All The Bond Buyer’s weekly yield indexes for long-term debt climbed this week, as muni yields continued to push higher, even increasing by as much as 10 basis points in spots Wednesday, prior to finally stabilizing yesterday.

“It’s a function of munis going from no bonds to no bid,” said Evan Rourke, portfolio manager at Eaton Vance. “We’ve come from being significantly cheaper. The shorter part of the curve may have given back a little, but that was the part of the curve that got impacted more, and that part of the curve had rallied more earlier. Rates are still lower than where they were earlier in the year.”

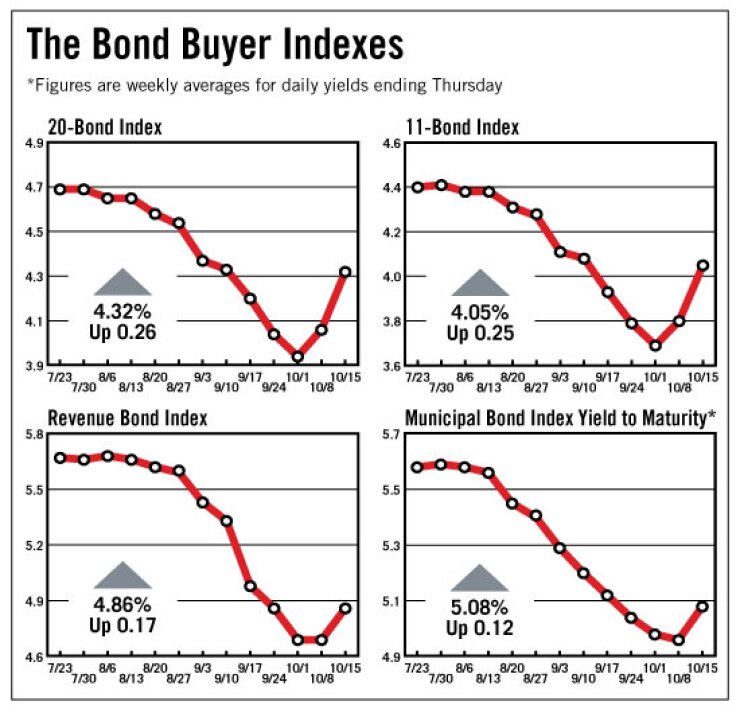

The Bond Buyer 20-bond index of 20-year general obligation bond yields rose 26 basis points this week to 4.32%. That is the highest level for the index since Sept. 10, when it was 4.33%. It is the largest one-week increase in the index since Jan. 22, when the index rose 33 basis points.

The 11-bond index of higher-grade 20-year GO yields rose 25 basis points this week to 4.05%.

That is the highest the index has been since Sept. 10, when it was 4.08%. It is the largest one-week increase in the index since Jan. 22, when it rose 31 basis points.

The revenue bond index, which measures 30-year revenue bond yields, rose 17 basis points this week to 4.86%, which is the highest the index has been since Sept. 24, when it was also 4.86%. The increase is the largest for a single week since Dec. 11, 2008, when it rose 22 basis points.

In the same period, the 10-year Treasury note yield rose 23 basis points to 3.47%, which is the highest note yield since Aug. 27, when it was also 3.47%. The 23-basis-point increase was the largest one-week gain since May 21, when the yield rose 25 basis points.

The 30-year Treasury bond also rose 23 basis points this week, to 4.31%, the highest yield since Aug. 13, when it was 4.42%. The increase was the largest for a single week since May 21, when the yield rose 24 basis points.

The only index that fell this week was The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields. It declined two basis points this week to 0.57%, but it remained above its all-time low of 0.56%, which was achieved for two week ending Sept. 30.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices finished at 5.08%, up 12 basis points from last week’s 4.96%.