-

Federal Reserve Vice Chairman Richard Clarida pushed back against speculation in financial markets the central bank will cut interest rates to boost softening inflation up to its 2% target.

May 7 -

U.S. interest rates are “in the right place” and don’t need to be lowered, although weak inflation merits close watching, according to Robert Kaplan, president and CEO of the Federal Reserve Bank of Dallas.

May 7 -

A posse of Federal Reserve policymakers met with skepticism last week when they described ways to potentially improve their management of the economy.

May 6 -

The White House asked former domestic policy adviser Paul Winfree if he was interested in joining the Federal Reserve Board of Governors.

May 6 -

The April employment report topped estimates for jobs created, while the jobless rate fell to a 49-year low; wage increases missed projections.

May 3 -

Federal Chair Jerome Powell doused market hopes for a rate cut, but it was not the result of a shift in Fed policy.

May 2 -

The Fed Chair said the FOMC is “comfortable with our current policy stance,” which he termed “appropriate.”

May 1 -

President Donald Trump suggested Tuesday that if the Federal Reserve cut interest rates by one percentage point and resumed bond purchases it would boost the economy “like a rocket,” as central bank policy makers met to decide on where to set borrowing costs.

April 30 -

President Donald Trump’s top economic adviser said the White House still backs Stephen Moore for a position on the Federal Reserve Board despite growing criticism over past comments deriding Midwestern cities and women.

April 29 -

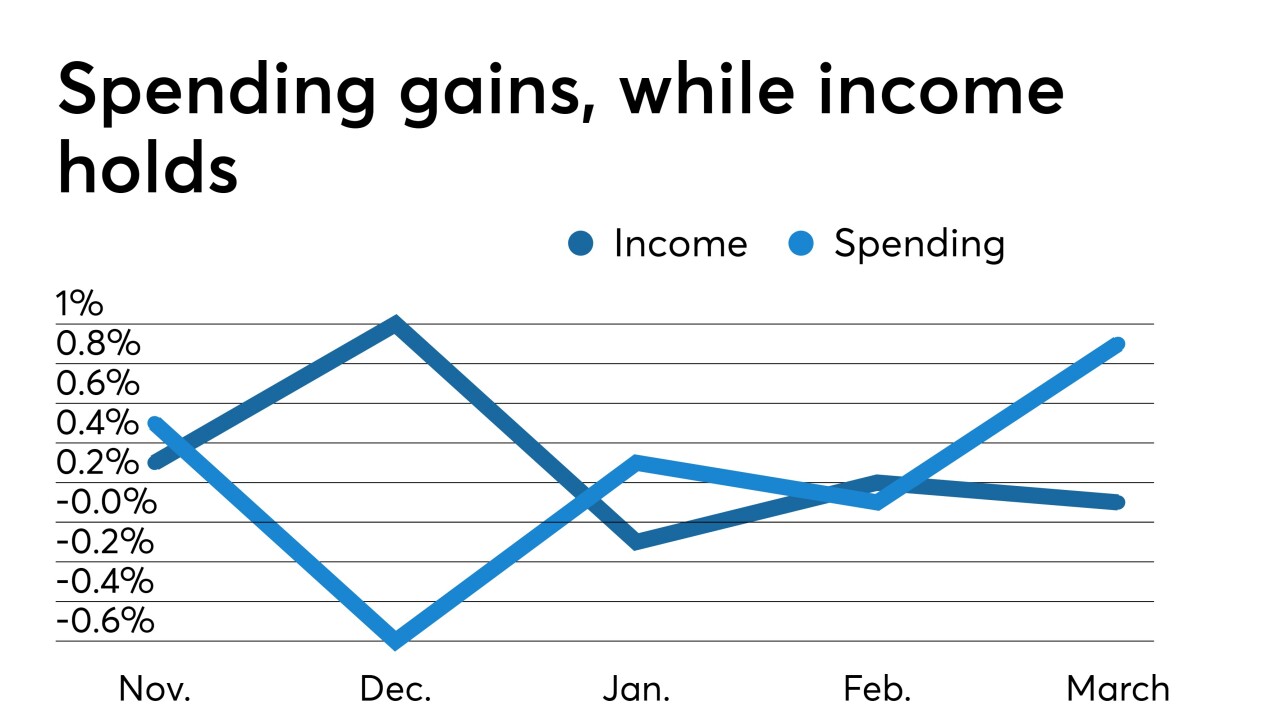

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29