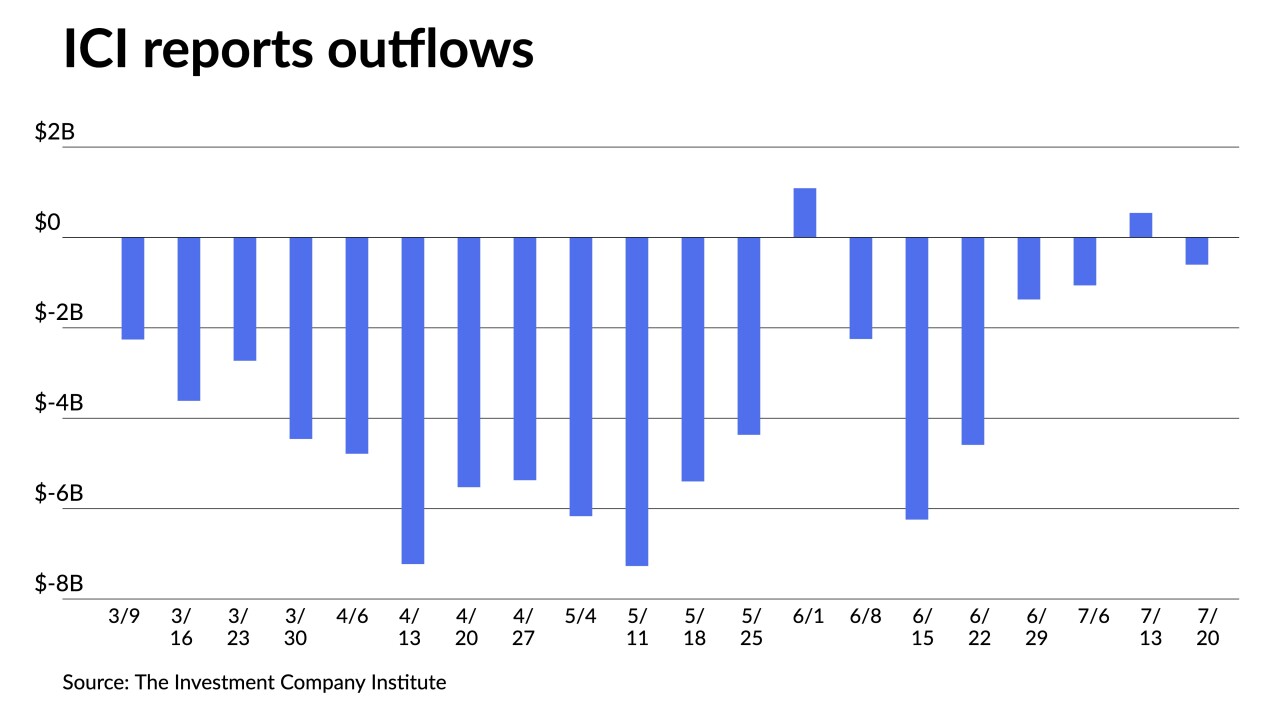

Investors pulled $229.263 million out of muni bond mutual funds in the latest week, versus the $635.177 million of outflows the prior week, according to Refinitiv Lipper. High-yield continues to see inflows.

August 18 -

Federal Reserve Bank of San Francisco President Mary Daly said the central bank should raise interest rates "a little" above 3% by the end of the year to cool inflation, pushing back against investor bets that officials would then reverse course.

August 18 -

The short end was hammered in the secondary with large blocks of high-grades showing big swings to higher yields while the rest of the curve wasn't spared the damage and triple-A yields rose by seven to 16 basis points.

August 17 -

Two Federal Reserve officials responded to softening inflation data by saying it doesn't change the U.S. central bank's path toward even higher interest rates this year and next.

August 10 -

The Investment Company Institute reported investors poured in $1.589 billion into muni bond mutual funds in the week ending August 3, the highest level since November.

August 10 -

The Federal Reserve is committed to cooling inflation and needs to raise interest rates to a little above 4% to ease demand, Cleveland Federal Reserve Bank President Loretta Mester said.

