CHICAGO - In a change from its tradition, Wisconsin, in restructuring $1.4 billion of outstanding tobacco bonds, will delay the selection of underwriters, instead relying more heavily on its financial advisers and input from a group of hand-picked bankers to craft the transaction.

Capital finance director Frank Hoadley said the current market turmoil and evolving banking landscape dictated a shift in strategy on the deal if the state is to accomplish the sale sooner rather than later. Officials are under pressure to get into the market before the state closes its books on the current biennium June 30, as the budget relies on some of the proceeds to remain balanced.

"The state is of the opinion that the contemplated transaction cannot be executed in the current market environment," Hoadley said. "In light of these disrupted market conditions and the fluid changes in investment banking firms and personnel, it is in the best interests of the state to defer selection of an underwriting syndicate until conditions lend themselves to actual execution of a transaction."

The financial advisers chosen by the state include Public Financial Management Inc., led by Jeanne Vanda, and Acacia Financial Group Inc., led by Noreen White. The two were selected from proposals submitted to the state during a competitive selection process.

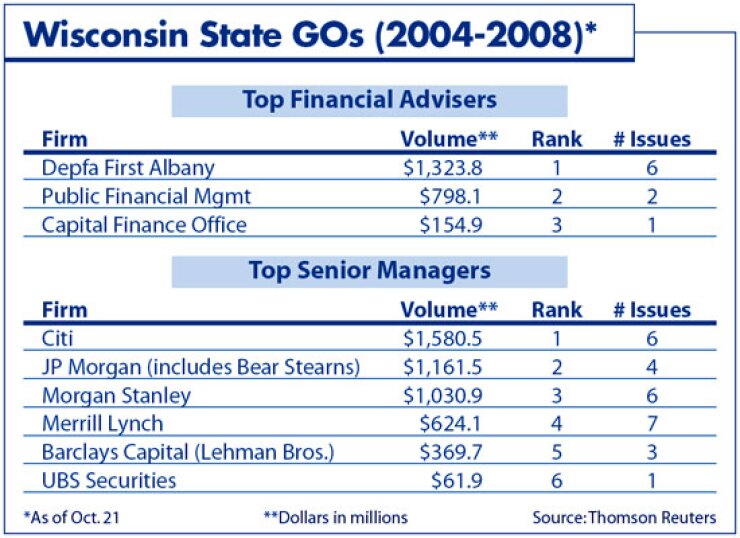

Although selection of a banking team is being postponed, Wisconsin will seek guidance from four investment bankers who were chosen based on their individual experience. They include Kym Arnone of Barclays Capital, which acquired Lehman Brothers, Tom Coomes and Tom Green of Citi, and Neil Flanagan of Depfa First Albany Securities LLC. The state may also seek input from additional bankers.

"The state together with its financial advisers will proceed to prepare the credit and transaction so that a sale can occur at such time as market conditions indicate. At that time, the state will then engage a syndicate of underwriters," Hoadley said, adding that the four bankers would be asked "to provide additional input" but are not guaranteed a role in the syndicate.

The action represents a shift from the tradition in past negotiated deals in which officials would select a financial adviser or advisers and with their help name an underwriting team.

"Our financial advisers will be providing the leadership and guidance we would normally get from the designated book-runner in terms of structuring, strategy, and credit," Hoadley explained.

Wisconsin has not completed fee negotiations, but Hoadley said he did not anticipate that either advisory firm would be paid a higher fee than has been paid in the past.

The deal will refund the bonds that remain outstanding from the original $1.6 billion transaction that was issued in 2002 through the Badger Tobacco Asset Securitization Corp. securitizing the state's $5.9 billion share of the 1998 settlement between most states and tobacco companies. The new bonds will be issued by the state with an appropriation pledge.

"It was a logical conclusion to reach when reading these proposals," Hoadley said of the decision to shift gears after reading the roughly 30 banking proposals received by the state. "A lot of firms have a lot of problems. Every firm has potential problems. It seems that decisions one might make today would have to be remade."

The state had originally named a financial team last fall, but the shuttering of some firms and movement among banking staff prompted the decision to revamp the team to reflect the changed environment. The structure of the deal had also significantly changed since the original request for qualifications was conducted.

The original team included Bear, Stearns & Co. as the book-runner. That firm has since been acquired by JPMorgan. UBS Securities LLC was also on the team but has since exited municipals. First Albany Capital Inc., an adviser on the original 2002 deal, was named a financial adviser for the restructuring but has since evolved into Depfa First Albany and its stronger capital base gave it the opportunity to vie for a spot on the underwriting team.

Key tobacco bankers had also moved to other positions at their firms or changed companies, including Arnone, who worked on the 2002 tobacco securitization but had since moved to Lehman Brothers, which is now Barclays.

Hoadley said Arnone, Green, Coomes, and Flanagan were chosen for their individual experience both nationally and with Wisconsin on either tobacco financings or appropriation-backed credits. They will not be paid for their input.

Gov. Jim Doyle included the tobacco restructuring plan in his current $57 billion two-year budget, but the deal had been on hold due to high interest rates that made the state's goals difficult to accomplish. Under the restructuring plan originally adopted last year, officials sought to refinance the bonds with the goal of generating $50 million annually to go into a permanent endowment fund to support health care and anti-smoking programs.

The plan was revised last May by Doyle and the Legislature as part of a so-called budget adjustment bill crafted to close a $527 million budget deficit. Under the revised plan, the state shifted to an appropriation pledge, a move that it anticipates would lower interest rates.

The goal of the transaction is to raise at least $100 million in upfront savings to establish the endowment and then $50 million in annual savings afterwards. An additional $150 million in upfront savings would go to help close the budget shortfall.

The tobacco securitization garnered ratings in the mid-to-high single-A category in 2002, but has since been downgraded several notches to reflect the turbulent tobacco industry that has been hit with litigation and declining profits.

Wisconsin's appropriation-backing is one notch lower than its general obligation ratings of AA from Standard & Poor's, AA-minus from Fitch Ratings, and Aa3 with a negative outlook from Moody's Investors Service. The state has $5.8 billion of GOs and $1.88 billion of appropriation-backed bonds outstanding.