-

Federal Reserve Bank of Boston Eric Rosengren offered an upbeat assessment in the face of the darkening economic crisis, saying the U.S. can withstand the short-term damage caused by the coronavirus pandemic.

March 19 -

With a significant decline in new infections in China, positive news may be ahead, one expert says.

March 18 -

The Federal Reserve continued its moves to minimize the effects of COVID-19 on the U.S. economy.

March 17 -

The Federal Open Market Committee lowered the fed funds rate target to between zero and ¼% in an emergency meeting on Sunday, but while analysts say the move was needed, they feel it will take more to offset the effects of COVID-19.

March 16 -

In an unprecedented move, the Federal Reserve on Sunday cut rates to near zero.

March 15 -

The markets continue to sink on virus fears, as even a 50 basis point rate cut by the Federal Reserve last week didn’t turn the markets around. The Fed meets again next week and many see more easing, but will those efforts prevent recession?

March 9 -

Marc Odo, client portfolio manager at Swan Global Investments, discusses the Federal Reserve’s emergency rate cut, why more easing may not help, the rocky road ahead, and why consumer confidence will be the key indicator to watch. Gary Siegel hosts.

March 6 -

Federal Reserve Bank of St. Louis President James Bullard said markets are wrong to assume that the central bank will cut rates again at the policy meeting in two weeks.

March 4 -

The Federal Open Market Committee cut the fed funds rate target 50 basis points to a range between 1% and 1.25%, it announced Tuesday.

March 3 -

Policymakers may not wait until their mid-month meeting and could act with other central banks.

March 2 -

The Federal Reserve is monitoring the COVID-19 issue and its economic effects, according to a release from the central bank, attributed to Chairman Jerome Powell, released Friday.

February 28 -

Federal Reserve Bank of St. Louis President James Bullard said the Fed is ready to act if the COVID-19 virus develops into a destabilizing force.

February 28 -

GOP’s Shelby says he could support Shelton for Fed board

February 27 -

It’s too soon to judge the potential impact of the coronavirus outbreak on the U.S. economy or consider a monetary policy response, Chicago Fed President Charles Evans said.

February 27 -

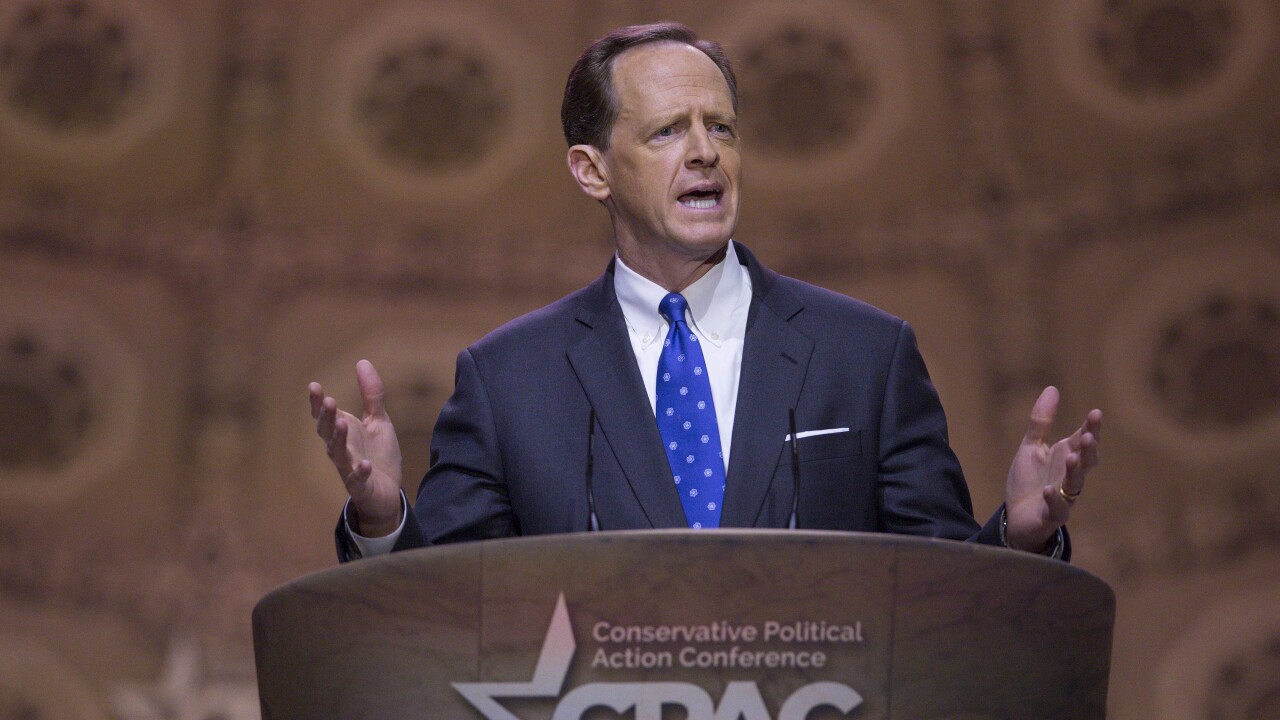

Republican Senator Pat Toomey said he’ll support President Donald Trump’s nomination of Judy Shelton for the Federal Reserve Board.

February 27 -

Attention is focused on the impact COVID-19 may have on economic growth in the United States in the short and long term.

February 26 -

It is “still too soon” to say whether the coronavirus outbreak will cause a material change in the U.S. outlook, said Federal Reserve Vice Chairman Richard Clarida, signaling officials won’t be rushed to judgment on the need to cut interest rates.

February 26 -

Three key Republicans on the Senate Banking Committee said Monday that they remain undecided on President Donald Trump’s nomination of Judy Shelton to the Federal Reserve Board.

February 25 -

Federal Reserve Vice Chairman Richard Clarida disputed suggestions that the central bank suffers from a “hall of mirrors” problem under which it slavishly follows financial-market expectations for monetary policy.

February 21 -

The suite of new monetary policy tools under consideration by the Federal Reserve are likely to have limited effectiveness in the next downturn.

February 21