-

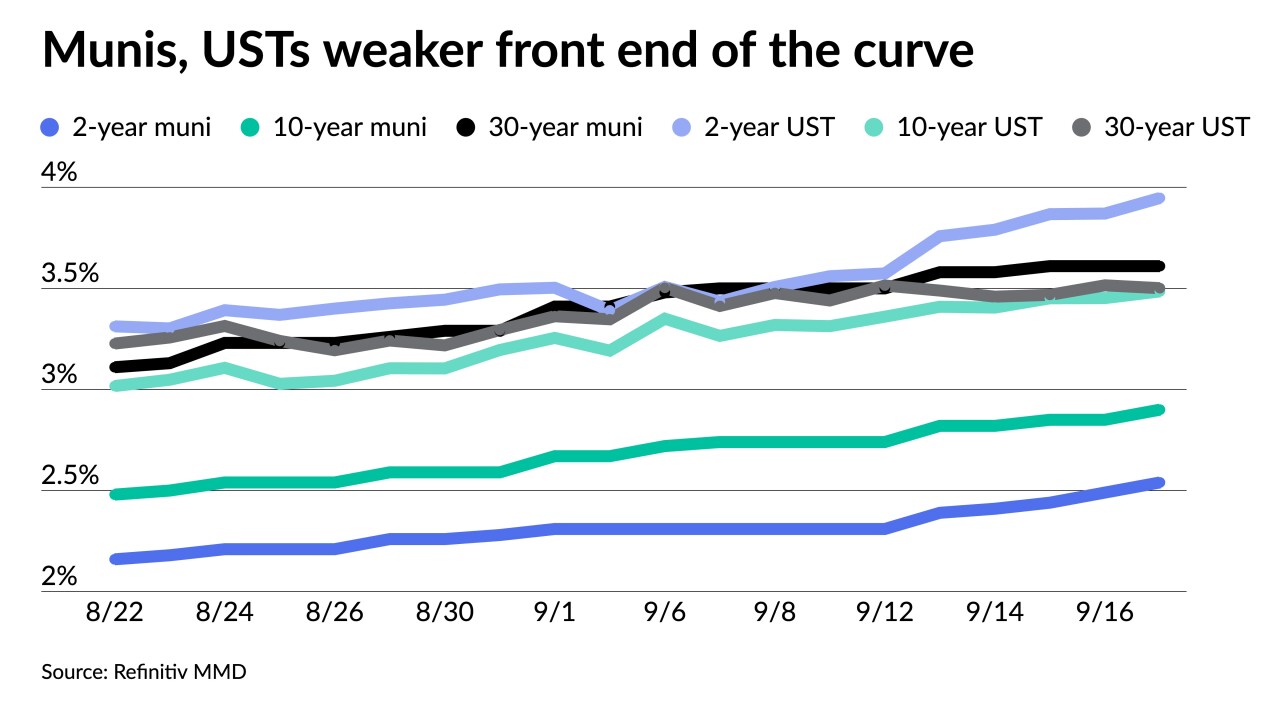

One-year rates have risen 100 basis points, intermediate maturities have traded up about 25 basis points and long-term munis are nearly 50 basis points above June's close.

September 22 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

Short triple-A yields have risen more than 30 basis points over the past eight sessions while the long bond has risen 19, per Refinitiv MMD data.

September 20 -

While a full basis point increase will be discussed, analysts see the Fed increasing 75 basis points to a 3% to 3.25% range, with a split between those who say inflation is worsening and those that believe it peaked.

September 20 -

Triple-A muni yields rose another five basis points on the short end while UST rose up to seven. UST yields are the highest since 2007.

