Federal Reserve

Federal Reserve

-

Panelists diverged sharply on the outlook for 2026 at the Executives' Club of Chicago's Annual Economic Outlook panel, held at a hotel in Chicago's Loop.

January 14 -

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

Despite the quiet start to the week for munis, all financial markets may feel a "heightened level of risk for rate volatility over the next few days," said Tim Iltz, a fixed income credit and market analyst at HJ Sims.

January 12 -

Federal Reserve Chair Jerome Powell said the central bank has been served grand jury subpoenas and been threatened with criminal indictment, moves he called "pretexts" to influence interest rates through "political pressure or intimidation."

January 11 -

"With decent job growth in December and a downtick in the federal funds rate, the Federal Reserve will likely hold the federal funds rate steady at [its] next decision in late January," said Comerica Bank Chief Economist Bill Adams.

January 9 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

Municipal bond issuers are on tap to sell about $6 billion of new issues in early January, but there should be plenty of money from maturing issues and interest payments to easily absorb that amount, as well as volume going forward, says Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

December 31 -

The Federal Open Market Committee meeting minutes showed the decision was closer than the vote indicated, with "a few" voters suggesting they would have supported no change at the meeting.

December 30 -

With Federal Reserve Chair Jerome Powell's term expiring, there is added uncertainty about monetary policy.

December 29 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

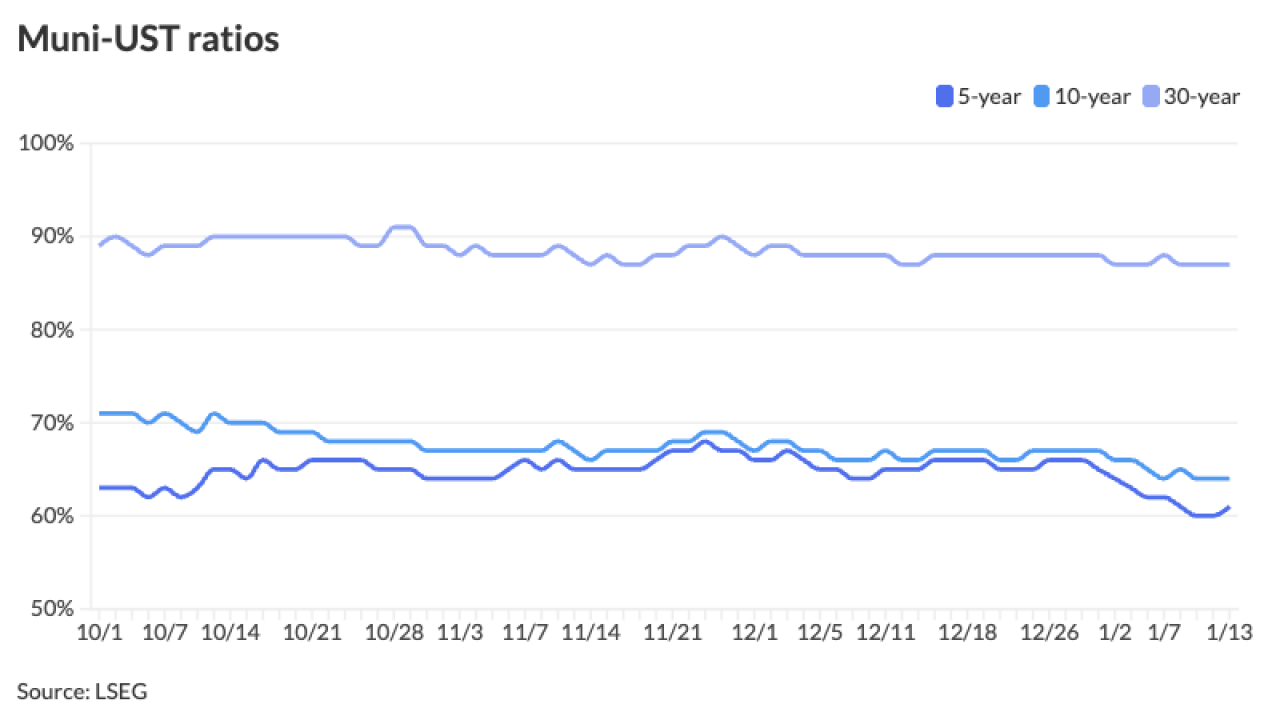

Muni yields were bumped a basis point, while UST yields fell two to four basis points.

December 18 -

Federal Reserve Gov. Christopher Waller said monetary policy must remain insulated from political pressure, arguing that communication with the White House should be limited. Waller is slated to meet with President Trump Wednesday afternoon.

December 17 -

Inflation reports may drive markets in 2026 since the labor market is "sending mixed messages," said Kevin O'Neil, associate portfolio manager and senior research analyst at Brandywine Global.

December 16 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

"With its third straight rate cut, the Fed is sending a clear message: it's no longer just watching inflation — it's managing risk," said Gina Bolvin, president of Bolvin Wealth Management Group.

December 11 -

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10 -

Issuers mostly avoided pricing deals in the previous weeks the Fed met this year, but that's not the case this week, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

December 8 -

Much has changed since October and most economists are sure the FOMC will lower rates by 25 basis points this week, with dissenting votes expected.

December 8 -

The new-issue calendar falls to an estimated $1.154 billion, with $939.1 million negotiated deals on tap and $214.8 million of competitives.

November 21