-

Powell is set to appear on Capitol Hill this week for his semi-annual monetary policy testimony, the first time the Fed chief will answer questions from Congress in public since early March.

June 21 -

Those "holding out for wider yields or relative value" are frustrated due to an extremely tight muni range, but FHN Financial's Kim Olsan said, "the reality is that supply has yet to materialize to force that change."

June 15 -

Munis did not follow USTs yet, "but given the outperformance of munis over the last couple days and while I wouldn't be surprised if they weaken a little given how expensive ratios are," said Breckinridge's Matt Buscone.

June 14 -

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Analysts agree with the market that the Federal Open Market Committee will hold rates in a range of 5% to 5.25%, but guidance will suggest a future hike.

June 13 -

The Federal Open Market Committee is scheduled to meet next week with many experts expecting to see a pause in federal fund rate hikes after ten straight upticks.

June 8 -

The U.S. economy is "too resilient and this will force the Fed to not only deliver more tightening but also to keep rates higher for much longer," OANDA's Edward Moya said. NYC and Connecticut GOs on tap.

May 26 -

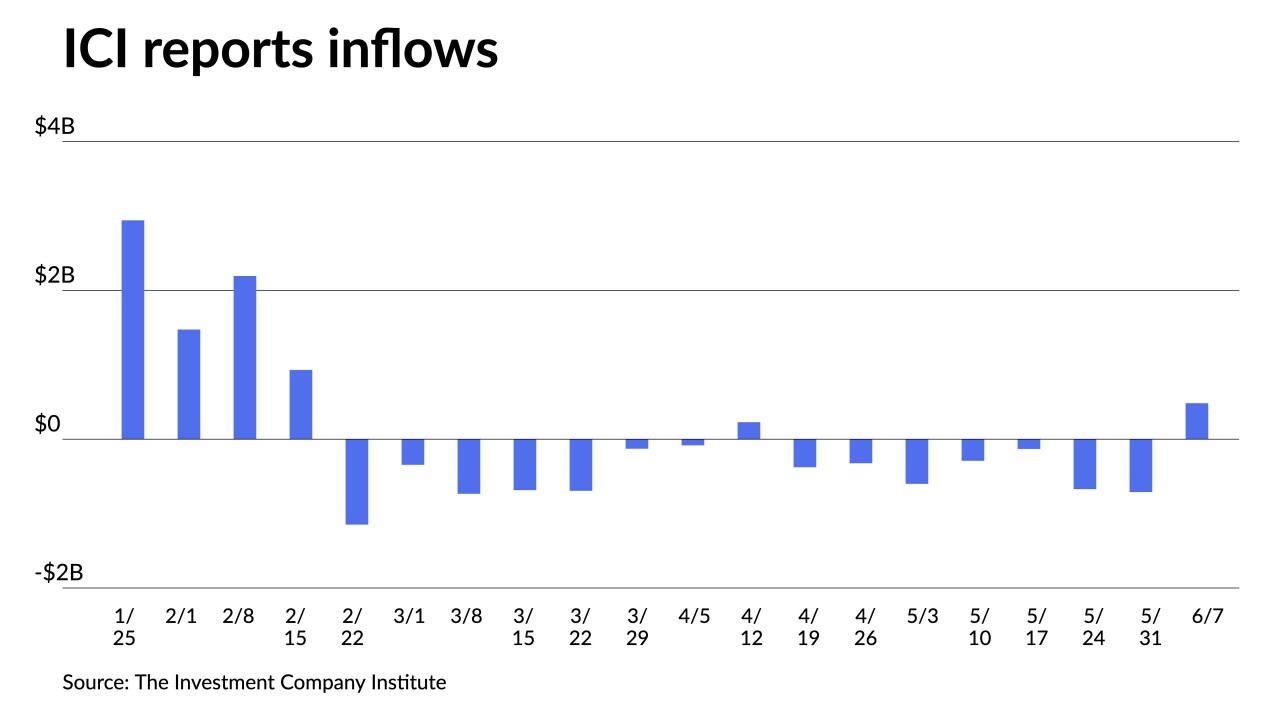

The Investment Company Institute reported investors pulled another $137 million out of municipal bond mutual funds in the week ending May 17, after $290 million of outflows the previous week.

May 24 -

"If the banking stresses start to bring inflation down for us, then maybe we're getting closer to being done. I just don't know right now," said Federal Reserve Bank of Minneapolis President Neel Kashkari.

May 22 -

Federal Reserve Chair Jerome Powell gave a clear signal he is inclined to pausing interest-rate increases next month and said that tighter credit conditions could mean the policy peak will be lower.

May 19 -

Federal Reserve Bank of Dallas President Lorie Logan said the case for pausing interest rate increases at the central bank's June meeting isn't yet clear, while her colleague Gov, Philip Jefferson sounded ready to be patient.

May 18 -

The FOMC meets June 13-14. Join us June 15 at 2 p.m., Eastern time, as Jeffrey Cleveland, chief economist at Payden & Rygel, provides his take on the meeting statement, Federal Reserve Board Chair Jerome Powell's press conference and the latest Fed projections.

-

Two Federal Reserve officials signaled they favored pausing interest rate increases, while a third policymaker said the central bank's task in subduing inflation was not complete.

May 15 -

The Federal Reserve meeting May 2-3 will be closely watched for hints about what the FOMC's next move is. Join BNP Pariba U.S. Economist Yelena Shulyatyeva at 11 a.m. May 4 as she takes a look at the meeting and Chair Powell's press conference.

-

The Federal Reserve said that banks reported tighter standards and weaker demand for loans in the first quarter, extending a trend that began before recent stresses in the banking sector emerged.

May 8 -

Federal Reserve Bank of St. Louis President James Bullard said he thinks the U.S. central bank can still achieve a soft landing, with inflation returning to the Fed's 2% target without triggering a significant downturn.

May 5 -

Outflows from municipal bond mutual funds intensified as Refinitiv Lipper reported $846.116 million was pulled from them as of Wednesday after $92.055 million of outflows the week prior.

May 4 -

The secondary was quiet and the sole deal of size came from a $400 million-plus competitive water and sewer loan from Portland, Oregon. The recent rise in yields makes for more compelling levels.

May 3 -

Still no clarity as the banking crisis adds to the difficulty of predicting an economy still feeling COVID impacts and uncertainty about the prospects for a recession.

April 24 -

Federal Reserve Bank of St. Louis President James Bullard said he favored continued interest-rate hikes to counter persistent inflation, while recession fears are overblown.

April 18