August 4 -

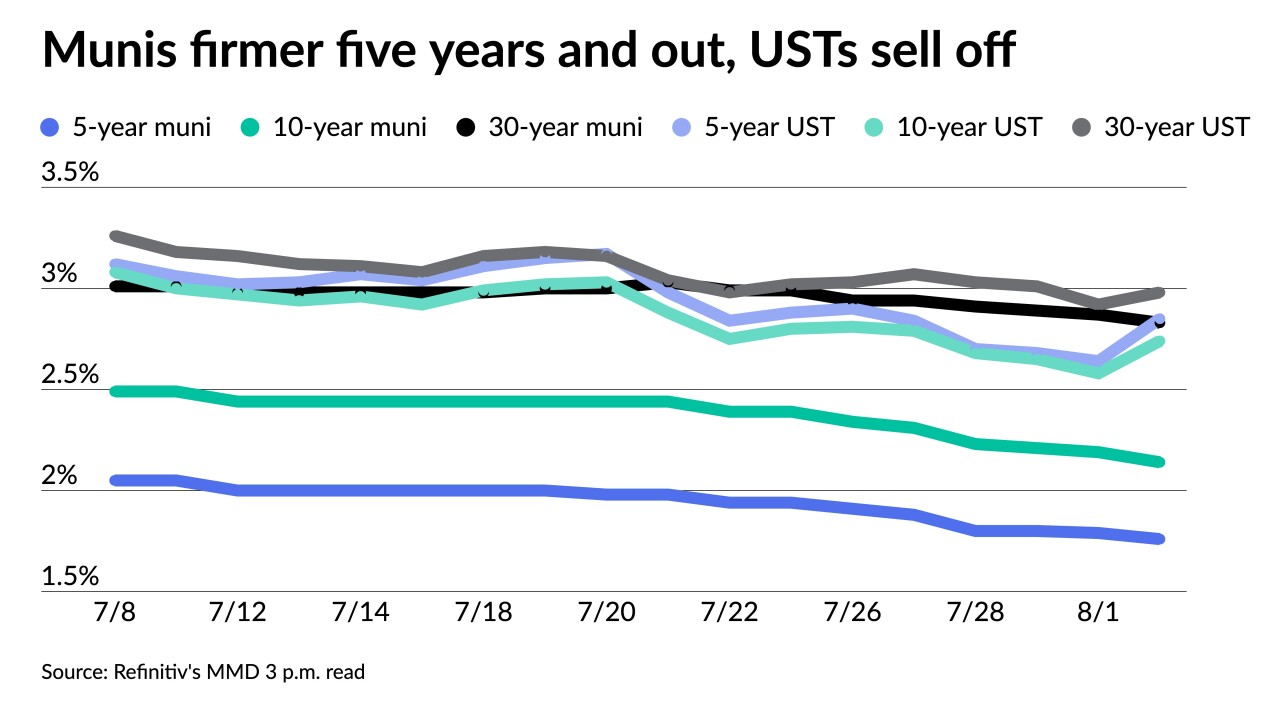

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

St. Louis Fed Bank President James Bullard said he favors a strategy of "front-loading" big interest-rate hikes, and he wants to end the year at 3.75% to 4%, while his Richmond counterpart, Thomas Barkin, said the central bank was committed to lowering inflation and a recession could happen.

August 3 -

Federal Reserve officials said they want strong evidence that the hottest inflation in four decades is on a sustainable downward path before declaring victory in their fight against it.

August 2 -

The day after the Federal Open Market Committee's next meeting we will analyze the increase and the signals about what rate hikes may be coming.

-

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what’s necessary to bring down demand in order to reach policy makers’ 2% long-term inflation goal, a target that remains far off.

August 1 -

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Former Treasury Secretary Lawrence Summers said he was concerned the Federal Reserve is still engaging in “wishful thinking” about how much it will take to bring inflation down from four-decade highs.

July 29 -

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

July 27 -

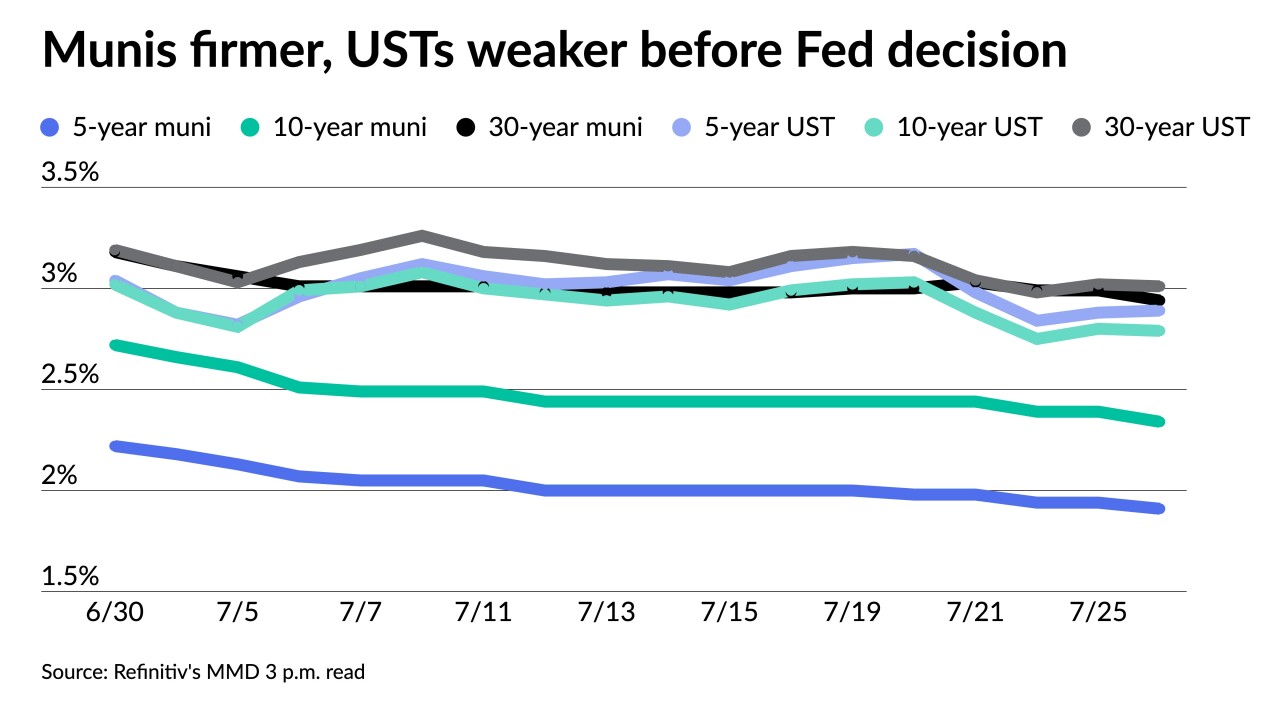

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25