-

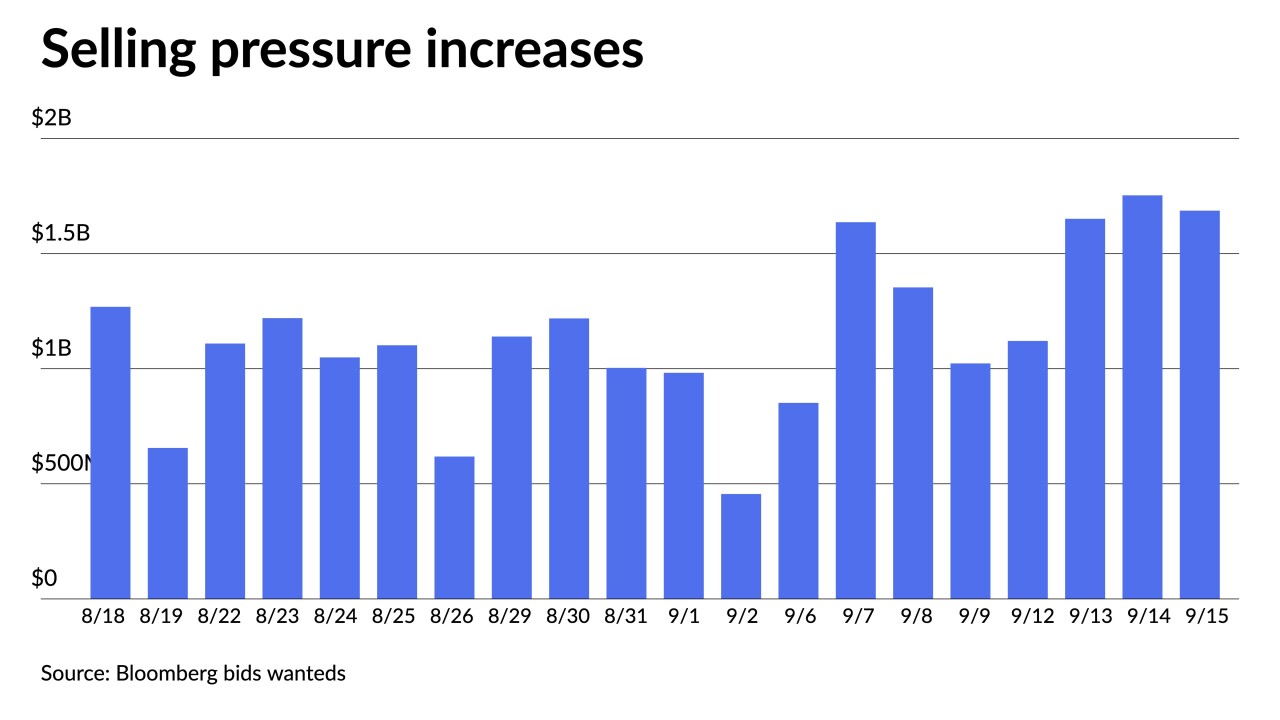

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

"The Fed is going to need great skill and also some good luck to achieve what we sometimes call a soft landing," Yellen said.

September 12 -

Federal Reserve Governor Christopher Waller said he favors "another significant" increase in interest rates when the central bank meets later this month, signaling his backing for a 75 basis-point move.

September 9 -

"I think that we've got a good plan in place. We could very well do 75 in September," he said.

September 8 -

"We need to act now, forthrightly, strongly as we have been doing," Powell said Thursday in remarks at the Cato Institute's monetary policy conference.

September 8 -

Federal Reserve Bank of Cleveland President Loretta Mester also reiterated that she does not expect the Fed to cut rates next year, noting that policy makers need to keep inflation expectations from becoming unanchored.

September 7 -

Investors will be greeted Tuesday with a larger new-issue calendar, estimated at $6.087 billion, up from total sales of $5.551 billion in the week of Aug. 29.

September 2 -

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

Many market players have revised their supply projections downward since rising interest rates have slowed down refunding and taxable volumes and general market volatility has stopped some issuers from participating.

August 31 -

The Federal Reserve needs to raise its benchmark rate above 4% by early next year and leave it there for some time to help cool inflation, Cleveland Fed President Loretta Mester reiterated on Wednesday.

August 31