-

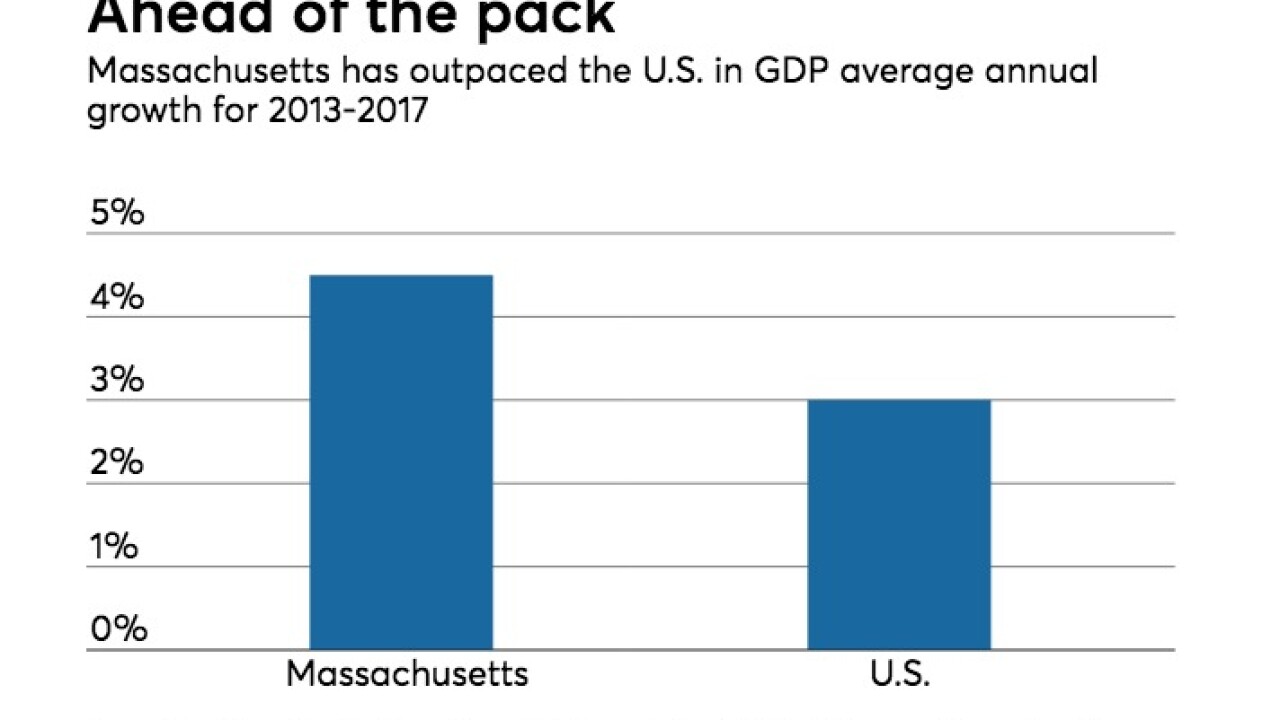

The situation could deteriorate because of an aging workforce and modest population growth, according to Moody's.

