-

The day after the FOMC announces its policy decision, Christian Scherrmann, U.S. Economist at DWS Group, will offer his take on the meeting, Fed Chair Powell's press conference and what comes next.

-

"It should at least be something we're considering at this point, but the data haven't been cooperating," Daly said Friday.

October 21 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

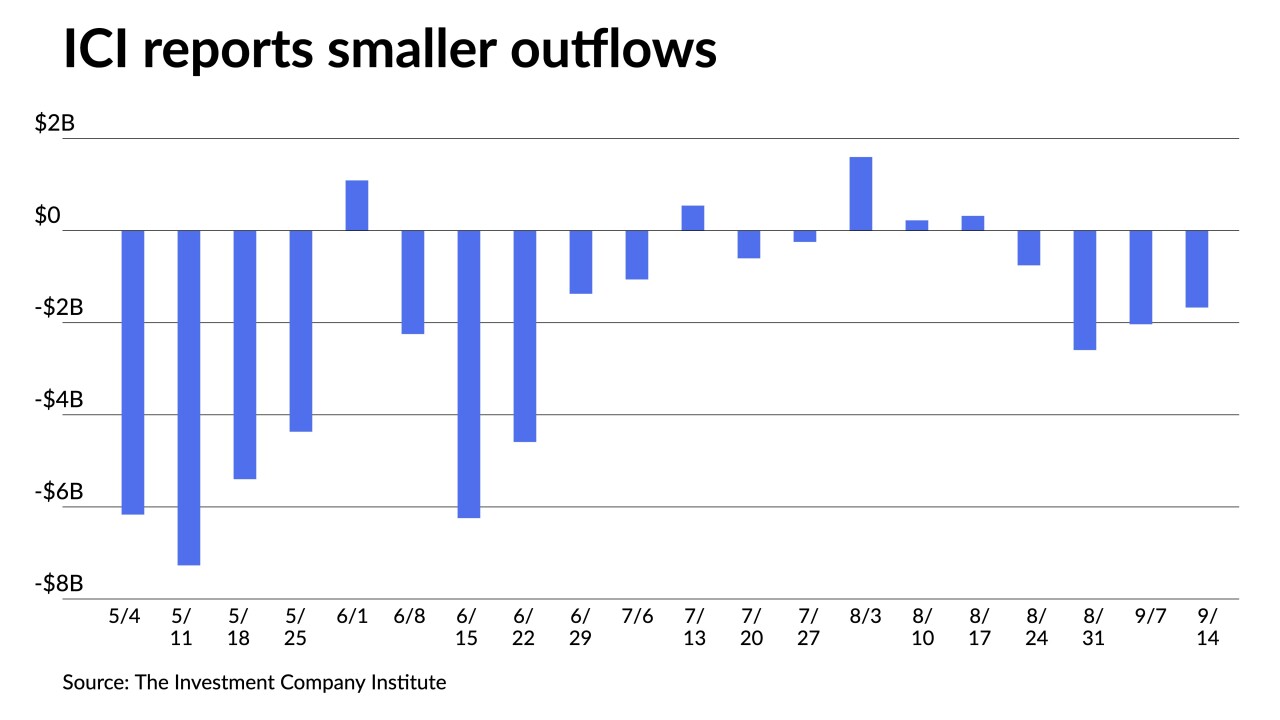

Refinitiv Lipper reported $2.262 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.057 billion the week prior.

October 13 -

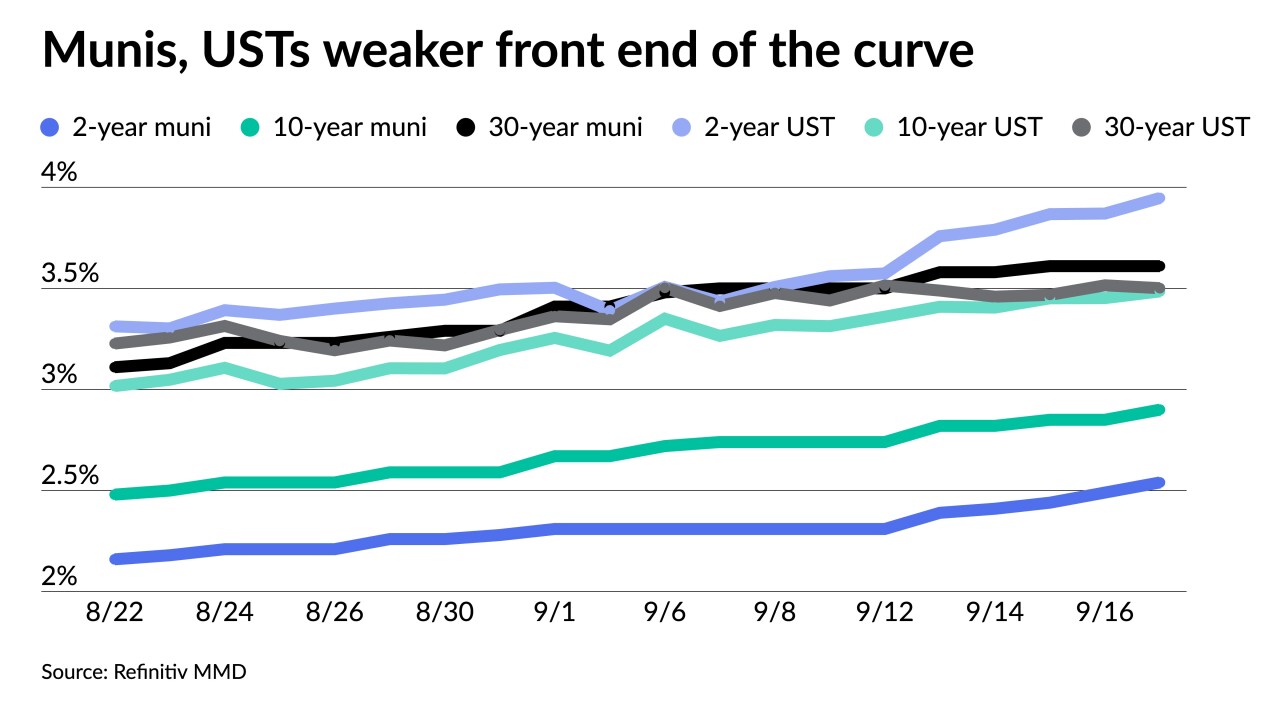

Triple-A yields rose more than three-quarters of a point on the front end and nearly half a point out long in September as munis posted 3.84% losses.