September 19 -

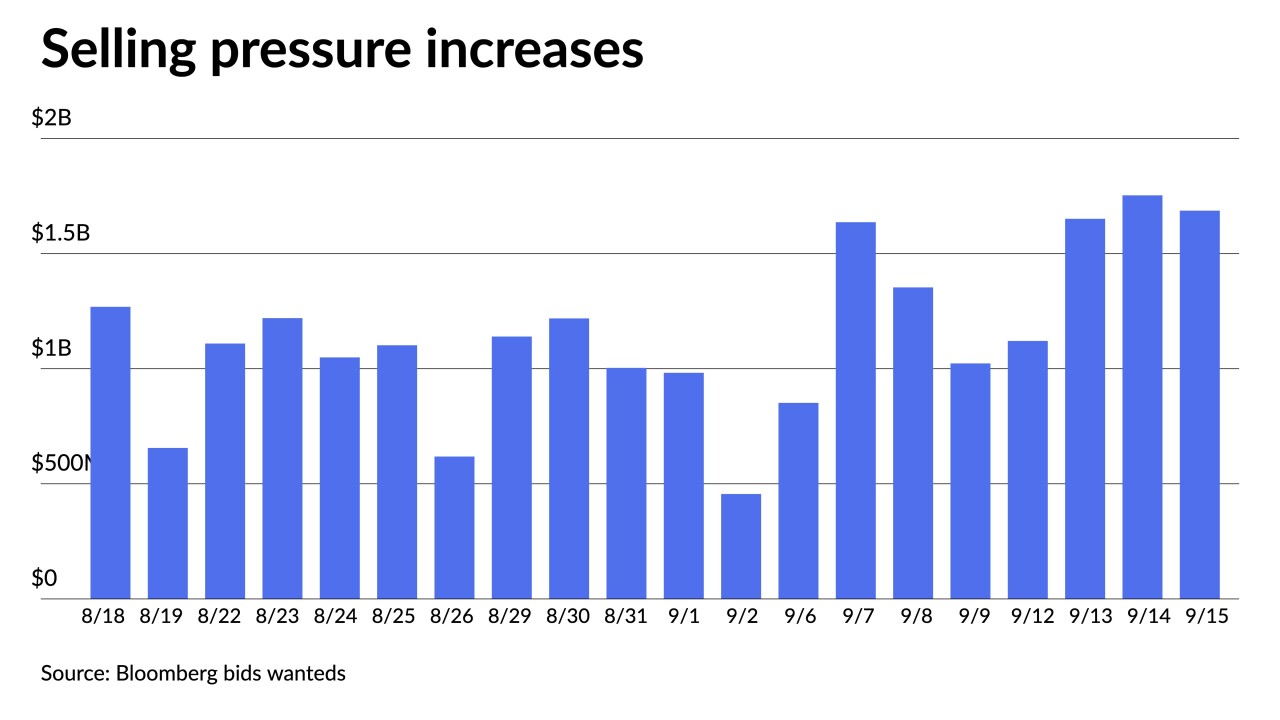

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

"The Fed is going to need great skill and also some good luck to achieve what we sometimes call a soft landing," Yellen said.

September 12 -

Federal Reserve Governor Christopher Waller said he favors "another significant" increase in interest rates when the central bank meets later this month, signaling his backing for a 75 basis-point move.

September 9 -

"I think that we've got a good plan in place. We could very well do 75 in September," he said.

September 8 -

"We need to act now, forthrightly, strongly as we have been doing," Powell said Thursday in remarks at the Cato Institute's monetary policy conference.

September 8 -

Federal Reserve Bank of Cleveland President Loretta Mester also reiterated that she does not expect the Fed to cut rates next year, noting that policy makers need to keep inflation expectations from becoming unanchored.

September 7 -

Investors will be greeted Tuesday with a larger new-issue calendar, estimated at $6.087 billion, up from total sales of $5.551 billion in the week of Aug. 29.

September 2 -

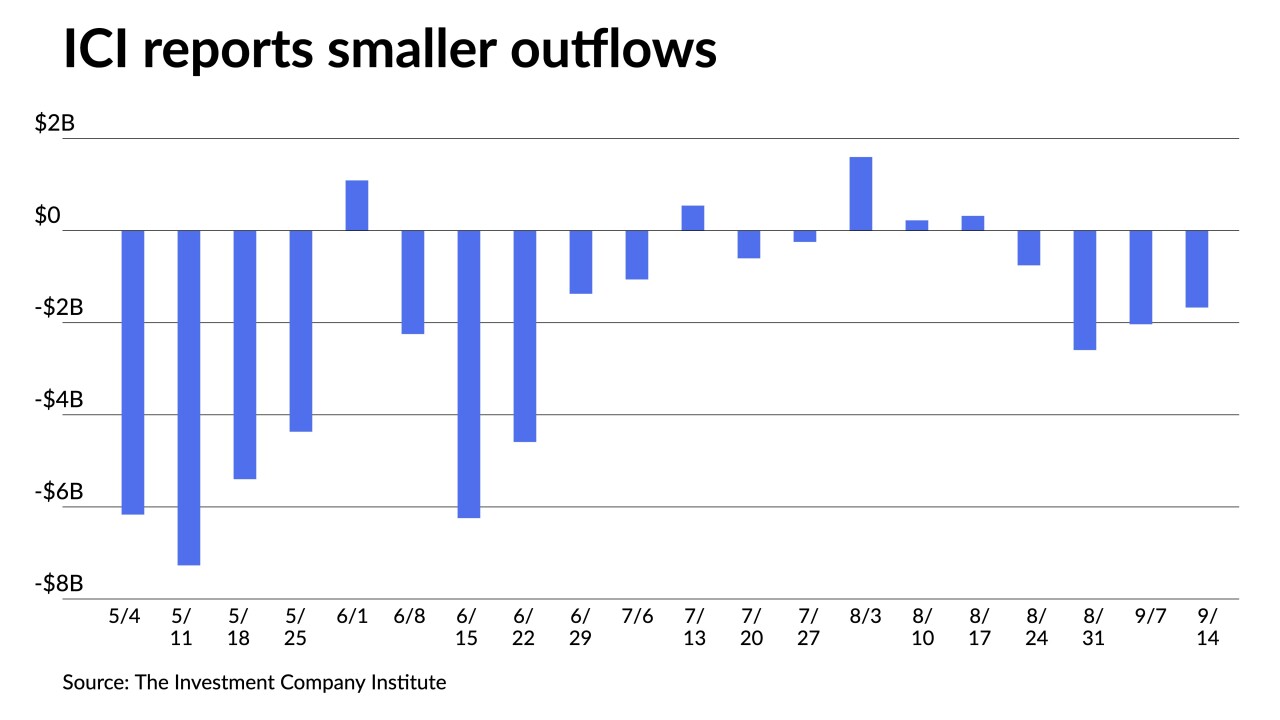

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

Many market players have revised their supply projections downward since rising interest rates have slowed down refunding and taxable volumes and general market volatility has stopped some issuers from participating.

August 31 -

The Federal Reserve needs to raise its benchmark rate above 4% by early next year and leave it there for some time to help cool inflation, Cleveland Fed President Loretta Mester reiterated on Wednesday.

August 31 -

Federal Reserve officials, picking up where they left off over the weekend in Jackson Hole, stressed their commitment to defeating inflation while remaining vague on how big their policy move will be next month.

August 30 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

Investors are probably in for disappointment if they continue to fight the Fed.

August 24 Payden & Rygel

Payden & Rygel -

Federal Reserve Bank of Minneapolis President Neel Kashkari said U.S. inflation is very high and the central bank must act to bring it back under control.

August 24 -

Former Treasury Secretary Lawrence Summers called on the Federal Reserve to deliver a clear message saying it will need to impose "restrictive" monetary policy that drives up the U.S. unemployment rate in order to quell inflation.

August 22