May 16 -

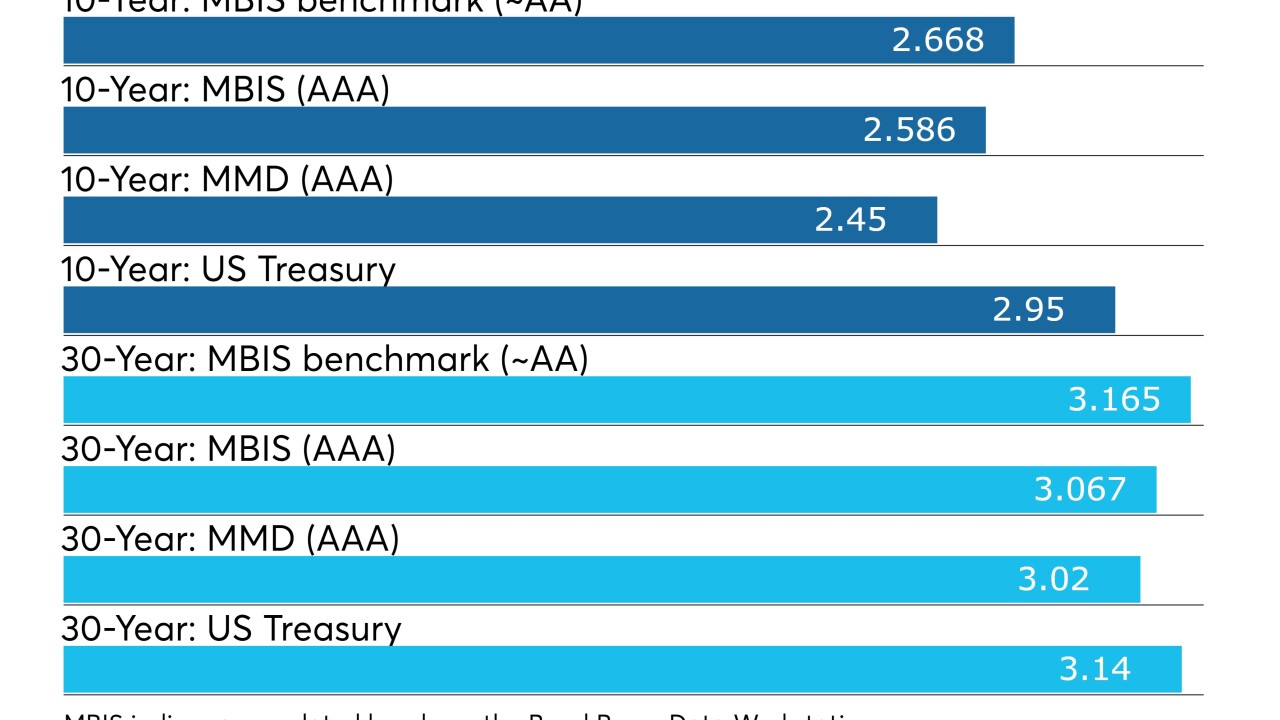

The municipal market and its participants were peppered with deals during what will go down as the week’s busiest day.

