-

Recipients included Marjorie Henning, retired deputy comptroller for public finance for the New York City Comptroller's office; Albert Simons, retired partner at Orrick, Herrington & Sutcliffe; and New York City Budget Director Jacques Jiha.

May 20 -

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear "to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds," said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

April 4 -

In a recently released survey by the Citizens Budget Commission, New Yorkers said they are feeling much less safe, with only 37% rating public safety in their neighborhood as excellent or good, down from 50% in 2017.

March 28 -

Congestion pricing proponents claim it will reduce gridlock, improve air quality in Manhattan and boost ridership on the MTA, which has never recovered its pre-pandemic ridership levels.

March 28 -

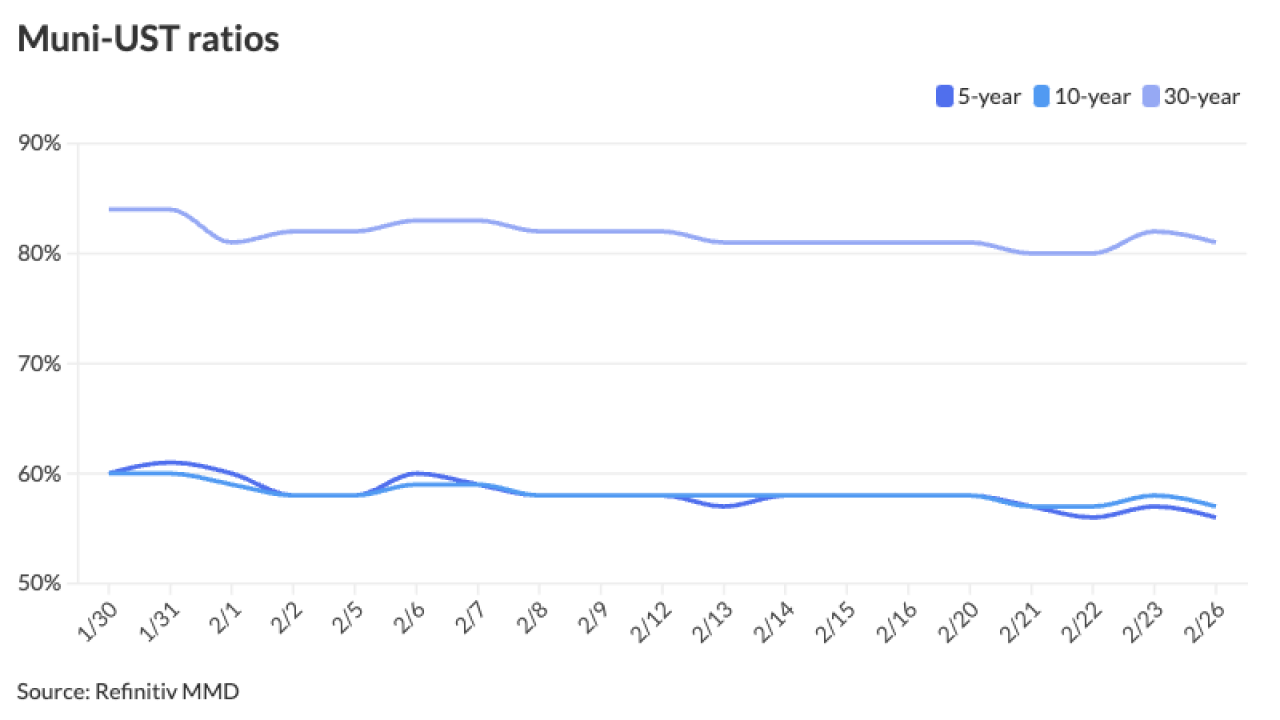

The onslaught of new-issuance and approaching month- and quarter-end led triple-A yields to rise up to seven basis points on the short end and as much as three to five elsewhere along the curve, despite stronger U.S. Treasuries. Short ratios rose as a result.

March 26 -

This week's new-issue calendar grows and includes some "common benchmark names like CA GO, NYC GO, and WA GO," Birch Creek strategists said.

March 25 -

The calendar is led by several high-profile deals, including $2.7 billion of GOs from California, $1.5 billion from New York City and $1.1 billion from Washington. High-yield gets another dose of unrated project finance debt from Miami Worldcenter Project tax increment revenue bonds. The Bond Buyer 30-day visible supply sits at $12.06 billion.

March 22 -

Set to be priced by Jefferies on Monday for retail investors and on Tuesday for institutions, New York City's tax-exempt general obligation bond deal is tentatively structured in four series with two subseries.

March 22 -

To maintain the city's good credit rating and robust fiscal health, New York City Comptroller Brad Lander is also proposing a stronger debt management policy to make sure the city keeps its debt service below 15% of tax revenues.

March 22 -

Despite several larger deals entering the primary, the vast amount of cash on hand has not allowed munis to cheapen amid UST volatility and ultra-rich ratios

March 19 -

The securities industry accounted for roughly $28.8 billion in state tax revenue and $5.4 billion in New York City tax revenue for fiscal 2023, state Comptroller Thomas DiNapoli estimated.

March 19 -

The city has again proven to have a resilient economy, with better than budgeted revenues, said Howard Cure, a partner and director of municipal bond research at Evercore Wealth Management LLC.

March 5 -

The city and its related issuers picked financial advisors to work on upcoming bond deals, including GO issuances, TFA deals and water authority sales.

March 4 -

Municipals look poised to close out February a touch in the black following a more constructive tone Thursday after being in a 'holding pattern' for much of the past two weeks.

February 29 -

Issuance is already slated to be healthy next week, with some large deals on the calendar.

February 28 -

Munis should remain well bid until issuance picks up "dramatically," said Nuveen's Anders S. Persson and Daniel J. Close.

February 27 -

CreditSights said states with the largest payments are Texas at $2 billion, Pennsylvania at $1.5 billion, South Carolina at $1.3 billion and California at $1.2 billion

February 26 -

The bonds are rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency. All four rating agencies have a stable outlook on the credit.

February 26 -

Meanwhile in New York, the state doubles down on climate investments and restricts investments in some big oil and gas companies as the city blasts several big banks as they pull out from the Climate Action 100+ initiative.

February 16 -

It's a color-coded controversy about how far the fight over ESG and green investing precepts will affect public finance this year, with the latest skirmishes involving Bank of America and New York and New Hampshire.

February 6