The Bond Buyer’s weekly yield indexes were narrowly mixed this week, as municipals ambled around unchanged amid somewhat light secondary trading.

“The market has been unchanged since last week. There was some sell-off in the Treasury this week, but we did not see the same in the munis,” said Fred Yosca, managing director and head of trading at Bank of New York Mellon. “The two positives for munis this week were the high crossover ratio to Treasuries and the June 1 reinvestment cash. But the offset to that is the fact that yields are so low. It may discourage a lot of people from reinvesting.”

Yosca also said that a reason why the market was relatively unchanged this week is the anticipation of today’s May nonfarm payrolls number. Economists polled by Thomson Reuters are predicting that 513,000 new jobs were created in May.

“It is unusual to have a number as large as what is being projected,” Yosca said. “If it comes up in that neighborhood or higher, it can have a serious impact on the prices.”

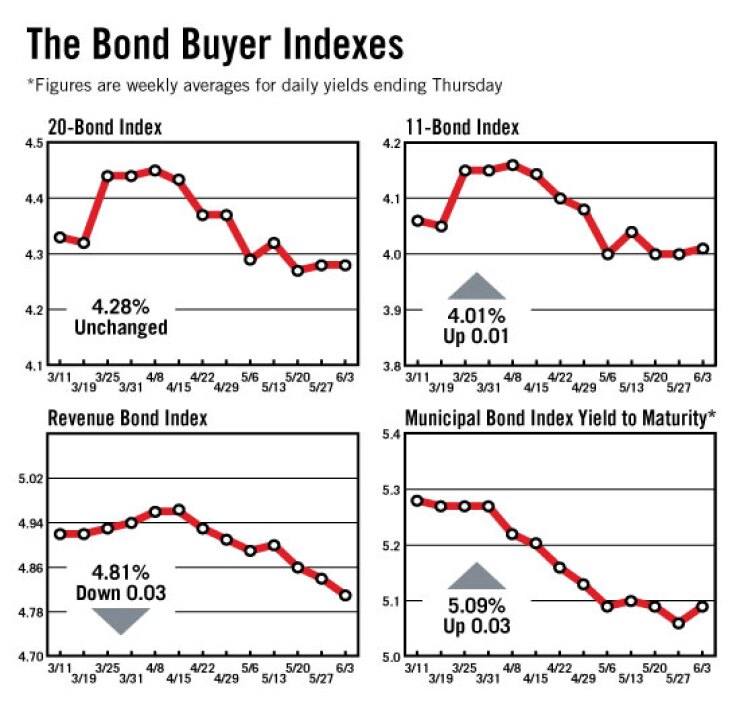

The Bond Buyer 20-bond index of 20-year general obligation bond yields was unchanged this week at 4.28%.

The 11-bond index of higher-grade 20-year GO yields rose one basis point this week to 4.01%, which is its highest level since May 13, when it was 4.04%.

The revenue bond index, which measures 30-year revenue bond yields, declined three basis points this week to 4.81%. This is the lowest the index has been since Oct. 8, 2009, when it was 4.69%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, declined four basis points this week to 0.47%, which is its lowest level since March 31, when it was 0.43%.

The yield on the 10-year Treasury note increased four basis points this week to 3.39%, which is its highest level since May 13, when it was 3.55%.

The yield on the 30-year Treasury bond also rose four basis points this week, to 4.29%. This is its highest level since May 13, when it was 4.45%.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 5.09%, up three basis points from last week’s 5.06%.

Priti Patnaik contributed to this column.