May 9 -

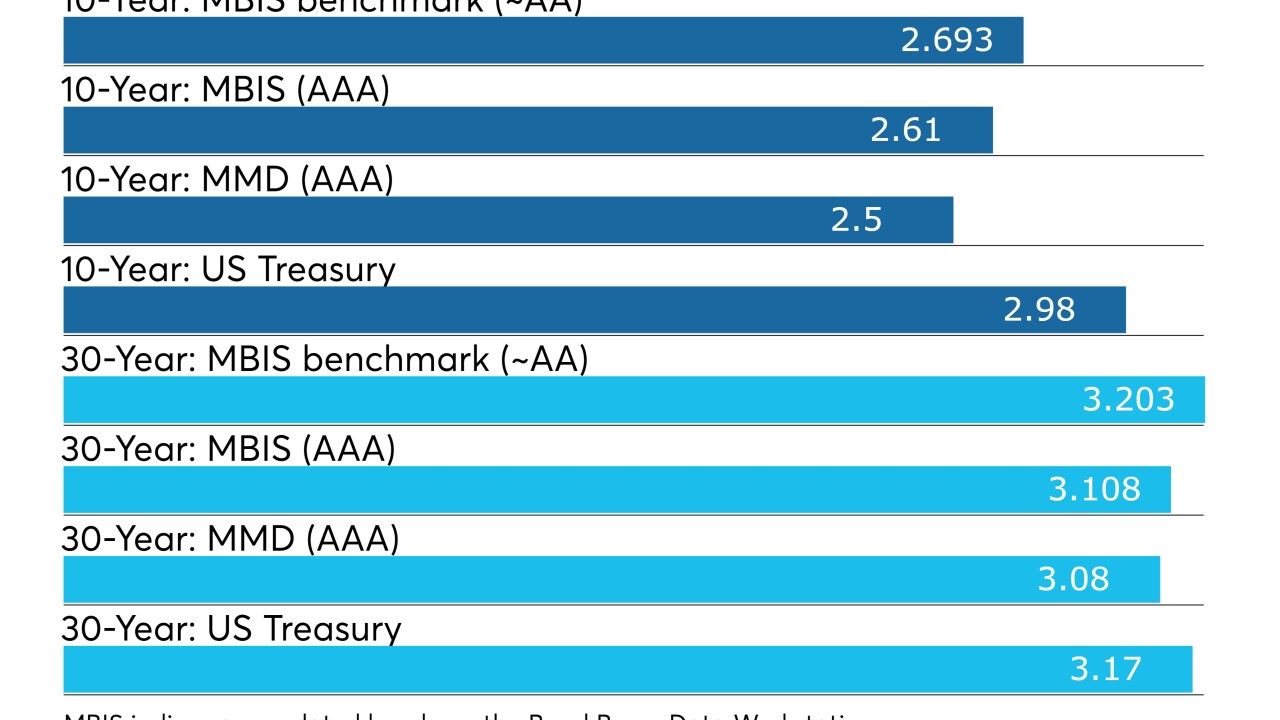

Municipal bond buyers had billions of new paper flow into the primary market - which took it all down but overall the market was weaker for the second day in a row as Treasury yields continue to climb.

April 24 -

Municipal bonds finished weaker on Monday ahead of a what will be an busy Tuesday with a few billion of new issuance hitting the market.

April 23 -

With tax season in the rear view mirror, supply is set to rise to $7.8 billion as demand rebounds.

April 20 -

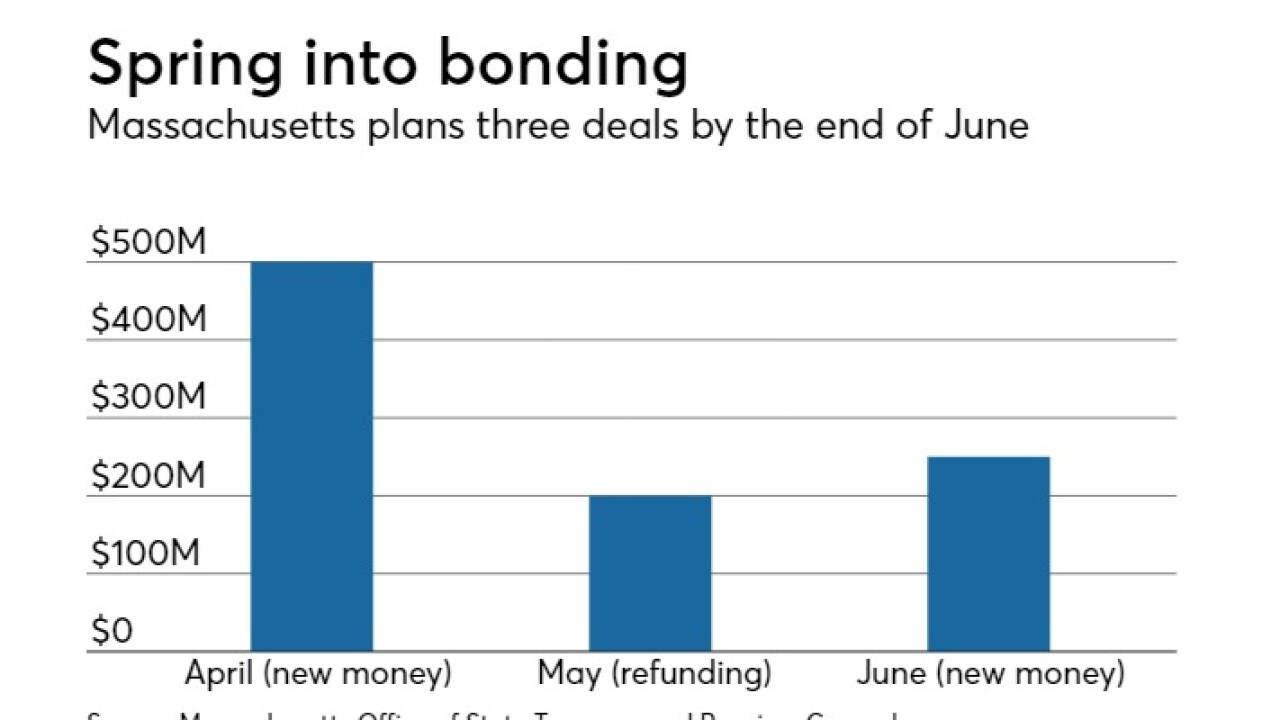

The commonwealth plans a competitive sale for the $500 million in fixed-rate, tax-exempt new-money general obligation bonds.