September 30 -

"All of you who are looking for a pivot, be careful what you wish for," the chief economic adviser at Allianz SE and Gramercy Funds chairman said.

September 30 -

For the first three quarters, total issuance sits at $308.440 billion, down from $361.932 billion in 2021. Taxables are down 48.0% to $45.724 billion from $87.979 billion.

September 30 -

"It will take time for the full effect of tighter financial conditions to work through different sectors and to bring inflation down," Brainard said. "Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target."

September 30 -

"The lack of progress thus far has me thinking much more now that we have to get to a moderately restrictive stance," he told reporters Wednesday.

September 28 -

John Hallacy talks with Chip Barnett about how fiscal and monetary policy is affecting the municipal bond market. He discusses recent data releases, supply forecasts and the midterm elections and the future of ESG in public finance. (20 minutes)

September 27 -

One-year rates have risen 100 basis points, intermediate maturities have traded up about 25 basis points and long-term munis are nearly 50 basis points above June's close.

September 22 -

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

Short triple-A yields have risen more than 30 basis points over the past eight sessions while the long bond has risen 19, per Refinitiv MMD data.

September 20 -

While a full basis point increase will be discussed, analysts see the Fed increasing 75 basis points to a 3% to 3.25% range, with a split between those who say inflation is worsening and those that believe it peaked.

September 20 -

Triple-A muni yields rose another five basis points on the short end while UST rose up to seven. UST yields are the highest since 2007.

September 19 -

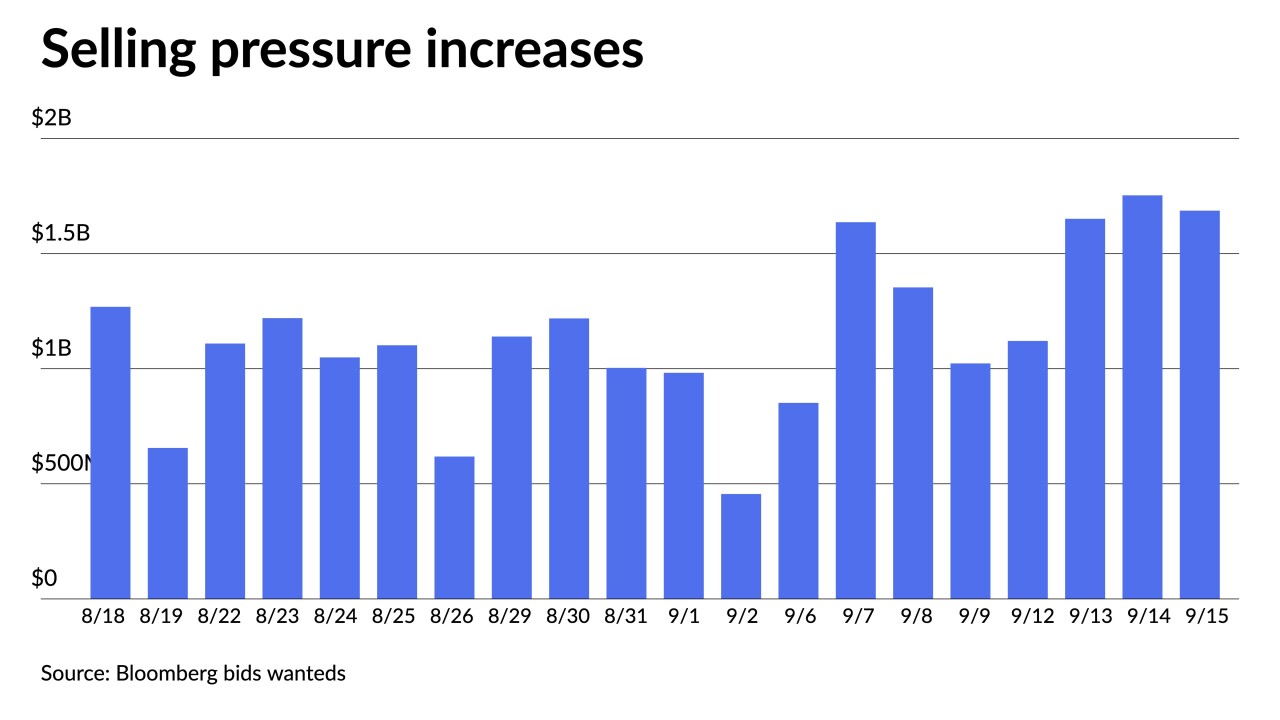

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

"The Fed is going to need great skill and also some good luck to achieve what we sometimes call a soft landing," Yellen said.

September 12 -

Federal Reserve Governor Christopher Waller said he favors "another significant" increase in interest rates when the central bank meets later this month, signaling his backing for a 75 basis-point move.

September 9 -

"I think that we've got a good plan in place. We could very well do 75 in September," he said.

September 8 -

"We need to act now, forthrightly, strongly as we have been doing," Powell said Thursday in remarks at the Cato Institute's monetary policy conference.

September 8