BRADENTON, Fla. – Spreads have widened on municipal bonds issued to build new nuclear units ensnared in Westinghouse Electric Co.’s bankruptcy, signaling heightened concern by investors.

But analysts say holders of the billions of dollars of revenue bonds issued by the Municipal Electric Authority of Georgia and South Carolina Public Service Authority’s Santee Cooper should not be alarmed.

At least not yet.

“Both issuers are exceptionally strong, well-managed operations with a long history of providing low cost power to a large and growing population in the Southeast,” said Municipal Market Analytics partner Matt Fabian. “MMA thus sees only a low potential for this new challenge to manifest as an existential risk for either utility.”

Westinghouse, owned by Japan’s Toshiba, filed a Chapter 11 petition on March 29, saying that it will use the bankruptcy code to resolve its losses on its U.S. nuclear construction business.

The company reported $9.8 billion of debt, saying most of the liability is related to its work as primary contractor for two reactors at Georgia’s Plant Vogtle and two reactors at South Carolina’s V.C. Summer Plant.

Since Westinghouse filed for reorganization, the investor-owned utilities and public power agencies for which the plants are being built have paid to keep construction going at the first U.S. nuclear power units to be built in decades.

The agreement providing for those payments is set to end next week, although it could be extended.

“Market participants have been evaluating what the Westinghouse bankruptcy means for construction of the already delayed nuclear projects,” said Wells Fargo Senior Analyst Randy Gerardes. “There is no question that uncertainty around the investment in these facilities has become elevated.”

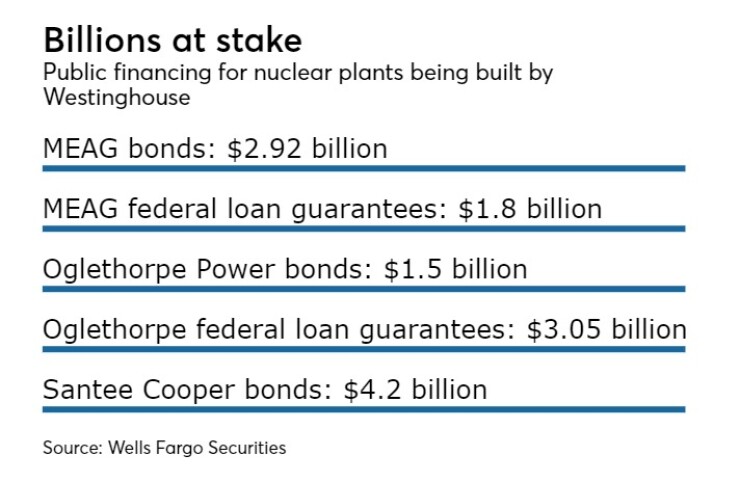

The major public power owners at Plant Vogtle are MEAG, which has issued $2.92 billion of bonds for its 22.7% ownership in the new units there, and the nonprofit Oglethorpe Power Corp., which has issued $1.5 billion of first mortgage bonds for its 30% ownership share.

The SCPSA’s Santee Cooper has issued $4.2 billion of debt toward its 45% share of the new units at V.C. Summer.

Prices for bonds issued by Santee Cooper and MEAG have fallen in recent months, Janney Montgomery Scott municipal analyst Alan Schankel said Monday.

In an examination of Santee Cooper’s bond trading, Schankel said recent yield increases and widening credit spreads indicate that investors already are considering the headline risk associated with the bankruptcy and the “real risk” should the project be abandoned.

Schankel said he found some credit spreads on bonds issued by the South Carolina Public Service Authority have widened by 60 basis points or more since reports of Westinghouse’s financial stress surfaced in February.

“Uncertainty persists, and there will be further bumps in the road for the Summer Units 2 and 3 partners, but we believe SCPSA will weather the current storms, buoyed by the utility’s ability to increase rates as needed,” he said.

The owners of both projects in Georgia and South Carolina still don’t know how much Westinghouse’s bankruptcy will increase their costs to build out the new nuclear units or whether it will delay their completion.

