The London Interbank Offered Rate or LIBOR, the global benchmark interest rate that impacts customers and companies borrowing money across the world, is to be replaced by the end of 2021, though uncertainty hangs on what the replacement will look like. As the industry grapples with replacing it, the key question is: with the advent of centralized data warehouses and data analytic tools, do market participants really need a new version of a survey-based benchmark or an entirely different process?

LIBOR became infamous due to the 2008 scandal when it was discovered that banks rigged reporting rates in order to profit from their derivatives trades, which use LIBOR as their pricing benchmark. While the scandal certainly expedited the pending replacement of LIBOR, the true demise of LIBOR was rooted in the subjective process it followed in a marketplace that has become more accustomed to unprecedented transparency and accuracy.

The process of setting LIBOR may surprise those unfamiliar with its mechanics. Beginning each weekday, leading banks around the world submit a figure to the ICE Benchmark Administration (IBA) based on the rate at which they estimate they could borrow funds from other banks. The IBA then throws out the lowest and highest 25% of submissions and averages the remaining rates, which creates the LIBOR.

That’s right, it’s not data driven. It’s determined by averaging bankers’ best guestimates of their borrowing rate. Obviously, this type of process opens the door for manipulation. But perhaps the larger issue for investors today is the inherent lack of quantitative precision.

Numerous alternatives are being explored to replace the LIBOR, and we’d argue that banks and their regulators could take a lesson from the trends driving the evolution of the fixed income market.

Traditionally, municipal market participants have had to rely on two primary qualitative yield curves for market analysis which are based on polling and surveyed opinions with their associated biases. For one such curve, yields are taken from evaluations of some of the largest municipal underwriting firms based on primary and secondary transactions, similar to the process for LIBOR. The high and low for each maturity are dropped and the average of the remaining firms is calculated for its daily yield curve.

The other well-known curve provider represents its analyst team’s opinion of a triple-A valuation, based on institutional block sized market activity in both the primary and secondary municipal bond market.

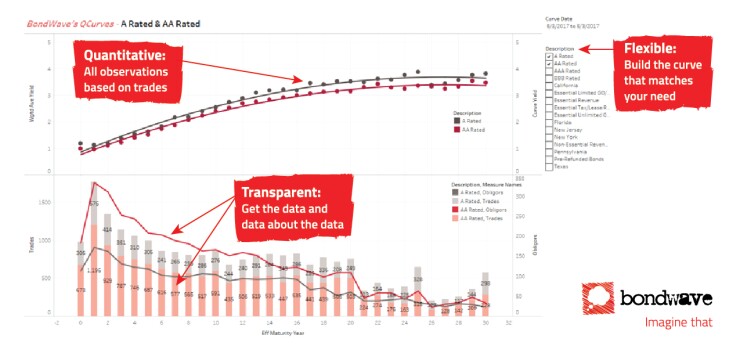

While these qualitative yield curves have provided investors with opinion-laced windows into the municipal marketplace, they lack meaningful context for price discovery without significant assumptions and the potential for subjectivity and manipulation. The evergreen issues plaguing the fixed income marketplace such as the lack of a single centralized database, non-transparent trading, fragmented view of the marketplace and antiquated execution will be eradicated due to a wave of new tools available to participants such as BondWave’s QCurves.

QCurves are created by using a consistent quantitative methodology based on publicly available municipal trade data from MSRB. QCurves enable traders and investors to analyze the municipal bond universe for their unique risk preferences. Because of the consistent methodology, these quantitative benchmarks can be leveraged to provide meaningful analysis of value across the maturity and ratings spectrum. They can also be used to understand the trends in municipal yields over time.

Tools like QCurves address the inherent potential for bias and subjectivity and lack of transparency plaguing current yield curves and municipal fixed income indices. This quantitative approach based upon actual trade data drives more confidence in investors for their trades and provides enhanced precision and accuracy. The BondWave QCurve process answers the question “Why guess when you can measure?”

Sticking with a subjective process could open the door up to manipulation, confusion and investor ambiguity as seen with LIBOR. With advancements in technology-based solutions, greater levels of transparency, data insights and market intelligence will continue to evolve. Bond market professionals will have access to more precise tools that enable them to efficiently manage and grow their businesses.

The combination of technology, access to data and market structure changes will support more bond investing and promote more sophisticated, multi-factor and needs-driven investment solutions. These should all contribute to greater investor confidence and a more vibrant bond market.