CHICAGO — Wisconsin will enter the market as soon as Wednesday with up to $276 million of general obligation refunding bonds to complete a debt restructuring originally held up by the controversy earlier this year over Gov. Scott Walker’s move to curtail the collective bargaining rights of most public unions.

The deal will take out $225.6 million of notes privately placed with Citibank. The remaining bonds will current refund other GOs.

The state used the notes to pay off debt service that came due May 1, easing pressure on the operating budget.

The state will amortize the debt service that had been due May 1 over 10 years, according to capital finance director Frank Hoadley.

“There are also now some maturities that have come into the money for economical savings,” adding to the size of the deal, Hoadley said.

Ahead of the issue, Fitch Ratings and Standard & Poor’s affirmed the state’s AA rating and Moody’s Investors Service affirmed its Aa2 on the new deal and $4.6 billion of outstanding GOs.

Walker, a Republican, included the authorization for $165 million of debt restructuring in his budget-repair bill released earlier this year to address the deficit in the current budget, which runs through June 30.

Wisconsin already had authorization to sell $61 million of restructuring bonds.

The bill also included increased employee health-care premiums and pension contributions and curtailed collective bargaining rights.

With Republican majorities in the Legislature, Walker expected easy passage, but because of the inclusion of the fiscal items, at least one Democratic senator was needed to establish a quorum.

Democrats fled the state in February over opposition to the GOP’s union-stripping provisions. Republicans later removed the restructuring from the measure, eliminating the need for a Democrat to be present, and passed the other pieces of the legislation.

The debt restructuring later passed with bipartisan support but the state remained under the gun to get the transaction completed because of an April 14 deadline to fund the May 1 debt service payment, so officials decided to privately place notes in anticipation of a traditional refunding at a later date.

Citi is the senior manager and Loop Capital Markets LLC is co-senior. Foley & Lardner LLP is bond counsel.

Hoadley said he expects to follow up the sale with new-money GOs over the summer and up to $800 million of operating notes in June.

Wisconsin also will release a request for proposals to update its list of qualified underwriters and bond counsel later this month.

Lawmakers continue to work on passing a new two-year budget.

Walker has proposed a $59 billion budget that would eliminate a $3.6 billion deficit with steep cuts.

The budget trims $1.2 billion in local government assistance, $494 million from Medicaid, and $250 million to higher education.

It includes an additional $439 million of debt restructuring. While the restructuring is a non-recurring revenue source, it represents a significant drop over past budgets that have relied heavily on one-shot solutions.

“The stable outlook reflects our expectation that Wisconsin’s trend of fiscal discipline, which has significantly reduced structural budget deficits in the past several years, will continue, and that the state will act purposefully and quickly to address any budget imbalances,” analyst John Kenward wrote in Standard & Poor’s new report.

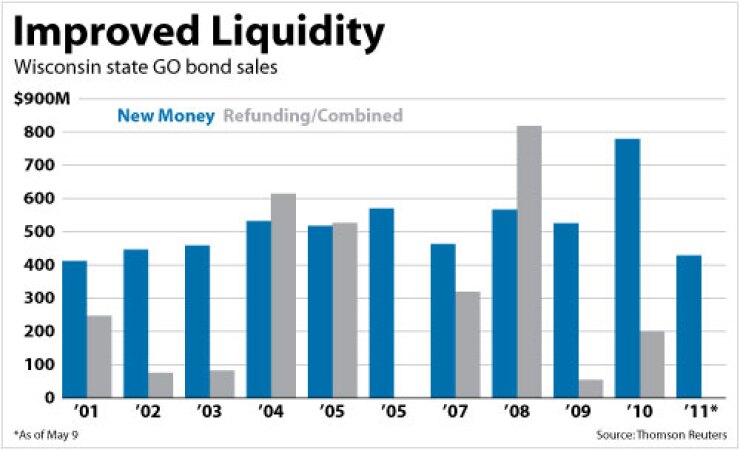

Moody’s said the rating is supported by the state’s improved liquidity position as well as its fully funded pension system and limited other post-employment benefits liabilities, which “eliminate long-term budgetary pressure that other states will have.”

Wisconsin remains challenged by a weak financial position and reliance on non-recurring measures to address shortfalls.