April 20 -

Next week's $7.8 billion new issue slate features airport and water deals coming from New York and Texas issuers.

April 20 -

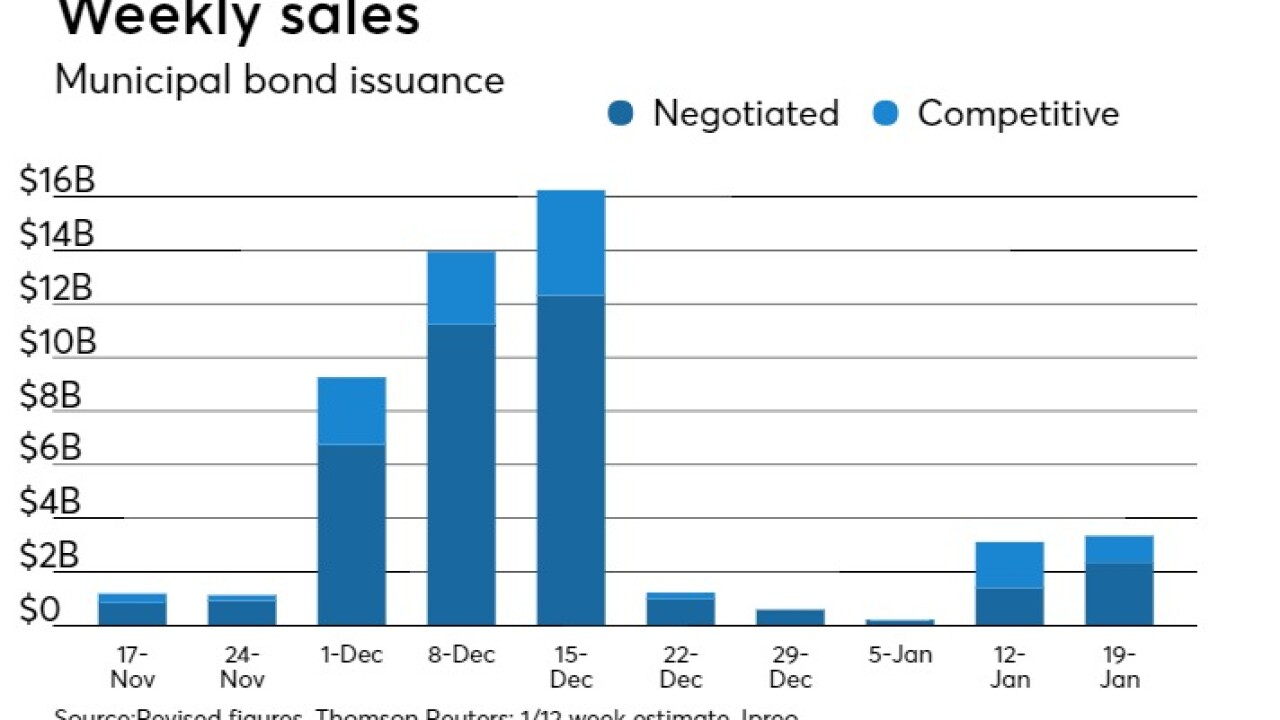

Municipal bond volume evaporated in January, as the market felt the aftereffect of federal tax legislation that pulled issuance forward into 2017.

January 31 -

Gov. Charlie Baker's group will examine changes in technology, climate and demographics.

January 24 -

The municipal bond market will see $3.35 billion of new deals hit the screens next in a holiday-shortened week. Ipreo estimates weekly volume at $3.35 billion, up from $3.12 billion this week.

January 12