-

On a quiet Monday where there is only one deal pricing for retail investors, municipals were mixed although some maturities on the long end were as much as one basis point higher, according to traders.

August 7 -

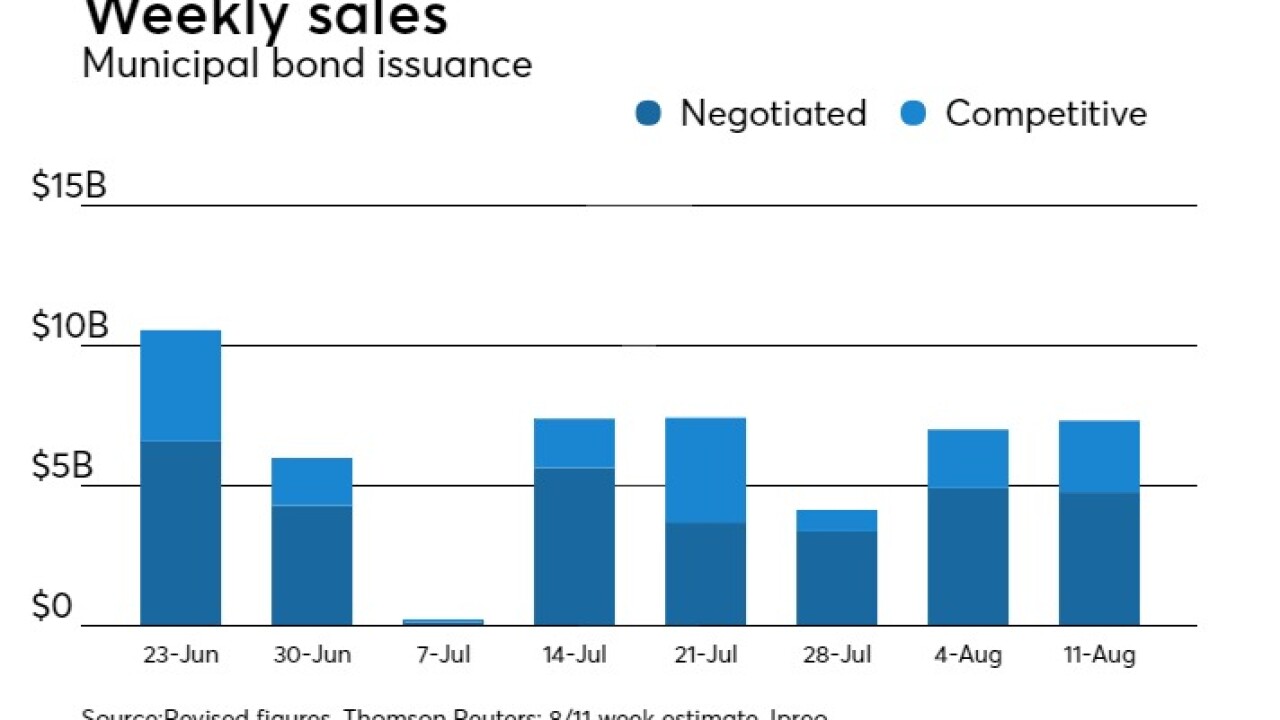

The municipal bond market is gearing up for about $7.3 billion of new supply this week, with $2.51 of that coming from two issuers.

August 7 -

Primary municipal bond market volume is expected to inch up to $7.3 billion, as analysts expect the muni market to stay on a path of suppressed supply and deep demand.

August 4 -

As the number of casinos continues to rise across the mid-Atlantic and New England regions, the industry boom could result in increased risk for those states, according to a report released Monday by S&P Global Ratings.

July 31 -

Top shelf municipal bonds were steady at mid-session, according to traders, who were looking ahead to next week’s new issue slate.

July 28 -

The municipal bond market is expected to remain quiet on Friday, ahead of next week’s new issue slate.

July 28 -

Top-rated municipal bonds ended weaker on Tuesday, according to traders, as deals from New York City, Philadelphia and the Port of Seattle hit the market.

July 25 -

Top-rated municipal bonds were weaker at mid-session, according to traders, who saw deals from New York City and Philadelphia hit the market.

July 25 -

After a busier-than-usual Monday, municipal bond traders will pick up right where they left off, with New York City and the Port of Seattle among the issuers coming to market.

July 25 -

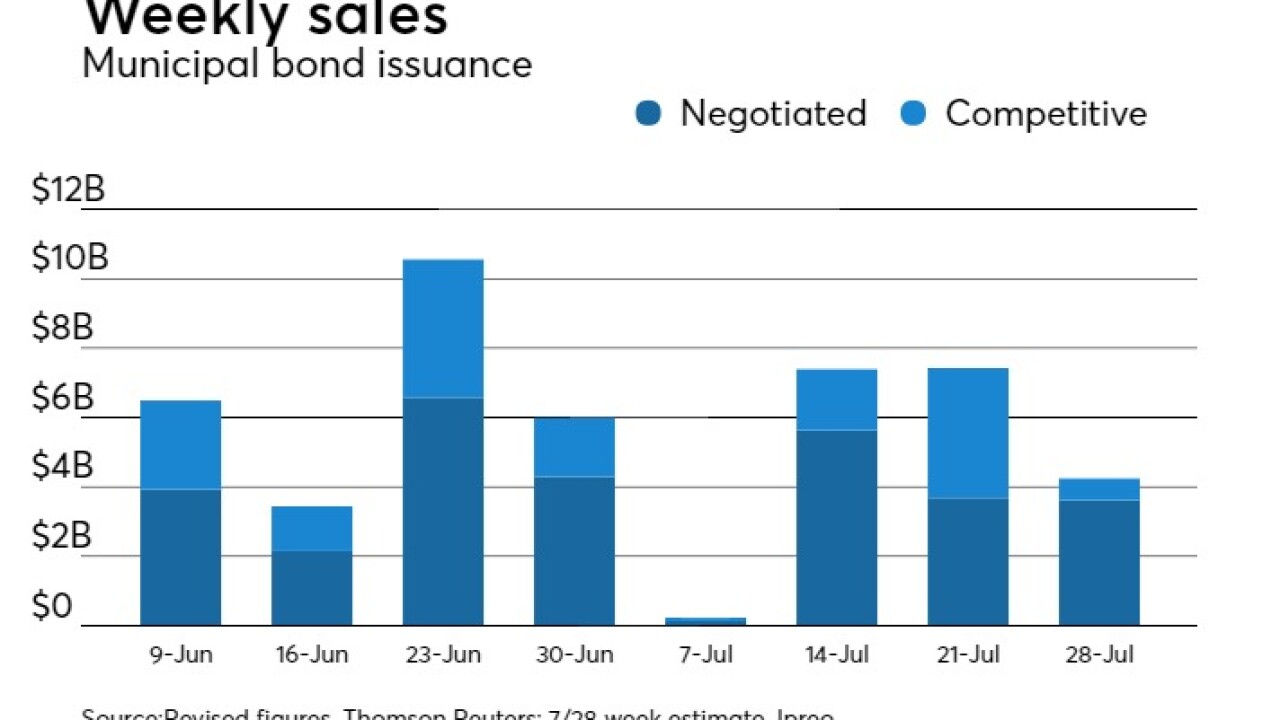

The drop in issuance comes despite a decline in yields over the past week that made the market issuer-friendly.

July 21