Too long of a delay could imperil federal tax credits that are included in V.C. Summer’s long-term financial outlook, SCANA Corp. Chairman Kevin B. Marsh told the South Carolina Public Service Commission last week.

Investor-owned South Carolina Electric & Gas, which has a 55% stake in the new units at Summer, is a subsidiary of SCANA Corp.

Westinghouse has said that overall construction at Summer is 61% complete as of Dec. 31.

“The federal production tax credits potentially available to the project represent approximately $2.2 billion in value to SCE&G’s customers, if both units are completed, and are an important part of our cost evaluation,” Marsh said. “Under current law, a unit must be in service before January 1, 2021, to earn the credits.”

Marsh said the substantial completion dates provided by Westinghouse currently support earning the full value of the credits.

He said SCANA and SCE&G are working with the state’s federal congressional delegation to extend the tax credit deadlines should Westinghouse’s bankruptcy result in a change in the completion schedule.

Rep. Tom Rice and Sen. Tim Scott, both South Carolina Republicans, filed bills in March that would allow investor-owned utilities to take advantage of the federal production tax credits if completion of new nuclear units is delayed.

The legislation would also allow public power agencies financing the projects to take advantage of the tax credits, which they cannot do under current federal law.

“Other energy technologies are able to effectively use their credits with public-private partnerships and nuclear energy should have the same consideration,” Rice said after introducing his bill. “This bill helps to correct a disparity of current law so savings can be passed on to consumers in South Carolina, the Southeast, and across the country who deserve affordable, reliable energy.”

Co-sponsors on both bills include lawmakers from Georgia.

In another report to the South Carolina PSC, SCANA Chief Financial Officer Jimmy E. Addison said that Westinghouse has indicated that the additional costs associated with completing the nuclear projects in South Carolina and Georgia are approximately $4 billion.

SCE&G’s share of the $4 billion cost estimate is about $1.5 billion, an amount that has not been validated, Addison said.

The uncertainty associated with the costs and completion of the units have led Fitch Ratings, Moody's Investors Service and S&P Global Ratings to place negative outlooks on all partners in the projects, as well as Toshiba.

“We have seen material spread widening since mid-February as Toshiba delayed its earnings report and rating agencies took action on Toshiba as the potential for a Westinghouse bankruptcy increased,” Gerardes said.

Based on Interactive Data information, Gerardes said the most spread widening has been seen in Santee Cooper’s tax-exempt bonds with $88 million in volume traded in 2056 maturities since February 2015.

Spreads on those bonds have widened by 50 basis points, to 145 basis points above the benchmark, he said.

In contrast, MEAG’s Project P tax-exempt bonds maturing in 2060 were 130 basis points from the benchmark.

“For many market participants, the associated uncertainty may be too much to continue to hold their positions,” Gerardes said. “For others, the spread widening may be an opportunity to add some additional yield to offset the elevated risk.”

Both Vogtle and Summer plants are being constructed under fixed-price engineering, procurement and construction contracts with Westinghouse. Fluor Corp. is the subcontractor.

Toshiba has guaranteed completion dates and associated liquidated damage provisions for both projects.

Despite the negative rating outlooks, Westinghouse’s bankruptcy should not affect investors’ long-term interest in buying and holding bonds sold by Santee Cooper and MEAG, according to Fabian.

Westinghouse’s restructuring could meaningfully increase the utilities’ costs for the new nuclear generating capacity, and to the extent the costs are passed along to customers they could face more political and operating pressure, he said.

Fabian has advised bondholders to prepare for “elevated headline risk and bouts of illiquidity” as Santee Cooper and MEAG work out a construction completion plan.

“Any pronounced decline in asking price for related bonds should be considered as a potential buying opportunity,” he said.

Santee Cooper, which did not respond to a request for comment, had said it planned to make a presentation to bondholders on Wednesday.

Westinghouse’s consolidated bankruptcy case is pending in the United States Bankruptcy Court for the Southern District of New York. The main case number is 17-10751.

Court filings